In his final budget before the general election, Chancellor George Osborne announced certain measures which could affect the car industry as well as the motor finance sector. These measures included: company car tax, capital allowances, fuel benefit charge, fuel duty, vehicle excise duty and intelligent mobility.

Company Car Tax

In 2017-18 the appropriate percentage of a car’s list price subject to company car tax will increase by 2% for cars emitting more than 75 grams of carbon dioxide per kilometre (gCO2 /km), to a maximum of 37%. This rate will remain constant throughout 2018-19 and will increase by another 1% in 2019-2020.

During the period 2017-2018, there will be a 4% tax differential between the 0-50 and 51-75 gCO2/km bands and between the 51-75 and 76-94 gCO2/Km bands. In 2018-19 this differential will reduce to 3% points and remain at that level for 2019-2020.

Capital Allowances

As was announced in the Budge2014, the government will extend the Enhanced Capital Allowance for zero emission goods vehicles to 31 March 2018.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe government previously introduced legislation – which came into effect on 26 February 2015 – to clarify the effect of capital allowances anti-avoidance rules where there are transactions between connected parties or sale and leaseback transactions.

Fuel Benefit Charge

The Fuel Benefit Charge multiplier for both cars and vans as well as the main Van Benefit Charge (VBC) will increase in line with the retail price index (RPI) from 6 April 2016. The government will extend VBC support for zero emission vans to 5 April 2020 on a tapered basis, in line with the Budget 2014 announcement.

Fuel duty

Osborne announced the cancellation of the 0.54p per litre increase in fuel duty, which was scheduled for 1 September 2015.

Vehicle Excise Duty

From 1 April 2015, VED rates for cars, vans, motorcycles and motorcycle trade licences will increase in line with RPI. At the same time Heavy Goods Vehicles VED and Road User Levy rates will be frozen for one year.

As mentioned in the Budget 2014, a vehicle manufactured before 1 January 1976 will be exempt from paying VED from 1 April 2016 onwards.

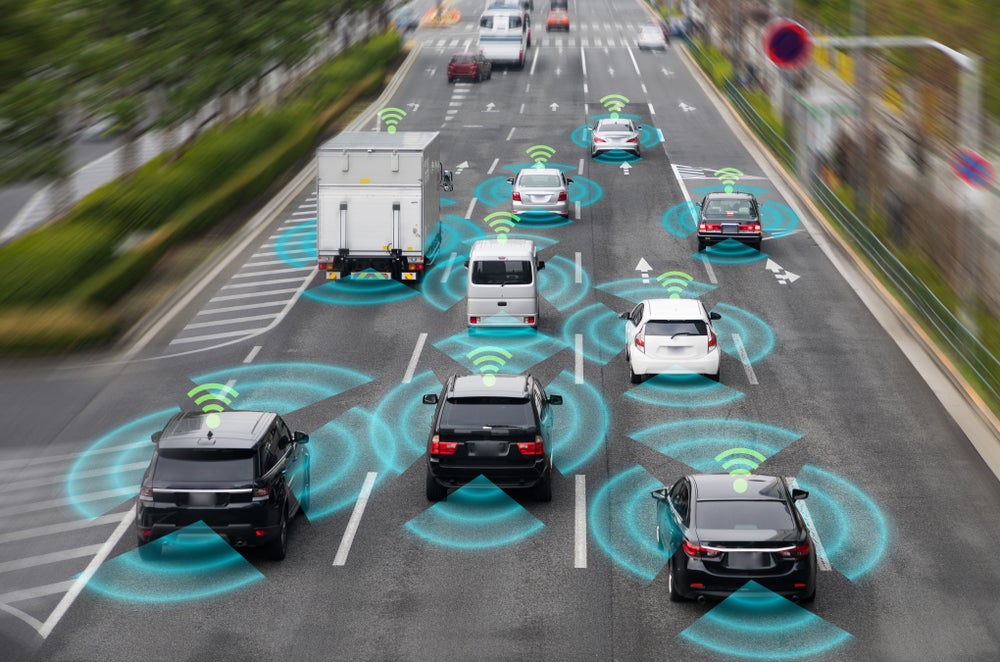

Intelligent mobility

The budget included £100m for research and development into intelligent mobility, which will focus on enhancing the development of driverless car technology and the systems required to implement and adopt the technology, such as telecommunications