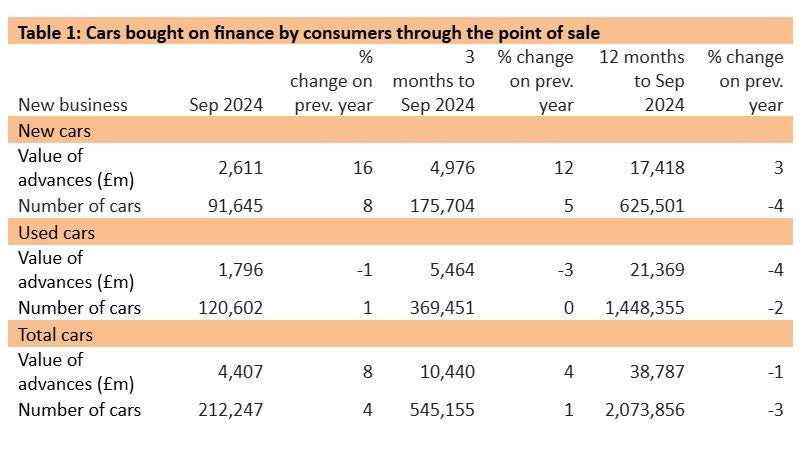

Consumer car finance new business volumes grew in September 2024 by 4% compared with the same month in 2023, according to new figures released by the Finance & Leasing Association (FLA).

The corresponding value of new business increased by 8% over the same period. In the first nine months of 2024, new business was 2% lower by volume compared with the same period in 2023.

The consumer new car finance market reported new business by value in September 16% higher than in the same month in 2023, while new business volumes grew by 8%. In the nine months to September 2024, new business volumes in this market were 3% lower than in the same period in 2023.

The consumer used car finance market reported a fall in the value of new business in September of 1% compared with the same month in 2023, while new business volumes grew by 1%. In the nine months to September 2024, new business volumes in this market were 1% lower than in the same period in 2023.

Geraldine Kilkelly, Director of Research and Chief Economist at the FLA, said: “Overall, the consumer car finance market reported growth in both the value and volume of new business in September which saw the issue of a new registration plate. In Q3 2024 as a whole, new business volumes in this market were 1% higher than the same quarter in 2023.

“The consumer car finance market is the largest of the UK consumer credit markets accounting for 36% of the total value of outstanding consumer credit contracts at the end of September 2024. It currently helps more than 6 million consumers fund car purchases across all regions of the UK.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData“As always, customers who are worried about meeting payments should speak to their lender as soon as possible to find a solution.”