Siemens Financial Services (SFS) has released a research paper estimating the current density of public EV chargers across several countries and regions.

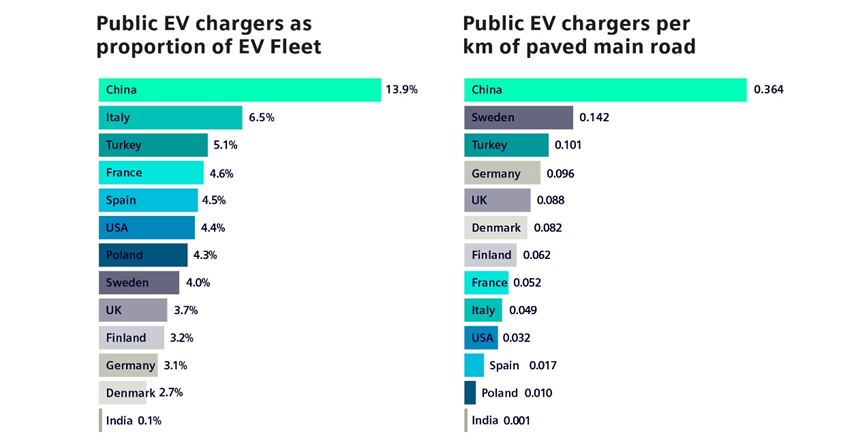

Density is calculated both as a proportion of the electric vehicle ‘fleet’ (the number of public EV chargers divided by the number of EVs) and as EV chargers per kilometre of the main road.

Almost all regions studied demonstrate a concerningly low ratio of publicly available charging facilities to the number of EVs on the roads or compared to the road infrastructure itself. Only China appears to have made serious investments in public EV charging networks. Meanwhile, European nations such as the UK, France, Germany and Spain do not even reach half of China’s implementation rate.

The findings come in the wake of previous research from SFS which estimated that a €104 billion ‘gap’ exists for the global development of EV charging infrastructure, just over the period 2023-25. This ‘gap’ represents the EV charging infrastructure not yet being acquired with smart, third-party finance – i.e. still being paid for out of CAPEX (capital expenditure).

To address the growing disparity between a growing EV market and the current lack of publicly available infrastructure to support it, the report points to the increasing interest in new private sector financing models based on usage, performance, and outcomes.

Such financing models range from leasing-based arrangements that help manage cash-flow, through to more complex usage-based arrangements that enable ‘X-as-a-Service’ methods of accessing e-Charging technology. No matter the structure, these models are designed to make investment affordable with manageable regular payments typically arranged to match the expected cash flow generated by the charging points, in some cases making the investment budget neutral.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“It’s encouraging to see the widespread take-up of electric vehicles and so important that countries urgently move to support this shift with the right infrastructure,” says Toby Horne, Siemens Infrastructure Financing Partner, Siemens Financial Services, UK.

“At its current pace of adoption, EV charging cannot yet meet demand. But intelligently deployed financing can help to accelerate investment and contribute to more sustainable road networks worldwide”, he adds.