Toyota Financial Services (TFS) grew its operating income 4% year-on-year to ¥76.6bn (£503m) in the three months to December, or Q3 in the company’s 2018 financial calendar.

The result was helped by a growth in net revenues to ¥512.5bn, up 7.6% from 2016. This brought year-to-date profits to ¥1.8tn, up 15%.

The company attributed the growth to an increased lending balance and decreased costs from loan losses in North America.

In December, the UK arm of TFS launched a point-of-sale system for retail partners, named NGage, which it said was designed to eliminate the need for paper documents at quotation and agreement stages of a purchase.

Across the Toyota group, net revenues totalled ¥7.6tn, up 7%. Operating income, meanwhile, jumped 53% to ¥673bn.

Vehicle sales totalled 6.67m units, up by about 34,900 units year-on-year. Deliveries in Japan and Europe saw a rise, while sales in North America and Asia decreased to 2.1m units (down 13,800) and 1.1m units ( down 44,600) respectively.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataLast week, Toyota reported they had reached the milestone of 1.52m electrified vehicles delivered in 2017, up 8% from 2016. This brought cumulative sales of electrified vehicles by the group to 11.4m since the introduction of the Prius in 1997.

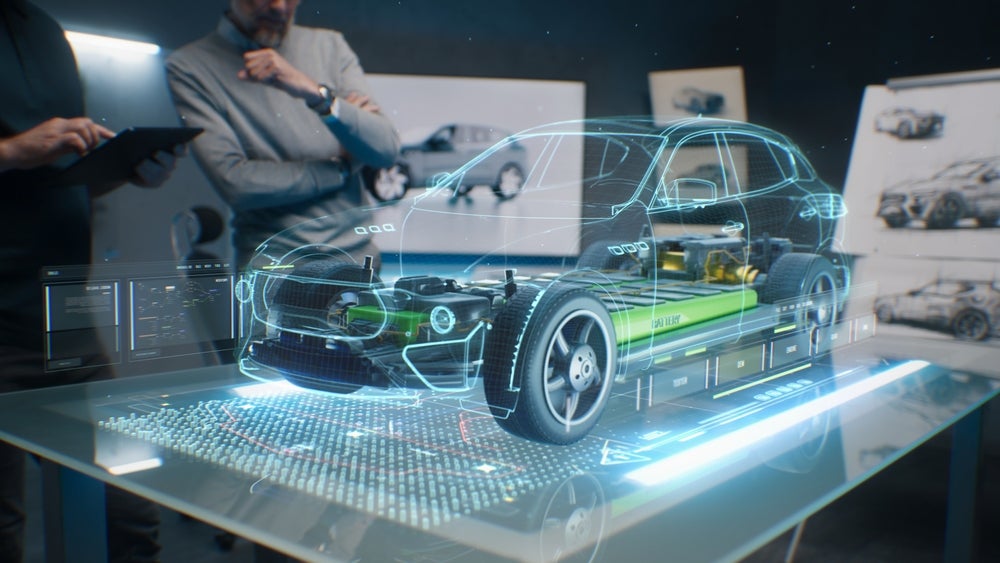

The group said in December it would launch 10 battery electric vehicles (EVs) by 2020, and has partnered with Mazda and engine maker Denso to develop EV capabilities.

Senior managing officer Masayoshi Shirayanagi said: “The latest operating income forecast is up ¥200bn from the previous forecast at the second quarter reporting.

“Excluding the overall impact of foreign exchange rates and swap valuation gains and losses, it is now up ¥130bn yen. This reflects additional contribution anticipated from profit improvement activities such as cost reduction, marketing efforts, and reduction of expenses.”