UK Chancellor Jeremy Hunt has unveiled the Autumn Statement, featuring substantial tax cuts for both individuals and businesses as he attempts to stimulate the British economy ahead of a general election next year.

Hunt has made the “full expensing” policy, offering 100% tax relief on capital spending, a permanent reality for businesses. Additionally, he has reduced the headline rate of national insurance from 12% to 10%. These measures come in response to a less optimistic economic outlook provided by the Office for Budget Responsibility.

Initially, the announcement seems to presents good news for the industry, with a range of measures aimed at promoting investment, notably the full capital expensing. However, when digging deeper, there seems to be a general feeling that more could have been done in the industries’ interest.

James Tew, CEO iVendi, explores the consequences of the statement for car dealerships: “There’s little in the Autumn Statement that is likely to have much direct effect on the fortunes of car dealers and the issues that they currently face, especially when it comes to how the used sector will absorb the growing numbers of EVs that will arrive over the next year or two. However, the various measures designed to help investment, especially full capital expensing, are good news and no doubt some automotive retailers will take advantage of them, while the NI cut will potentially provide a little more financial flexibility for car buyers. After the various substantial blows that the economy has taken in previous years, the chancellor is keen to promote a narrative that we’re ‘back on track’ and that might be a stretch, but we might at least be entering a phase where things have stopped getting worse. In its own way, this is to be welcomed.”

Philip Nothard, chair of the VRA, questions whether the policies will be enough to reverse low growth predictions, highlighting the need for subsidies in the future: “The autumn statement was about two things – putting more money in the pockets of consumers through the reduction in NI and encouraging growth through a range of measures, including the commitment to full capital expensing. In general terms, both are good for the remarketing sector – consumers will have a little more to spend on used cars and businesses that want to invest now have more options. However, the Bank of England presented to our organisation yesterday and their prediction for 2024 was very much that there would be no perceptible economic growth. Whether these measures will be enough to noticeably change that trend is open to question – but they certainly can’t hurt.

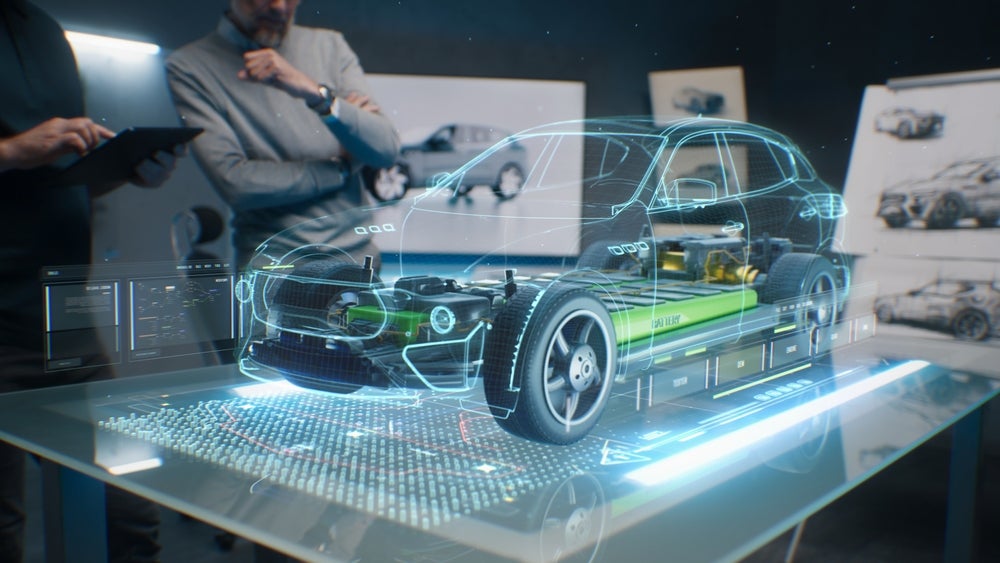

“It was encouraging to see a £2bn investment in zero emissions manufacturing although given the scale of global spending on EV investment, this is a relatively small amount. There’s also no sign of additional help to support electric cars in the used car sector. We know that large numbers of EVs are about to enter the remarketing cycle and that there isn’t necessarily the demand in the market to soak up that volume. Measures such as subsidies or interest free loans may be needed at some point before the end of the decade.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataDespite the resulting increases in investment that the tax cuts are likely to generate and the £4.6bn that will made available for strategic manufacturing sectors, nothing in the statement addressed the Auto industry’s major problem; infrastructure.

Commenting on this, Lisa Watson, Director of Sales at Close Brothers Motor Finance, said: “More than two thirds (68%) of dealers stated earlier this year that a lack of charging infrastructure is the biggest barrier to drivers buying an electric or hybrid vehicle, so while the Chancellor’s planned investment in electric car manufacturing will be welcome news to dealers and motorists, it doesn’t appear to address the need for infrastructure.

Adequate investment is needed for the UK to finally step-up its efforts to cater for a shift to alternative fuel vehicles (AFVs). With the 2030 ban having to be pushed back, this will be critical to reaching the revised 2035 target. Despite barriers in place, two-in-three (64%) motorists surveyed would consider buying an electric vehicle, so demand is there should the infrastructure be in place.”

The cuts reflect the governments’ commitment to enhancing economic activity, amidst predictions of low growth for 2024. Ed Rimmer, Chief Executive Officer at Time Finance believe tax cuts will not be sufficient to increase the productivity of UK businesses: “For businesses, this is very welcome news, but tax is not the only barrier for businesses looking to invest. There are many businesses that simply don’t have the working capital to invest in growth. The Chancellor suggests that this business tax cut will prevent the need for borrowing, which simply isn’t realistic for businesses, many of which are still battling high overheads. If the Chancellor wants businesses to grow, increase productivity and contribute to GDP, he must recognise that borrowing to invest is a viable business strategy, albeit one that will certainly be boosted by this tax relief package.”