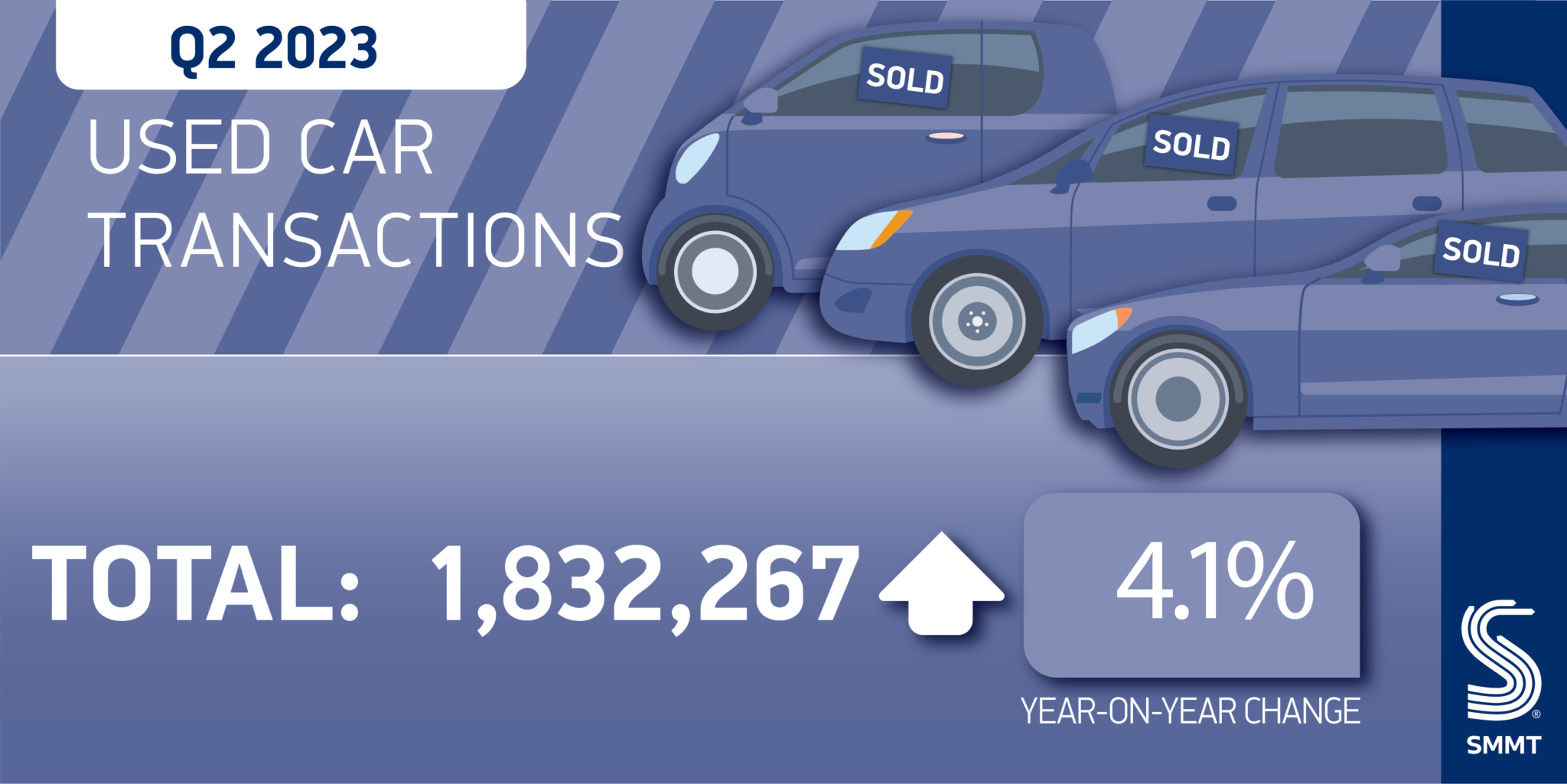

The UK’s used car market rose by 4.1% during the second quarter of the year, with 1,832,267 units changing hands, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT).

The increase equates to an additional 72,583 transactions compared with the same period in 2022, reflecting sustained growth in the new car market and improving availability.

The easing of supply chain disruptions has driven sales growth in every month so far this year and, although the Q2 market remains -9.9% below 2019 levels, its recovery continues apace.

Used battery electric vehicle (BEV) sales continued to soar in the second quarter, growing by 81.8% to 30,645 units, representing 1.7% of the market – a new record – up from 1.0% last year.

Double-digit growth also continued for plug-in hybrids (PHEVs) and hybrids (HEVs), up 11.4% to 18,437 units and 29.5% to 53,634 units respectively. The rising proportion of electrified vehicles meant that market share for conventionally powered cars marginally fell to 94.3% from 95.7% last year, even though volumes of petrol and diesel cars saw growth of 2.5% and 2.8% respectively.

Superminis remained the best-selling used vehicle type, making up 31.5% of transactions and growing by 4.4% to 576,980 units. This was followed by lower medium, accounting for 26.5% of the market, while dual-purpose cars rounded off the top three with a 15.1% share.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataBlack retained its position as the most popular colour choice for the 10th quarter in a row, representing more than one in five (21.3%) transactions. It was followed by grey and blue in second and third places with respective 16.9% and 16.3% market shares.

Mike Hawes, SMMT chief executive, said, “It’s great to see a recharged new car sector supporting demand for used cars and, in particular, helping more people to get behind the wheel of an electric vehicle.

“Meeting the undoubted appetite for pre-owned EVs will depend on sustaining a buoyant new car market and on the provision of accessible, reliable charging infrastructure powered by affordable, green energy.

“This, in turn, will allow more people to drive zero at a price point suited to them, helping accelerate delivery of our environmental goals.”

Lisa Watson, director of sales at Close Brothers Motor Finance, said: “Though well-documented supply constraints and production issues have eased, the cost-of-living crisis is having a prolonged effect on consumer’s buying plans for new cars.

“However, recovering production levels will lead to an influx of much-needed stock into the second-hand market, which is reflected in strong Q2 used sales figures.

“The introduction of the Ultra Low Emission Zone (ULEZ) expansion in London and the likelihood of other cities adopting similar schemes could have a further impact on used car sales.

“As consumers look for compliant vehicles, many will turn to the used market in order to save money compared to purchasing a new car.

“This should also make alternative fuel vehicles (AFVs) accessible to consumers, as more have come onto the used market and sales have increased. As we approach the 2030 ban on new petrol and diesel vehicles, dealers will need to utilise tools and insight to cater for an increase in AFV demand.”

Summer surge as one new EV registered every 60 seconds