Analysis undertaken by GlobalData shows that Tesla led Europe’s battery electric vehicle (BEV) market in the first quarter of 2023, with around 93,000 units sold versus 91,000 units for Volkswagen Group brands.

Tesla is benefiting from ramped up production of the Model Y from its Berlin manufacturing plant as well as price cuts.

GlobalData’s analysis also suggests that Tesla’s better component supply management during the semiconductors crisis enabled it to keep up with orders better than many other OEMs, who have built up big order backlogs during the past year.

As Tesla has prioritised volume over profit, that has brought its order backlog down rapidly – alongside more output becoming available from its Shanghai and Berlin plants.

However, other manufacturers may be forced to react to Tesla’s actions and cut their prices, too, according to GlobalData senior analyst Al Bedwell.

Speaking to Just Auto, he said that other OEMs are reluctant to go down the price cutting path in BEV sales, if that can possibly be avoided.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“The problem is, they have built up high backlogs over the past year,” Bedwell points out. “These will start to decline as production improves and more supply to the market at the same time as Tesla is pushing for higher sales will put pressure on prices across the board.

“The second half of this year could see something of a BEV price war break out in Europe, especially if consumer enthusiasm for BEVs remains somewhat lukewarm in a generally downbeat economic environment.”

Bedwell also points out that lower prices would lift Europe’s BEV (cars) segment as a whole in 2023, as long as prospective buyers don’t hold off and wait for further price cuts.

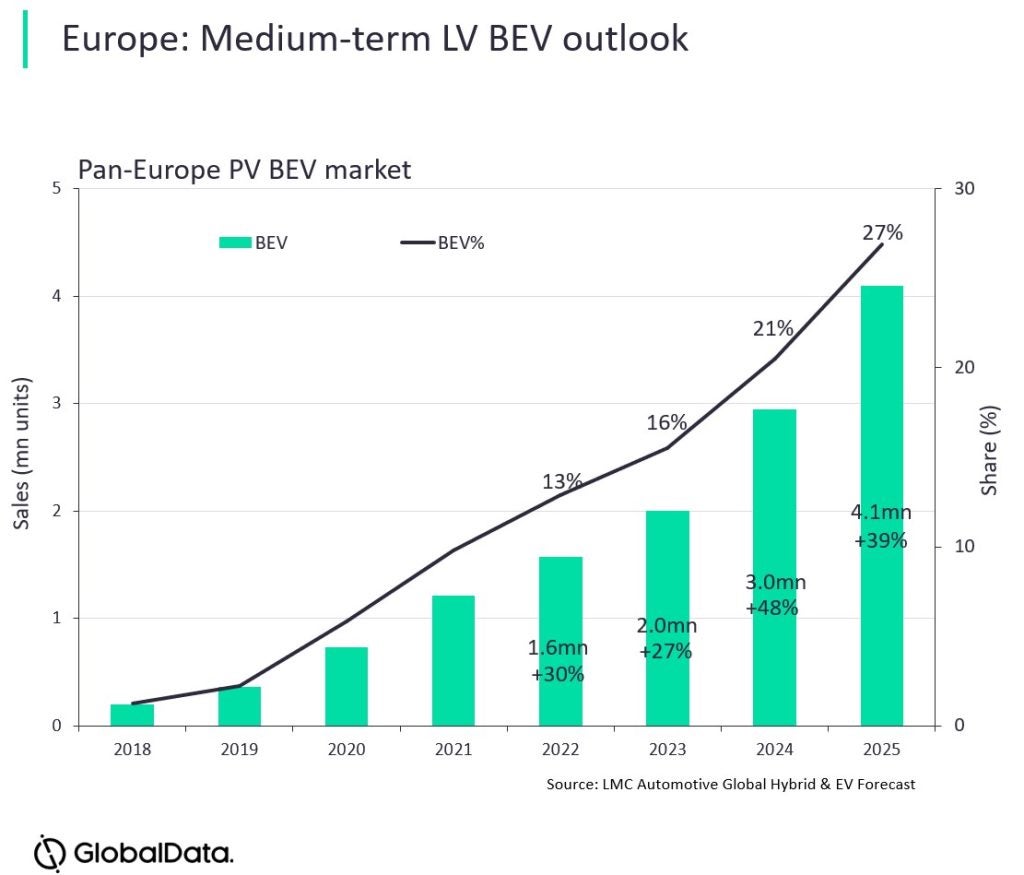

“We currently see the BEV market in Europe rising by 27% for the year as a whole to around two million units, but it could go higher than that if other manufacturers react to Tesla and we get a price war. Attention then turns to who has the largest margins and is willing to sacrifice them for greater share in a market that is still in an early – if rapid – growth phase.”

Consumer car finance new business volumes fell by 8% in March