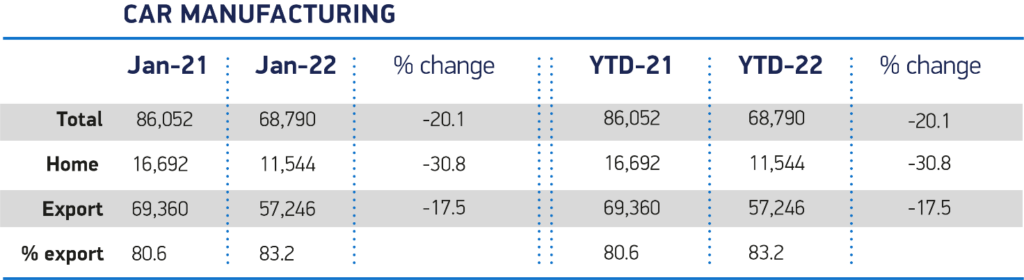

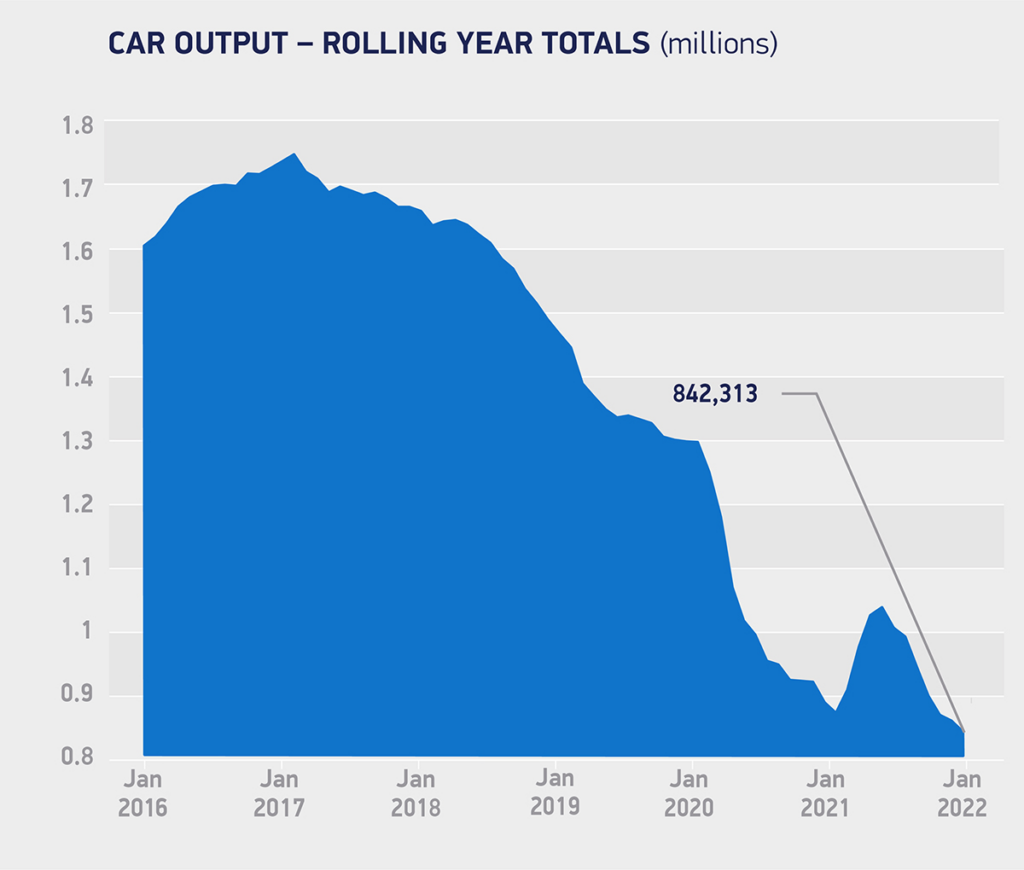

UK car production fell 20.1% to 68,790 units last month, according to figures released by the Society of Motor Manufacturers and Traders (SMMT), the weakest January total since 2009.

Output was down 17,262 units against the same month last year, which itself was one of the worst Januarys on record when volumes were impacted by friction in the new post-Brexit trading arrangements, extended shutdowns and the pandemic.

Several factors conspired to drive year on year production down still further in January 2022. The sustained worldwide shortage of semiconductors was the most significant cause, exacerbated by the loss of volume arising from a major plant closure in July 2021 and production variations caused by the changeover of some popular models.

More positive, however, was the continued shift towards electrified vehicles, with zero-emission battery electric vehicles now accounting for one in 11 cars made in the UK, as their production rose 37.6% to 6,326 units. Including plug-in hybrids and hybrids, electrified vehicles accounted for more than a quarter of output (27.4%, up from 25.4% in 2021).

Production for both overseas and domestic markets was down year on year, by -17.5% and -30.8% respectively, as exports accounted for more than eight in 10 cars made. The EU remained the largest destination for UK-made cars, taking 59.1% of exports, followed by China (10.4%) and the US (10.0%).

Mike Hawes, SMMT chief executive, said, “It’s another torrid start to the year as global supply issues and structural changes squeeze output while model changes impact production scheduling. The UK automotive manufacturing industry is, however, fundamentally strong and recent investment announcements are testament to the potential for growth, not least in terms of rising EV production. Long-term recovery can only be delivered, however, if global competitiveness is assured and for that we must address both inflationary and fixed costs, most obviously escalating energy prices, but also fiscal and trading costs. Every measure must be taken if we are to secure a bright, electrified future for our world-class automotive manufacturing base and the high skilled, high-value jobs it creates across Britain.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataReflecting the challenging start to the year, independent expectations for UK car production have been revised downwards from the autumn outlook by -2.4%, to approximately 979,000 units for 2022,2 although this would still represent a 14.4% increase on 2021’s outturn, despite the loss of some OEMs and some car production facilities switching to LCV production. However, the future of electric vehicle production is more positive, following confirmations from several manufacturers to expand EV production in the UK. Longer term, car production is expected to exceed one million units from 2023 onwards, and surpass 1.1 million in 2027.

Leasing.com forecasts increase in UK business in 2022