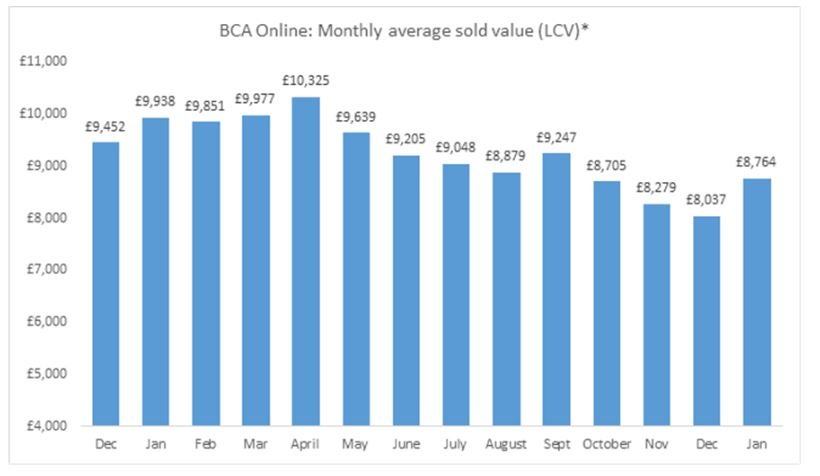

Light commercial vehicle (LCV) values experienced a notable rebound at vehicle remarketing company BCA in January 2024, reaching their highest point since September of the previous year.

This upswing marks a significant turnaround from three consecutive monthly falls, with values improving by £727 over the month, equivalent to a substantial 9% rise. The positive trend was attributed not only to increased buyer participation but also to a more favourable mix of vehicles entering the market.

Throughout January, anecdotal reports indicated a growing momentum, with retail demand steadily rising as the month progressed. The improving economic backdrop played a crucial role in fostering confidence within the used LCV sector.

Concurrently, the new van sector continued its positive trajectory, recording growth for the 13th consecutive month. UK new van registration volumes surged by 8.4%, reaching 23,962 units in January, marking the highest volume recorded for the month in three years.

Stuart Pearson, BCA COO UK, highlighted the steady rise in confidence within the used LCV sector since the beginning of the year. He acknowledged the potential for further improvement while anticipating a return to more seasonal trends in the LCV wholesale market in the coming weeks. Pearson expects robust stock availability, particularly from rental, fleet, lease, and contract hire sources.

The condition remains a pivotal factor in ensuring the attractiveness of LCVs to a broad market. BCA is actively collaborating with various customers to optimize values through a data-driven approach to refurbishment. With an extensive online sales program offering thousands of light commercial vehicles each week, BCA assures its buyer customers of timely access to the stock they require.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe positive trends in LCV values and market dynamics suggest a promising outlook for the sector, with stakeholders poised for a return to more predictable patterns in the upcoming weeks.