British drivers are among the most sceptical in the world when it comes to having artificial intelligence (AI) in vehicles, according to research by Deloitte.

The Global Automotive Consumer Study, surveying over 31,000 individuals across 30 countries, found that over a quarter (26%) of British drivers remain unconvinced about the benefits of AI in cars. This puts the UK on par with the US (26%) and Germany (25%) in terms of scepticism, a stark contrast to the overwhelming acceptance seen in India (82%) and China (77%).

The 2025 study UK sample size was 1,505 and fielded between October and November 2024.

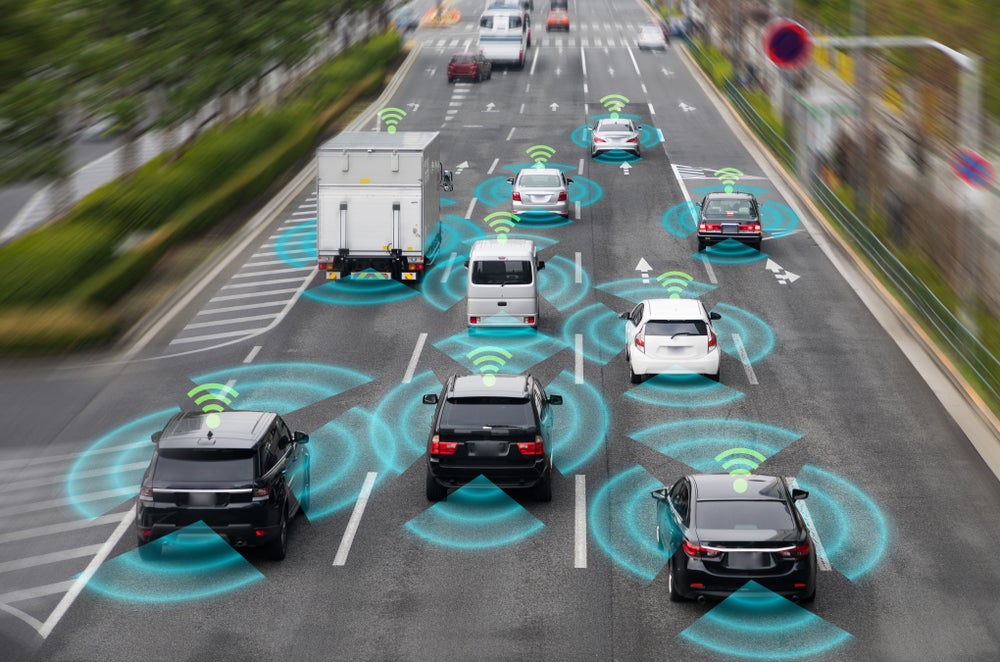

AI-powered systems can analyse real-time data from car sensors to detect potential hazards, automate parking manoeuvres and predict potential maintenance needs, reducing breakdowns and costly repairs.

Jamie Hamilton, automotive partner and head of electric vehicles at Deloitte, said: “Building trust in AI technology is paramount, especially in a market like the UK where consumers are expressing significant reservations. However, while AI promises to potentially revolutionise the car industry, these findings also highlight a crucial need for greater consumer education and engagement.”

Concerns with autonomous robotaxis and commercial vehicles

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThere were similar reservations from UK consumers on autonomous vehicles – as India (63%), the UK (52%) and the US (52%) were more concerned about fully autonomous vehicles when compared to other nations such as Germany (36%), Japan (41%), or China (43%). A significant number of UK respondents (67%) also expressed concerns about commercial vehicles - trucks and lorries delivering goods - operating in a fully autonomous mode on motorways.

Sarah Noble, automotive partner and consumer supply chain lead at Deloitte, explained that while autonomous vehicles have integrated well in some parts of the world, UK consumers still have reservations about how these vehicles will navigate complex real-time driving scenarios.

"Rigorous testing and clear demonstrations of safety protocols will be crucial to building public trust and addressing consumer anxiety. Only then will the tangible benefits of this technology be recognised in a way that resonates with UK drivers."

Consumers wary of sharing vehicle data

In most countries, consumers trust car manufacturers when it comes to managing connected vehicle data. However, consumers surveyed in the US (31%), the UK (30%) and Germany (26%), do not trust manufacturers or other organisations, such as government agencies, cloud providers and insurance companies, to have access to their vehicle data.

However, when asked about sharing their vehicle data with manufacturers to support extra security and safety features, even at an additional cost to the driver, UK consumers showed more willingness. A majority would pay extra for anti-theft tracking services (65%), emergency assistance services (58%) and services for the automatic detection of vehicles and pedestrians (50%).

Noble commented: "While consumers generally trust car manufacturers with their data, a sizable portion, particularly in key markets like the UK, remain wary.

“Our research also shows UK drivers are willing to trade data for security and safety. They see value in features like anti-theft tracking and emergency assistance, even if it means sharing some personal information. This presents a real opportunity for manufacturers to build trust and demonstrate the tangible benefits of connected car technology.

“Giving consumers clear choices and control over their data will be essential for building trust in this increasingly connected era of mobility."

UK drivers overwhelmingly favour home EV charging

Out of all the surveyed nations, drivers in the UK ranked the highest (80%) when it came to their preference for charging their electric vehicles at home, compared to other options such as public charging stations (10%) or at work (11%).

Hamilton added: “Our research shows a strong majority of UK consumers who intend to purchase an electric vehicle plan to charge their vehicle at home.

“While home charging simplifies the charging experience for some people, it also highlights the need to address potential barriers for those without a driveway or off-street parking. A robust public charging network is essential for wider EV adoption - it's about providing convenience and peace of mind for longer journeys and for those who can't charge at home."