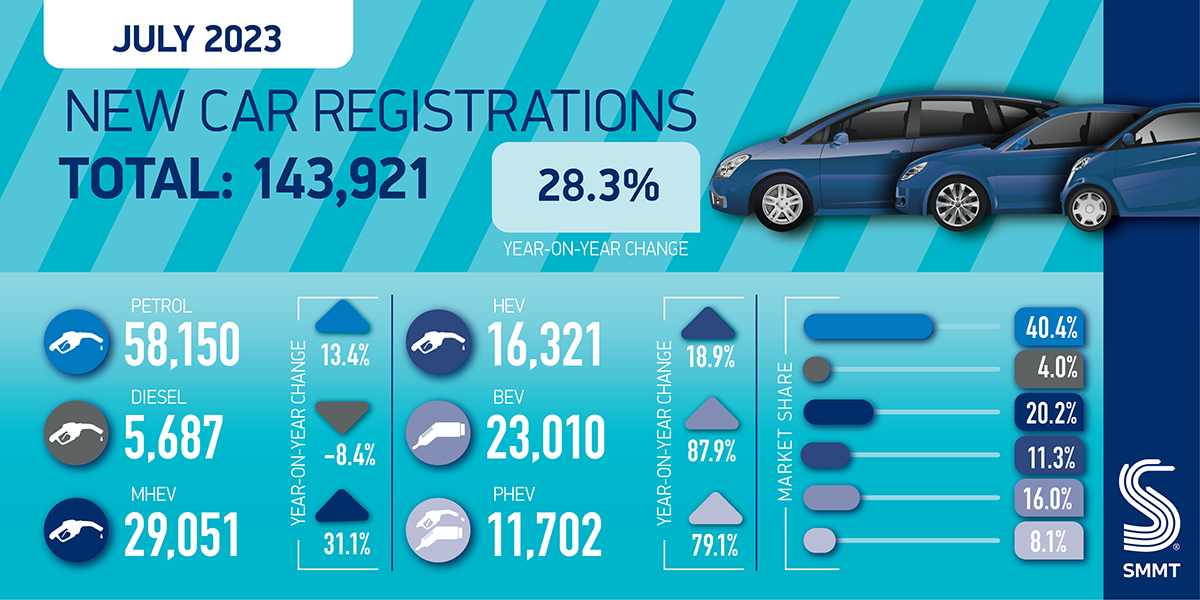

The new car market grew 28.3% in July with 143,921 new vehicles registered, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

The market has enjoyed non-stop growth for a full year despite challenging economic conditions, as supply chain challenges ease, production increases and deliveries can be fulfilled.

This was the best July performance since 2020, when pent-up demand for new cars was unleashed following three months of lockdown during the pandemic. Despite this continuous growth, however, the overall market year to date remains behind pre-pandemic levels.

Company registrations drove the growth, as uptake by large fleets increased 61.9% to 80,961 units and business registrations rose 28.7% to 2,915 new vehicles. Private demand remained stable at 60,045 units (up 0.3%).

Electrified vehicles accounted for more than a third (35.4% of the market). Hybrid (HEV) volumes grew, although their overall market share fell to 11.3%. Plug-in hybrid (PHEV) registrations saw a significant uplift for the second month in a row as uptake rose 79.1% to account for 8.1% of the market.

The biggest increase, however, was for battery electric vehicles (BEVs), which recorded an 87.9% increase to account for 16.0% of all new registrations for the month, a market share broadly consistent with that seen so far this year.

The demand for battery electric cars was such that a new one was registered every 60 seconds in the month. According to the latest market outlook published today, this will accelerate to one every 50 seconds by the end of the year, and up to one every 40 seconds by the end of 2024.

While the growth in electric vehicles hitting UK roads is significant, it must move even faster if it is to outpace the rest of the market and enable the UK to meet ambitious but necessary environmental targets.

To get even more consumers to make the switch, every means of support must be provided, from fiscal incentives to purchase reassurance – and, most obviously, in ensuring drivers have full confidence that they will be able to charge wherever and whenever required, sustainably and affordably.

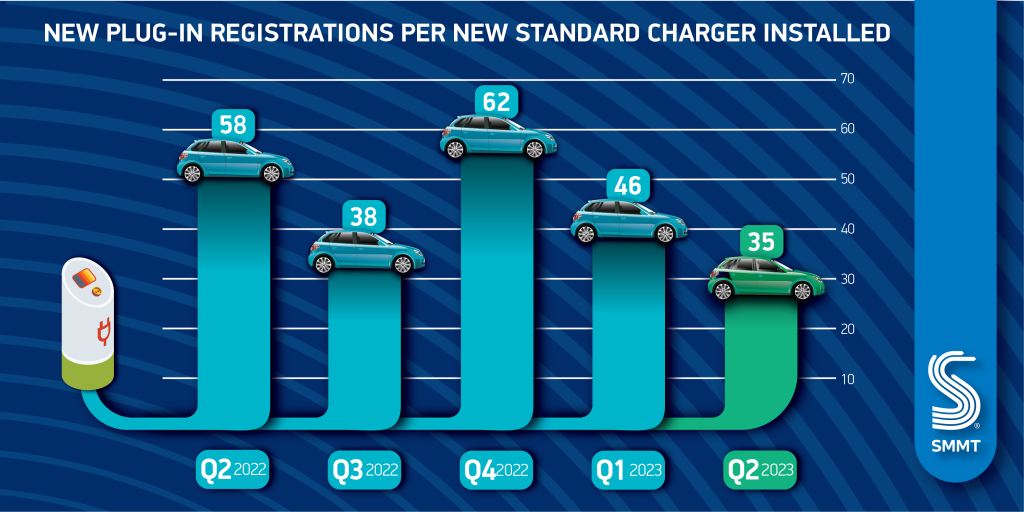

There were positive signs on this over the last quarter, as a record high of 3,056 new standard public chargers were installed. This was equal to one new charger for every 35 new plug-in vehicles registered, a significant improvement on the same quarter last year, when the ratio was one for every 58 cars.

However, as government, charge point operators and the automotive industry all agree, reassuring drivers means building ahead of need. To reach the government’s minimum target of 300,000 charge points by 2030, the installation rate must treble to almost 10,000 chargers per quarter, every quarter.

This can only be achieved if the obstacles to installation so commonly cited – arcane planning regulations, competing pressures on local authorities and delays to grid connections – are overcome.

An overarching strategy, including a chargepoint mandate, is necessary to create the reliable, accessible and affordable charging network consumers deserve.

Mike Hawes, SMMT Chief Executive, said, “The industry remains committed to meeting the UK’s zero emission deadlines and continues to make the investments to get us there. Choice and innovation in the market are growing, so it’s encouraging to see more people switching on to the benefits of driving electric.

Nick Williams, managing director, Lex Autolease, said: “Every month electric vehicles (EV) registrations continue to grow, with another 23,010 vehicles added to our roads in July, helping drive the transition to electric.

“This month, all eyes will be on the government as we await the result of its consultation on the Zero Emissions Vehicles mandate.

“It’s promising that recent weeks have seen multiple manufacturers commit to an electric future in the UK, with EV-focused investments recently announced by Renault and Geely, and Jaguar Land Rover-owner Tata.

“However, if we’re to see real change we need a robust finalised mandate with ambitious targets, as well as continued support for the rollout of charging infrastructure right across the country.

“Our new Future of Transport Report, which looks at how travel is changing and the implications for the environment, revealed that 60 per cent of drivers will opt for battery technology when purchasing their next car, which is a positive sign as the government’s 2030 deadline approaches.”

Melanie Shufflebotham, COO of Zapmap, said: “The latest figures are clear evidence that electric vehicles continue to grow in popularity, with drivers keen to play their part in the transition to a greener future.

“We support the SMMT’s call for the Government to make it easier for people to buy, run and charge EVs, and we hope people will be encouraged by the continuing growth in infrastructure.

“At the of July 2023 there were more than 45,700 charging points across the UK, across more than 26,800 locations – that’s a significant 40 per cent increase since the same time last year – and the number of ultra-rapid devices for en-route charging has increased by 90 per cent.”

John Veichmanis, CEO at carwow UK, said the surge in BEV registrations was “predominantly being driven by fleet sales, up 61.9% year-on-year, and business registrations which rose 28.7%.

“While private registrations saw just 0.3% growth, our data which shows that nearly two in five (38%) carwow customers would consider an EV as their next car. But while there’s appetite for people to go electric, we know that a lack of infrastructure is still putting many off. A reliable charging network and lower price point cars, need to be accompanies by a widespread scale-up of public charging points if more private buyers are to be persuaded to go electric in the coming years. There’s also still a way to go before we reach the 22% BEV registration figure needed for the zero-emission vehicle mandate, but this growth definitely shows that the broad UK market is going in the right direction.”

Who’s finding it difficult to finance their wheels? The vulnerable and the unbanked