The European Commission (EC) has announced that electric vehicles (EVs) manufactured in China will face import tariffs of up to 38.1%.

This decision aims to bolster the EU’s EV supply chain and promote the production of affordable, locally-made electric cars. However, it has been criticised by China, which labelled it as protectionist, arguing that the measures are aimed at countering what Brussels describes as excessive subsidies for Chinese carmakers.

Following a similar move by Washington, which recently quadrupled duties on Chinese EVs to 100%, the European Union will introduce tariffs of 17.4% for BYD, 20% for Geely, and 38.1% for SAIC, in addition to the existing 10%. These additional costs could amount to billions of euros for the carmakers, who are already grappling with slowing demand and falling prices in their home market. This estimation is based on 2023 EU trade data, according to Reuters.

The influx of lower-cost EVs from Chinese manufacturers has posed a significant challenge to European automakers. “This anti-subsidy investigation is a typical case of protectionism,” Lin Jian, a spokesperson for the Chinese foreign ministry told Reuters. Jian warned that the tariffs would harm China-EU economic and trade relations and disrupt the global automobile production and supply chain.

The move by Brussels reflects growing concerns within the EU about the competitive threat posed by Chinese EVs, and the measures aim to level the playing field for European carmakers.

At the same time, the share prices of some of Europe’s largest carmakers, which rely heavily on sales in China, fell due to fears of Chinese retaliation. Companies like BMW will now also face duties on their EVs made in China and sold in Europe.

The EU’s provisional duties are scheduled to take effect by July 4, with the anti-subsidy investigation ongoing until November 2. At that point, definitive duties, typically lasting five years, could be implemented.

The Commission outlined rates of 21% for companies that cooperated with the investigation and 38.1% for those that did not. Western manufacturers such as Tesla and BMW, which export vehicles from China to Europe, were considered as cooperating entities.

Green advocacy group Transport & Environment (T&E) welcomed the tariffs but stressed the need for a broader industrial policy.

Julia Poliscanova, Senior Director for Vehicles and e-mobility Supply Chains at T&E, emphasised the importance of maintaining the 2035 deadline for ending the sale of polluting cars. “The EU Green Deal came with the promise of growth and jobs, and that’s not possible if our EVs are all imported.

“The tariffs are welcome, but Europe needs a strong industrial policy to speed up electrification and localise manufacturing. Just introducing tariffs while scrapping the 2035 deadline for polluting cars would slow down the transition and be self-defeating,” Poliscanova said.

T&E highlighted that maintaining the EU’s CO2 goals for carmakers, including the 2035 zero-emission target, is crucial for signalling to manufacturers the importance of transitioning to electric vehicles.

“The group also advocated for an EU industrial policy that includes strong sustainability criteria to support local clean manufacturing. Additionally, T&E called for an EU investment plan to enhance EV and battery manufacturing, arguing that it would be more effective than the current fragmented national state aid programmes.

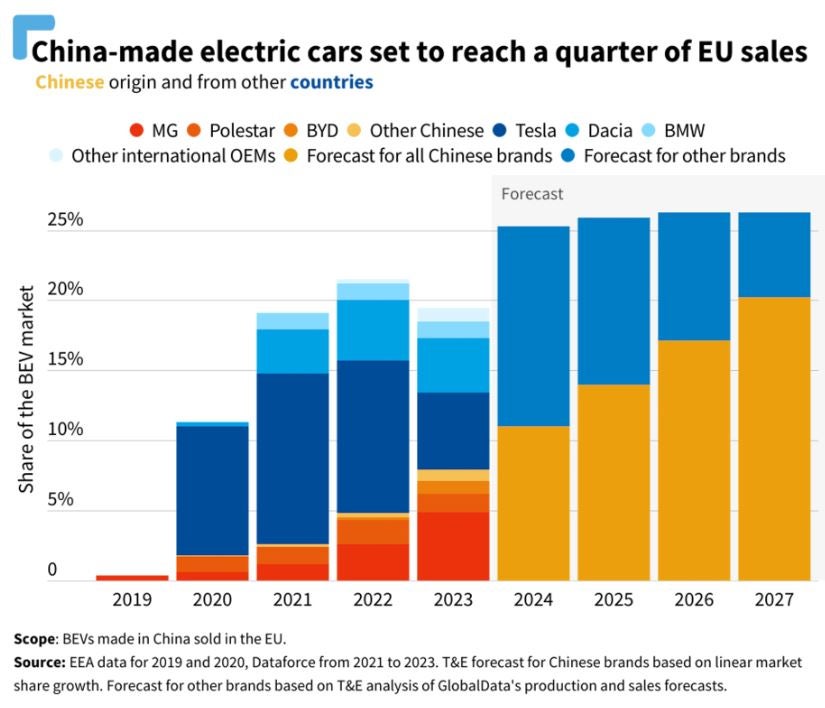

According to a T&E analysis published in March, one in four EVs sold in Europe this year could be imported from China. The EU will retain three-quarters of the revenue generated from these tariffs, and T&E suggested that these funds should be used to scale up the battery supply chain through the EU Innovation Fund.

Biden and Trump face off: the battle over the future of the EV industry

How will Biden’s China tariff hikes affect European car financing?