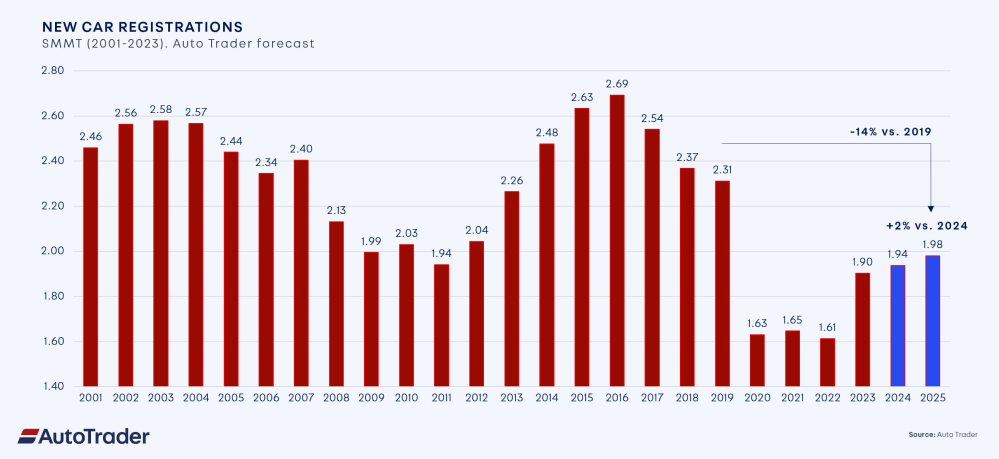

As the UK’s automotive sector looks ahead to 2025, manufacturers and retailers are navigating a market that is growing, but not without significant hurdles. According to data from Auto Trader, new car registrations are expected to increase by 2% next year, reaching an estimated 1.98 million. While this marks the fourth consecutive year of growth, the market will still fall 14% short of the 2.31 million registrations recorded in 2019, the last full year before the pandemic disrupted global supply chains and demand patterns.

A tougher road for EV sales

Despite progress in vehicle production and availability, the road to electrification is proving to be uneven. Auto Trader projects that electric vehicles (EVs) will account for just 18% of new car sales in 2024, falling short of the 22% required by the Zero Emission Vehicle (ZEV) mandate. This shortfall underscores the challenges manufacturers face in balancing compliance with customer demand.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAuto Trader’s analysis also highlights a worrying decline in private car sales, estimated at 740,000 units in 2024—a 27% drop compared to 2019. Contributing factors include the rising cost of new cars, which now average £43,020, up from £31,000 just five years ago.

The pressure to meet stricter ZEV targets, which rise to 28% in 2025, is likely to push manufacturers toward aggressive marketing campaigns. Auto Trader expects the EV market share to increase to 23% in 2025, but brands will still need to innovate to attract customers, particularly as car buyers are now researching an average of 17 brands before making a decision.

The used car market holds steady

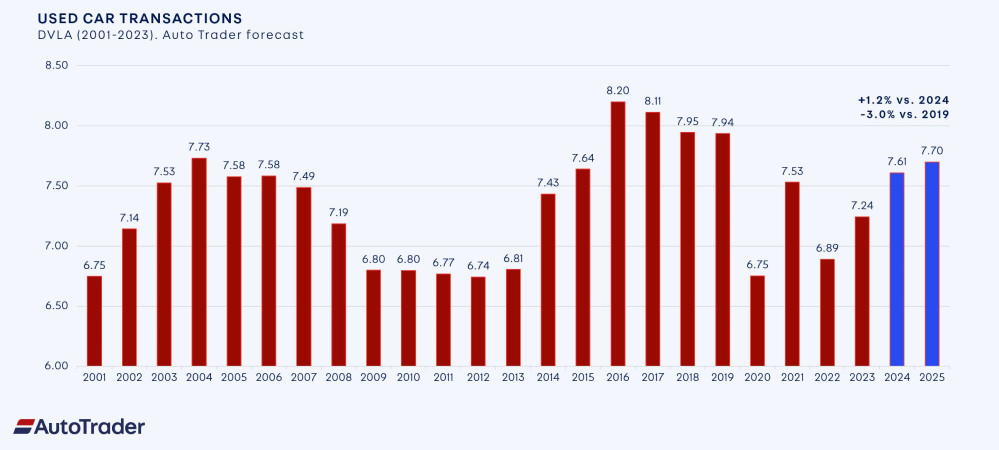

In contrast, the used car market remains a beacon of stability. Auto Trader forecasts that sales will increase by 1% in 2025, rising to 7.7 million, putting the market within 3% of its pre-pandemic levels. Demand has been supported by strong consumer engagement, with Auto Trader recording 970.6 million visits to its platform over the past 12 months—an increase of 74 million year-on-year.

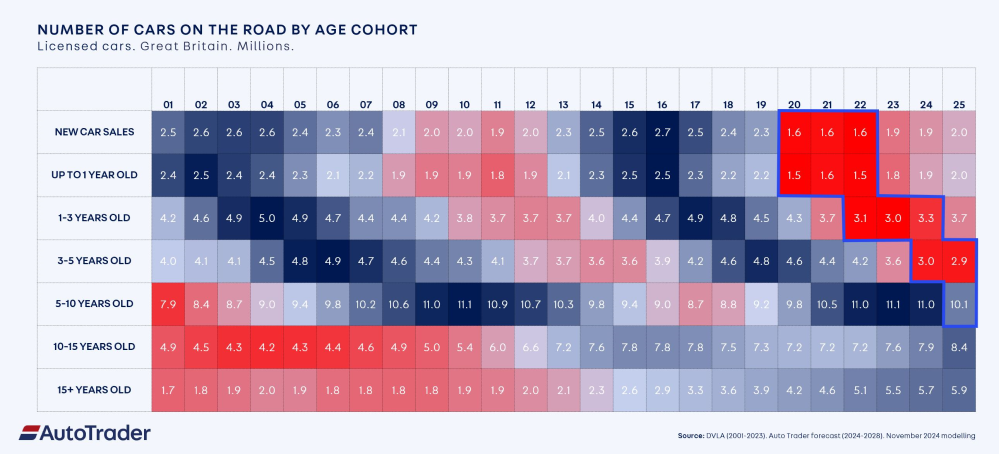

Even as the new car supply chain recovers, the pandemic’s impact continues to shape the availability of used vehicles. Auto Trader notes that the UK’s stock of three-to-five-year-old cars has dropped 37% since 2019 and is expected to decline further in 2025. This trend is likely to maintain competitive pricing in the used car sector, where stock turnover remains brisk.

Shifting fuel dynamics

Another shift in the market is the changing mix of fuel types in the UK’s car parc. According to Auto Trader, 2024 will mark the peak for petrol cars, with their numbers starting to decline in 2025 as electric supply accelerates. The number of EVs in use is expected to rise by 33% next year, reaching 1.66 million and accounting for 5% of all cars on the road.

With demand for petrol vehicles still high, but supply shrinking, prices are likely to rise. Meanwhile, competition for used EVs is set to intensify, making a robust strategy for managing EV inventory a necessity for dealerships.

Brands face growing competition

The challenge for manufacturers is not just meeting demand but standing out in an increasingly crowded marketplace. Since 2019, 17 new automotive brands and 81 new models have entered the UK market, adding to the competition for customer attention. Auto Trader’s research suggests that rebuilding brand equity will be crucial as consumers become less familiar with the expanding range of models available, especially in the EV category.

Ian Plummer, Auto Trader’s Commercial Director, said: “It’s been another landmark year for automotive retailing, one that’s included a range of challenges, not least the introduction of ZEV targets, constrained supply, changing finance rules, and the budget, but also exceptionally strong used car demand, record levels of engagement on our platform, rapid speed of sale, and the stabilising of retail prices. And with the more attractively priced and available stock in recent months helping to fuel new car interest, the overall retail market is entering 2025 on a strong footing.”

A complex year ahead

As the industry moves into 2025, it faces a unique mix of challenges and opportunities. Regulatory pressures, shifting fuel preferences, and a rapidly evolving competitive environment mean that both new and used car markets will need to adapt. While the used car market continues to show resilience, the new car sector is contending with stricter ZEV mandates and changing consumer behaviours.

“The overall retail market is entering 2025 on a strong footing,” Plummer noted, but he cautioned that success will depend on manufacturers and retailers innovating to meet evolving customer expectations and regulatory demands. With strategic planning and targeted marketing, the sector may find a way to thrive despite the challenges ahead.