European carmakers could reclaim a significant portion of the electric vehicle (EV) market in the EU, which has been lost to Chinese imports, if the bloc maintains its CO2 emissions targets and imposes tariffs, according to a new report by Transport & Environment (T&E).

The forecast predicts that European manufacturers will introduce more affordable EVs in 2024 and 2025 to meet these regulatory demands.

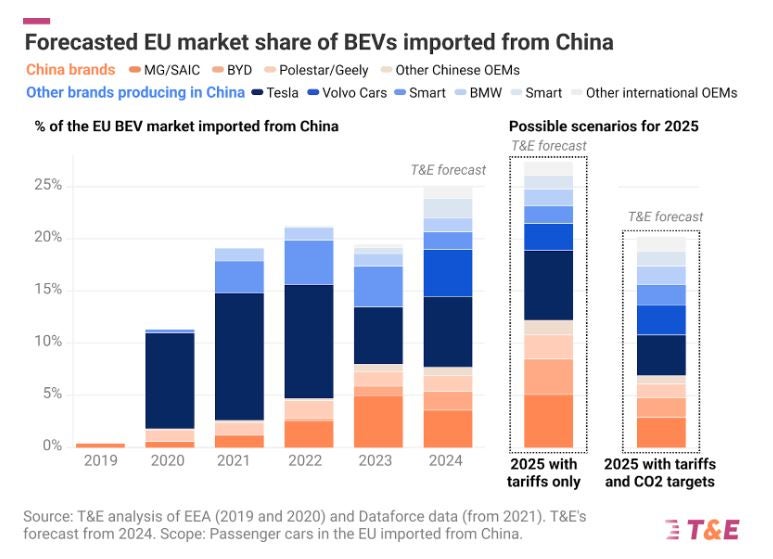

Currently, Chinese imports — including models from Tesla, BMW, and Volvo —account for a quarter of EV sales in Europe. However, T&E projects this could drop to 20% by 2025 and 18% by 2026, provided the EU upholds its car emissions targets and enforces tariffs on China-made EVs. In contrast, delaying the 2025 CO2 targets would allow Chinese EVs to expand their market share to 27% by next year, the report warns.

Some European automakers have urged the EU to soften or delay its emissions standards, a move T&E suggests would slow down the rollout of affordable EVs by domestic producers, as they focus instead on more profitable combustion-engine vehicles.

Julia Poliscanova, senior director for vehicles and e-mobility at T&E, emphasised that “higher EV tariffs are right but only in tandem with the car CO2 targets,” arguing that a delay in standards could lead to stagnation in EU-produced EV sales while limiting the number of affordable models from China.

T&E’s analysis of the EV-Volumes database shows a mixed impact of current EU tariffs on Chinese EV manufacturers. MG saw its European battery electric vehicle (BEV) market share drop from 4.1% in August 2023 to 2.4% in August 2024, while BYD’s share grew from 1.6% to 2.9%. Geely also increased its market share from 1.3% to 2% over the same period.

EU gigafactories

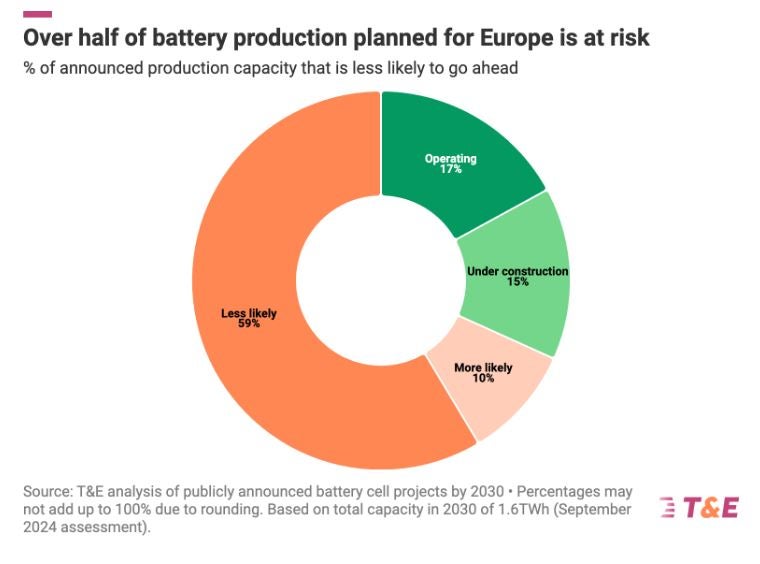

Beyond EVs, T&E highlighted the need for a stronger EU approach to domestic battery production, warning that 59% of planned European battery manufacturing could be at risk without intervention. T&E called for an EU investigation into battery cells and the introduction of trade defence measures to support local producers.

Poliscanova added that it “makes no sense to jeopardise the billions of investment in EU gigafactories” by maintaining low tariffs on batteries, urging for policies that reward clean battery production and an EU Battery Fund to support the sector.