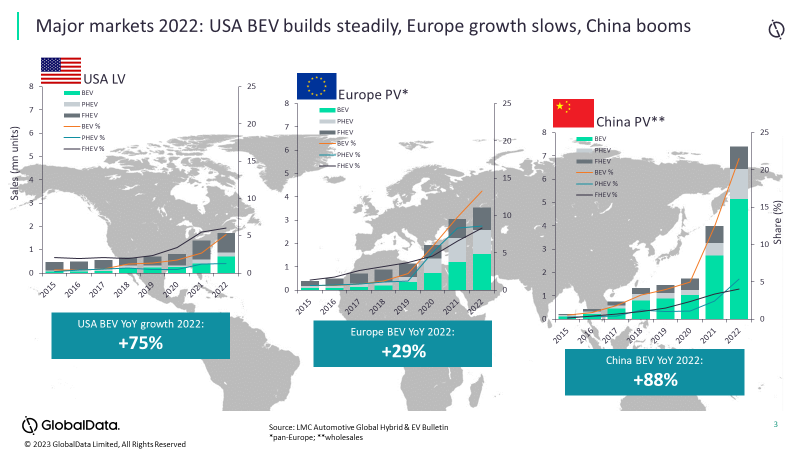

China is leading the global battery electric vehicle market by a considerable margin, according to the latest data analysis by GlobalData – and the EV market in China boomed in 2022.

Speaking to just-auto, GlobalData analyst Al Bedwell says that 2022 saw good growth in light vehicle electrification in most regions of the world.

However, China led the way with the personal vehicle battery electric vehicle market expanding by 88% last year. It also saw a strong performance from the PHEV (plug-in hybrids) segment.

“China’s NEV market [BEVs and PHEVs] continues to make astonishing progress with battery electric car wholesales making up at least a fifth of all car sales since March 2022 with NEV share exceeding a quarter of sales since April,” Bedwell says.

Bedwell believes government incentives have played a key role as the Chinese market bounced back from lockdowns and supply to the market improved during the course of 2022. “Extended national and local incentives, government NEV credit targets, a mass of product entering the market, free license plates in mega-cities plus fast evolution in the desirability of local product has stimulated the market hugely,” he says.

Bedwell adds that the possible disruption from Covid lockdowns in late 2022 didn’t materialise and so the end of the year was particularly strong for BEV deliveries.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“January came in weak, as it usually does,” he says. “But like Europe, the scale of the drop from December was much higher than in past years. There was a notable payback effect in China to start the year.”

GlobalData data shows that the Chinese BEV market has grown from one million a year in 2020 to five million sales in 2022.

Bedwell sees a highly positive outlook for BEVs and PHEVs in China. “Given the continued support for the NEV segment, the mandated NEV credit policy – which is getting much tougher – and the clear market opportunities, we see continued strong growth for China’s EV segment although not quite at the rate seen in 2022.

“By 2025, NEV sales could be in excess of 10 million units annually, with almost 90% of that being BEVs,” Bedwell says

GlobalData data also shows that the top three electric vehicle manufacturers – BYD, Tesla and Wuling – dominate the Chinese BEV market. In China’s BEV market in 2022, BYD, Tesla and Wuling took 29.0%, 11% and 9% market share respectively.

Bedwell also draws a link between high volumes and global competitiveness. “If the Chinese vehicle makers can meet supply chain challenges ahead – especially in the area of batteries – then high domestic market volume could give them a major lift in terms of their level of competitiveness in the global marketplace,” he says.

‘Global autotech sector saw 119 M&A deals in 2022’