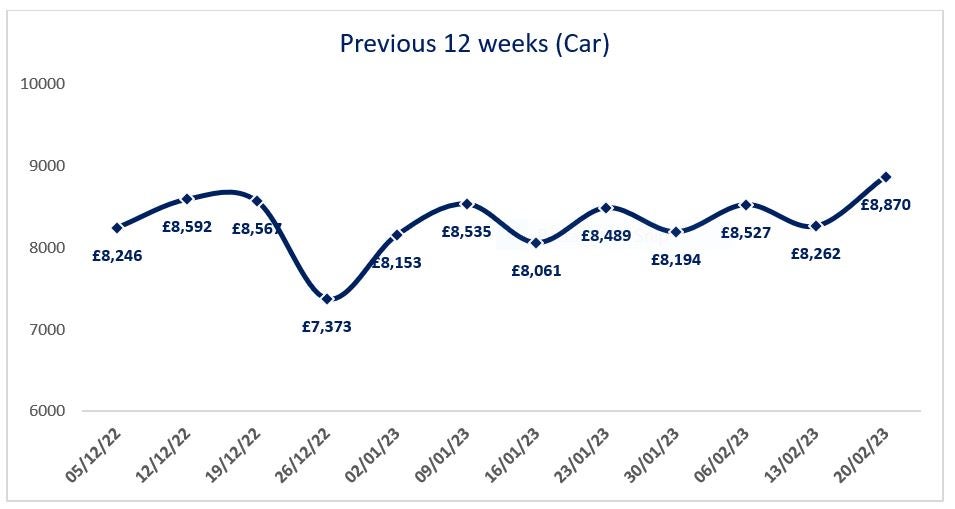

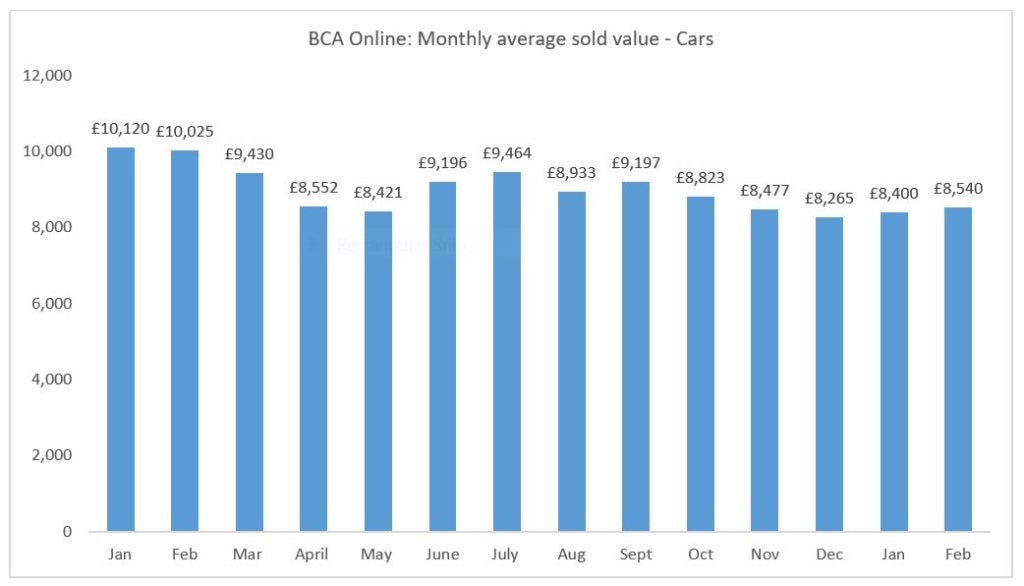

The strong start seen by the used car sector in 2023 continued during February as average values rose for the second month running. Weekly volume sold increased significantly to reach the highest point of the last 12 months as online sales activity was supported by record numbers of buyers joining from across the franchised and non-franchised sectors.

Values averaged £8,540 at BCA in February 2023, up by £140 or 1.7% compared to January 2023, as sold volumes increased for the second month running and performance against guide price also improved.

Whilst average values continue to climb, understanding the different sectors remains important with some softening within the budget sector and continuing pressure generally on EV values, but significant strength in retail stock up to five years old. Despite the combination of movements, the final week of February saw average values reach their highest point so far this year.

(Source: BCA Valuations)

BCA UK COO Stuart Pearson said, “Whilst the cost of living squeeze continues, there appears to be some light at the end of the tunnel for consumers with news that government help with energy costs is expected to continue and forecasts that inflation will fall to around 4% by the end of the year.”

“After some significant pricing realignment over recent months, we’ve also seen the used EV sector starting to stabilise for a number of models, which has stimulated a significant change in retail interest.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“From a supply perspective, the SMMT has reported seven consecutive months of growth in new car registrations but, even after a 26.2% rise in February, we are still a long way behind the high points of the pre-pandemic period. Added to this, we are also approaching the 3-year anniversary of the first lockdown, when many of the supply challenges in the new car market commenced.”

Pearson concluded “The net result of all of this is a definite resilience to the used car sector that is unlikely to waiver for some time. Even with some further acceleration in new car registrations expected over the next few months, the ongoing shortage of quality 0-3-year-old products should mean that supply and demand will remain reasonably well balanced for the foreseeable future.”

(Source: BCA Valuations)