The latest data from Dealer Auction’s EV Performance Review indicates continued stability in the alternatively fuelled vehicle (AFV) market, with sold prices rising and high-performing models leading the segment. February 2025 saw a near 5% increase in average AFV sold prices, reaching £17,766—the highest recorded since Dealer Auction began tracking AFV performance in January 2024.

The average age of AFVs in the market decreased from 4.4 to 4.2 years, while average mileage fell from 36,129 to 33,980. These figures, which fluctuated throughout 2024, have shown a consistent downward trend in recent months, suggesting improved market stability.

Dealer Auction’s Marketplace director, Kieran TeeBoon, noted: “It’s encouraging to see February following the lead of a strong January. Last month, I said the key to long-term success for the used market will be seeing younger and lower mileage stock, and February certainly delivered on this. Vehicles that are younger and carry fewer miles might be what tips the scales in terms of attracting AFV-curious drivers.”

Hybrids dominate market trends

The hybrid Hyundai Tucson remained the top-performing trade-to-trade AFV in February, continuing its dominance from 2024 and January 2025. The family SUV more than doubled its January sales volume and ranked third in average retail margin at £3,378. It also entered the CAP performance top 10 for the first time in 2025, achieving 110.4%.

Toyota hybrids performed strongly, with the Yaris hybrid ranking second in sales. The Yaris, Prius, and Auris hybrid models took the top three CAP performance spots, recording 112.7%, 112.7%, and 112.0%, respectively.

While hybrid models dominated the rankings, one fully electric vehicle made an impact—the Peugeot E-208, a new entry in the top 10 charts, marking a model to watch in the coming months.

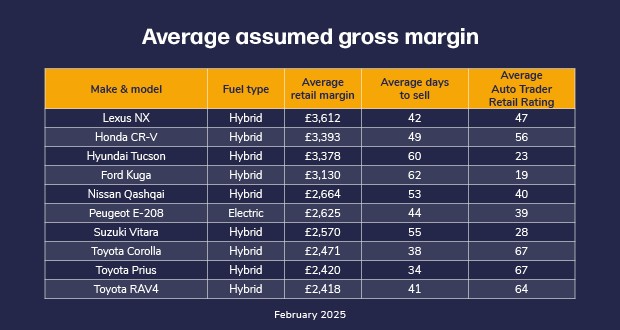

Lexus models also delivered strong margins, with the NX hybrid generating the highest average gross margin of £3,612 while securing positions in both the top 10 sales and CAP performance rankings. However, mainstream vehicles continued to dominate overall, taking 90% of the CAP performance top 10, 90% of the top 10 for average gross margin, and 80% of the top 10 in sales. This reflects a shift from January’s 60:40 mainstream-premium split, with premium brands such as Mercedes-Benz seeing reduced presence in February’s rankings.

Market outlook

Despite a 2% decline in bid and retail margins compared to January, both remained above 2024 averages, at 5,068 and £2,945, respectively. Looking ahead, TeeBoon highlighted the potential impact of upcoming tax changes: “Many dealers are pushing new EVs due to the change in VED rates from April, so it will be interesting to see if this results in an influx of younger, lower-mileage EVs or hybrids on the trade scene, as drivers look to upgrade before the deadline.”

Dealer Auction is a UK-based digital remarketing platform, created through a joint venture between Cox Automotive and Auto Trader.