In the context of ESG ratings, one would expect a company at the forefront of electric vehicle (EV) innovation, like Tesla, to boast a stellar score, far surpassing that of a fossil fuel giant such as Shell. However, reality presents a different picture.

Tesla, widely regarded as the automotive leader of the clean energy transition, paradoxically finds itself trailing behind Shell on ESG scores. Intuitively, this is hard to comprehend, especially when you consider that the global fleet of Tesla vehicles, energy storage and solar panels enabled its customers to avoid emitting 8.4 million metric tons of CO2e in 2021, while Shell made an annual gross profit of $72.5bn out of poisoning the environment. To make sense of this, it’s worth digging deeper into how ESG scores are constructed.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataESG, a three-legged stool:

The S&P Global ESG Score is an aggregate measure of a company’s sustainability performance derived by combining the Environmental (E), Social (S), and Governance (G) dimension scores, with each dimension’s weight determined by its significance within a specific sub-industry. These individual scores usually fall within a scale of 0 to 100, where a score below 50 is generally viewed as poor, while a score exceeding 70 is considered respectable.

In 2021, Tesla’s ESG score was 27, while Shell’s rating amounted to an impressive figure of 65, according to the S&P 500. This disparity was reduced considerably in 2022 as Shell’s score dropped to 41 and Tesla’s improved to 37.

The E in ESG

In this context, some argue that Tesla might be forgetting something, ESG is not only about producing environmentally focused products, the two other legs of the stool, the social and governance dimensions of the concept, also require attention.

Although it does considerably well on the E, Tesla has received criticism for neglecting the S and the G.

In an interview with GlobalData, Ty Francis, the Chief Advisory Officer of LRN, an ethics & compliance advisory firm, asked: “What happened when the rating agencies looked at Tesla? Tesla has faced accusations of racism and poor working conditions, especially in the California plant. They looked at executive pay, they looked at their internal controls. And Tesla historically, has faced, you know, a lot of governance issues.

CEOs and ESG

“I think the elephant in the room is their CEO, his behaviour as a CEO, that is communications, not just at Tesla, but also at X [formerly Twitter]. He is facing regulatory fines, he is facing the SEC, for disclosing non-public information, artificially inflating the stock price of Tesla by saying, you know, we’re going to produce 500,000 cars, when in fact, he then corrected that, so it’s going to be 400,000.”

“At that moment, the problem is, it’s not particularly environmentally friendly to make the batteries and then dispose of the batteries. You know, you look at conflict, mineral mining, at how Cobalt is mined in different countries, within those countries, how its mining has labour issues and human capital issues. Are workers treated fairly? So, the ecosystem of power electric cars made is more complicated than the fact that it doesn’t have fumes coming out the back of it”, he added.

The G in ESG

When asked about the importance of governance for ESG, Ty replied: “How important is governance across the board? Governance has been around for a long time; environmental concerns are a relatively new concern in the industry. In the 1940s, people weren’t worried about climate change. However, they did have governance structures in their companies, to make sure that their boards of directors, or their C-suites managed the company correctly, they had fiduciary duties, to ensure that they were doing things in the best interest of the company, the shareholders, the stakeholders, the governance has always been the overarching foundation for how companies should operate.”

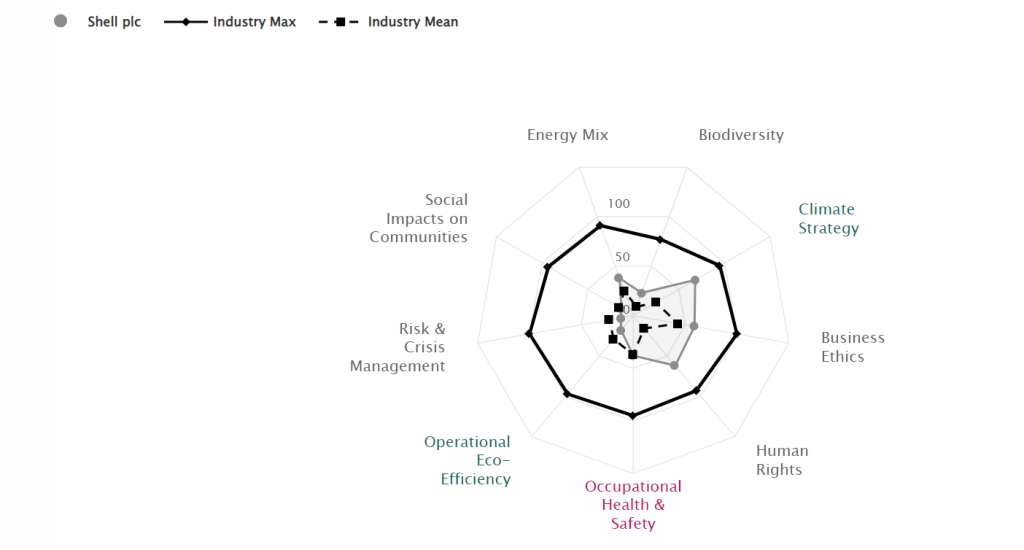

On the other hand, Shell’s governance is rather impeccable, he notes: “Transparency is a big thing as well, when you look at companies, you know, shell, even though it seems to be fossil fuels, you know, archaic dinosaurs, it’s been very transparent. It’s very proactive and reports, its environmental, social and governance issues and practices. It lays out plans, it’s very clear from Shell that it is trying to transition from fossil fuels to cleaner energy”.

ESG metric and its limitations

He concluded: “So really, if you boil it down, Tesla didn’t have a very transparent or low carbon strategy. It didn’t have a particularly robust Code of Business Conduct. And his track record on human rights and environmental issues is very poor. So, when you add all those together it’s pretty clear, that when you dig down, that Shell would have a higher rating. But again, it’s about context. It doesn’t mean that Shell is a better company. But the factors and disclosures it’s being measured by at that point worked in the favour of Shell.”

I would like to highlight the fact that a higher ESG rating does not necessarily entail that “Shell is a better company”, particularly if you are looking for “green” investments, in that case, ESG ratings might not be the most valuable tool.

How are ESG ratings constructed? What do they reflect?

In its 2021 Impact Report, Tesla expressed the view that existing ESG evaluation methods are flawed at their core as they fail to reflect the company’s positive impact on society and the environment. Instead, they focus on measuring the dollar value of risk/return, the company argued.

In essence, there is a growing acknowledgement that these ratings do not gauge a company’s influence on the planet; rather, they primarily measure the influence that climate change has on the company’s finances. If this is the case, ESG ratings might not be a particularly useful metric to evaluate the sustainability of an investment.

At the end of the day, it’s difficult to compare different companies on a like-to-like basis.

To illustrate this, Ty Francis uses an example: “You’re looking at how you are prioritising those risks and putting resources to mitigate those risks. The baker doesn’t have to think about sanctions that the baker probably doesn’t have to think about, such as cybersecurity, or FCPA, which is the Foreign Corrupt Practices Act or the UK Bribery Act.”

In addition, “rating agencies have different criteria for rating different companies at different times. These ratings do vary significantly. And it’s methodology, it’s how they weighed those factors”.

Improving governance

Regardless of the methodology used to calculate ESG scores and whether these truly reflect a corporation’s social and environmental impact, Ty says improving governance is about setting the right tone and that starts at the top.

“This may sound cliche, but the corporate tone starts with the board, it starts with the leadership teams, making sure they’re instilling a culture of compliance and ethics within the organization, making sure that employees don’t feel pressured, they feel the ability to speak up, they feel safe.”

Companies have HR survey data, they have Glassdoor and job listings data, such as Indeed, and the relevant board teams can scour social media to establish what is being said about the company by employees and ex-employees, says Ty. So often companies have early warnings about areas of concern or pockets of division, “your duty as the Board, is to ask questions.”

We approached Tesla for comment about the issues raised in this article. Unfortunately, the company did not get back to us at the time of publication.

Ty Francis was a keynote speaker at LTI‘s conference “The G of ESG” on the 21st of September 2023.