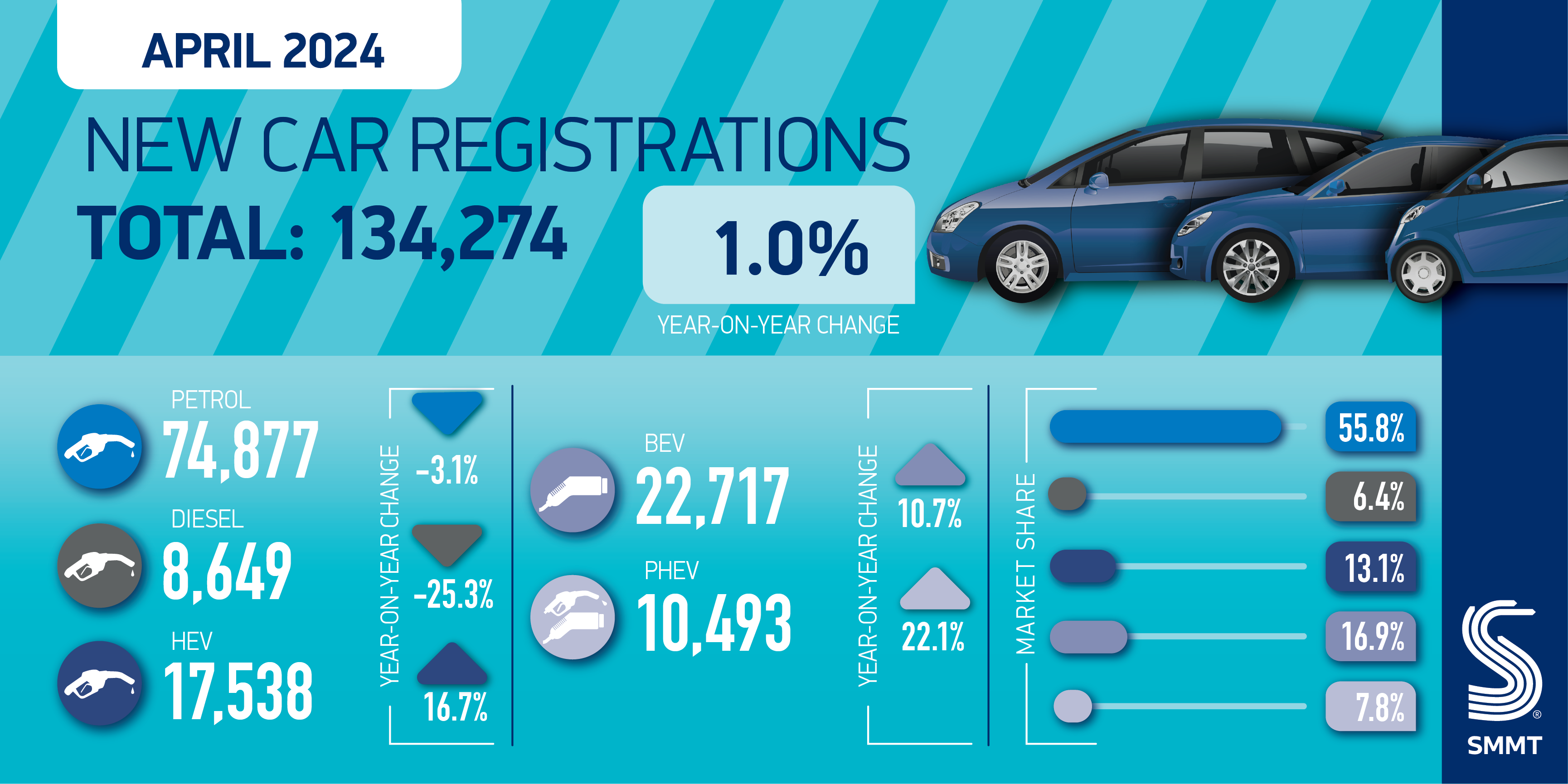

In April 2024, UK new car registrations marked their 21st consecutive month of growth, albeit with a modest increase of 1.0% to reach 134,274 units, according to data released by the Society of Motor Manufacturers and Traders (SMMT).

This performance marked the strongest April since 2021, although registrations still lagged -16.6% below pre-pandemic levels, a typical trend for a low-volume month following the March plate change.

The growth trend, consistent throughout the year, was entirely driven by fleet registrations, which surged by 18.5% to hit 81,207 units – representing over six in ten of all new cars registered in April. Conversely, private buyer uptake dipped by -17.7% to 50,458 units, while business registrations fell by -16.1% to 2,609.

Electrified vehicles continued to be the primary drivers of market expansion. Plug-in Hybrids (PHEVs) saw the strongest growth, rising by 22.1% to capture 7.8% of the market share, followed by Hybrid Electric Vehicles (HEVs), up 16.7% with a 13.1% share of demand.

Battery Electric Vehicle (BEV) registrations experienced a more positive April, largely due to compelling fiscal incentives for businesses, with overall BEV uptake climbing by 10.7% and market share reaching 16.9%, a notable increase from the previous April’s 15.4%.

Despite the overall increase in BEV demand, urgent action is required to reignite private buyer interest in electric vehicles. Less than one in six new BEVs purchased in April were bought by consumers, with private uptake volumes declining by -21.9%. While there is a wide range of BEV models available, supported by manufacturers’ offers, the lack of government incentives for private motorists remains a significant barrier.

Mike Hawes, SMMT Chief Executive, emphasised the necessity of government intervention to drive EV adoption, stating, “Although attractive deals on EVs are in place, manufacturers cannot fund the mass market transition single-handedly. Temporarily cutting VAT, treating EVs as fiscally mainstream not luxury vehicles, and taking steps to instil consumer confidence in the chargepoint network will drive the market growth on which Britain’s net zero ambition depends.”

David Borland, EY UK & Ireland Automotive Leader, noted the progress in BEV market share but stressed the need for further growth, stating, “This was, however, up from 15.2% in March, representing a step in the right direction.” Borland highlighted challenges such as limited charging infrastructure and affordability concerns hindering BEV sales.

Caroline Litchfield, Partner at Brabners, echoed concerns over sluggish private EV uptake and urged for government incentivisation and infrastructure investment. She stated, “Without further incentivization and investment in EV infrastructure, demand for plug-ins will continue to lag supply.”

Jamie Hamilton, automotive partner at Deloitte, identified a gap between fleet and private retail demand for EVs, calling for measures to stimulate private consumer interest. Hamilton stressed, “Lack of accessible electric vehicle charging infrastructure continues to be the biggest barrier for many looking to make the switch.”

Lisa Watson, Director of Sales at Close Brothers Motor Finance, highlighted robust consumer demand despite challenges like fluctuating fuel prices and rising insurance premiums. “It’s vital that dealers keep abreast of consumer demand by using the tools and insights at their disposal to stock forecourts appropriately,” Watson said.