Citigroup has downgraded Lloyds Banking Group PLC due to ongoing concerns related to the UK’s motor finance review. Citigroup lowered Lloyds’ rating from “buy” to “neutral” while maintaining an “overweight” rating for the UK banking sector overall.

Despite Lloyds announcing a £3.32 billion profit for the first half of the year, which exceeded market expectations, Citigroup highlighted that the bank fell short on pre-provision profit. Lloyds was unique among its peers in missing this benchmark, attributed to “higher operating lease depreciation” and motor finance redress, which is anticipated to remain a challenge until May 2025.

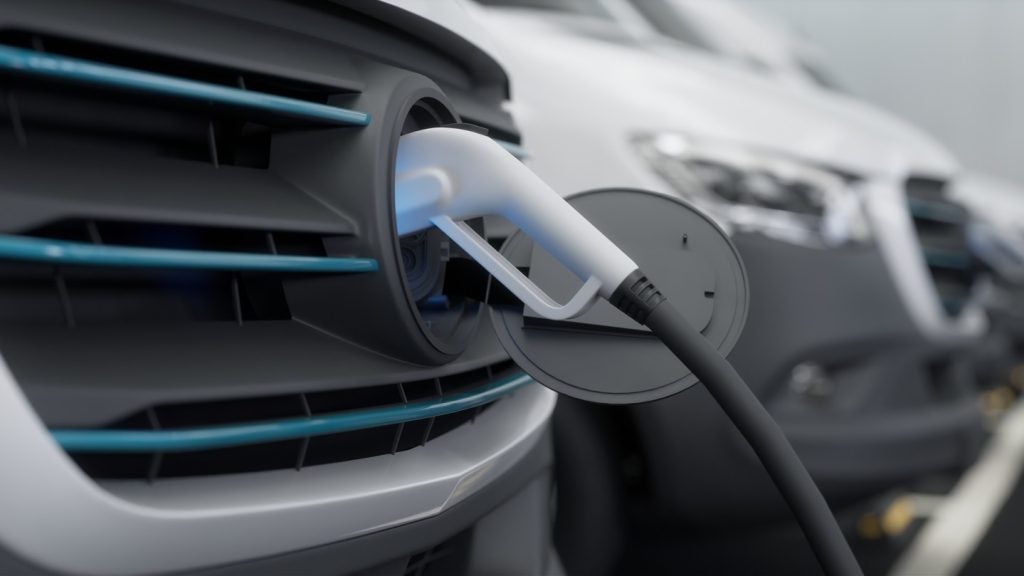

The Financial Conduct Authority (FCA) recently delayed its review of the motor finance market from September this year to May 2025, causing further uncertainty. This review scrutinises the historic use of discretionary commission arrangements in the sector. The FCA said that redress payments related to discretionary commission arrangements (DCA) are now “more likely,” adding to Lloyds’s concerns.

Citigroup maintained “buy” ratings for HSBC PLC, NatWest Group PLC (LSE), and Barclays PLC, while Standard Chartered PLC (LSE) retained its “neutral” rating.

Explainer: What is Discretionary Commission and why has the FCA launched a probe?

Investec sets aside £30m amid FCA commission probe