The ongoing conflict in Ukraine will have repercussions throughout the automotive market for years to come. That’s according to Grant Thornton, who previously stated that the sector would experience more change in the next five years than the previous 50 in the January 2022 issue of Cox Automotive’s AutoFocus insight publication. However, three months later, the professional services giant suggests there will be no let-up for quite some time.

In the latest issue of AutoFocus, Cox Automotive and Grant Thornton discuss the current and predicted impact on the automotive industry from the war in Ukraine. Philip Nothard, Insight and Strategy Director, Cox Automotive, explained: “The automotive sector across the UK and Europe has already undergone significant change over the past five years, and the conflict in Ukraine has created new challenges. AutoFocus discusses the impact this conflict is having now and will have on the automotive sector.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataRussia and Ukraine’s contribution to the European and global automotive ecosystems

Owen Edwards, head of downstream automotive at Grant Thornton, explained the substantial part Russia and Ukraine both play in the European and global automotive ecosystems: “Both Russia and Ukraine operate 34 and seven automotive assembly and production plants respectively, where passenger cars, light commercial vehicles, heavy-duty vehicles, buses, and engines are produced. Much of the vehicle production is for their own domestic markets, but for OEMs that export to these countries, a direct impact will be felt from halted production in Russia. Some of the largest effects of the conflict on the industry in the West will be felt the most by the supply chain, which ranges from raw materials to sales and operations.”

The raw materials shortages include gases and microchip production, palladium and platinum, wire harnesses, aluminium, and cobalt.

Edwards added: “The much-discussed semiconductor chip shortages, which have badly affected the automotive industry in the past year, are further impacted by the conflict. 50% of the world’s output of neon and 40% of the world’s krypton, which are needed to manufacture semiconductor chips, comes from Ukraine.

“Russia is the primary supplier of palladium, which is used for catalytic converters to meet emissions requirements. In addition, Ukraine produces a large number of wiring harnesses, which are used in car production. The German car industry, in particular, will be affected badly by both these materials shortages. Meanwhile, Russia (outside of China) plays a large part in aluminium supply. Shortages of this metal are expected in the coming months, which will drive up the price of raw materials. Electric car production could also be affected by shortages in cobalt production, which is used as a component of lithium-ion batteries. Russia was the second-largest producer of cobalt last year.”

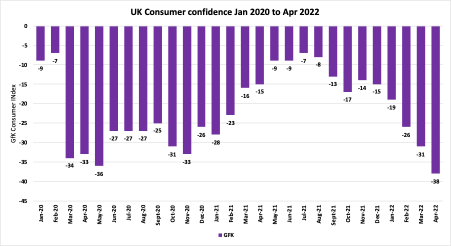

Consumer confidence set to take an even bigger setback

Grant Thornton explains the effects that further shortages of vehicles and continuing shortages of semiconductors may bring. The organisation anticipated that normal new vehicle production levels could return by the end of 2022/early 2023, but this now appears unlikely.

Edwards added: “The conflict in Ukraine will influence raw material prices, which will continue to rise, and some of these costs will be pushed on to the consumer. This comes at a time when the West is grappling with a cost-of-living crisis, as general increases in the price of oil, gas, electricity, food, and inflation are also expected to continue.”

Edwards believes this will likely weaken consumer confidence, with disposable income expected to come under pressure. In the UK, the Bank of England is forecasting that inflation will rise to 7% in 2022. Further increases in inflation could provide a catalyst for future interest rate rises.

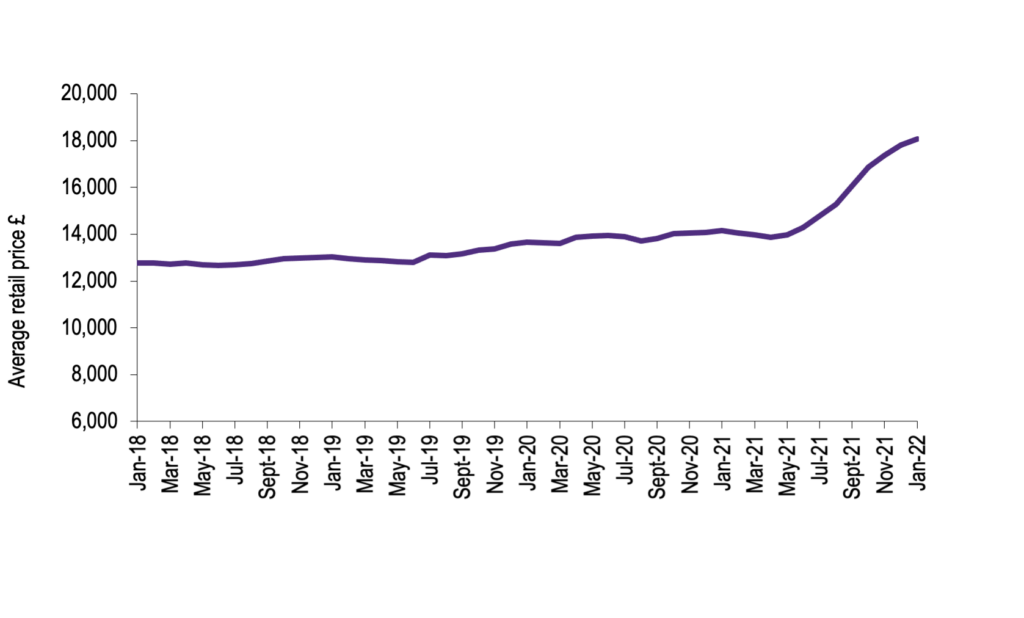

UK average retail price of used vehicles by month Jan 2018 to Jan 2022

Edwards added: “The prices of used cars are expected to remain above pre-COVID levels, but whether they remain at the high levels seen at the end of 2021 will depend on whether demand weakens. Grant Thornton is happy to support both upstream and downstream automotive companies in navigating these uncertain waters.”

Nothard concluded: “The war in Ukraine will bring further disruption in the supply chain and shortages of new vehicles. In addition, the much-debated shortage of semiconductors will continue longer than expected. As a result, the industry should prepare for further impact as the used car market supply becomes even more constrained.

“The past five years have proven that the automotive industry can adapt well to significant turmoil. The investment in battery electric vehicles (BEVs) by OEMs and Tier 1-4 parts suppliers is paying off, as consumers have started to change their purchasing habits. According to the Society of Motor Manufacturers and Traders (SMMT), BEVs accounted for around 18% of all new vehicles sold in February 2022. In addition, while dealer groups have continued to perform well with robust earnings results, in many cases, the Plc companies have provided trading upgrades to earnings.”