The August SMMT new car registration data confirms that the new car market has experienced an exceptional level of activity over the past few weeks, with figures up by 23.1% over the same period last year. However, Rupert Pontin, director of valuations at Cazana, warns that this is not a sign of a recovery.

It would be fabulous to think the surge in registrations was due to a significant change in consumer demand driven by confidence in the economy or outstanding demand for cost-effective new cars.

Unfortunately, this is not the case – although this unseasonal boost has brought the year-to-date market performance to a 4.2% deficit over the volume of cars registered by this point in 2017.

The reality is that August registrations have been boosted by the introduction of the new WLTP regulations that came into place at the beginning of September, which effectively meant large volumes of cars that could only meet the outgoing NEDC legislation needed to be registered before the 31 August cut-off.

This has resulted in some unprecedented new car deals being offered in an attempt to sell stock to retail consumers. However, it has also led to a significant increase in preregistration activity.

As a result, the detail of the market changes could be seen as largely irrelevant as it is so distorted. Looking at diesel car registration data demonstrates the level of potential inaccuracy, with a decline in volume of 7.7% over August 2017.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataCompare this to the year-to-date drop in diesel registrations of 28.7% and it is clear something is not right, although the market share for the month at 29.7% is 10% lower than in 2017, which is more in line with the 11.1% decline measured year to date in 2018.

Petrol-powered registrations for the month have improved by 39.1%, which is notable to say the least, but not as large as the 88.7% rise in registrations for alternative-fuel vehicles.

With figures that appear to be so inflated, the need for detailed new car market analysis has never been greater. It will be fascinating to see what happens to registrations during the usually key month of September, although indications are that new car supply has been disrupted and focus may well be on moving the quantity of pre-registered vehicles now sitting in the used-car market.

The remainder of the year is likely to be hard to forecast, and will bring challenges to some new car franchises.

STABILITY AND PROFIT

With such a difficult trading period in the new car market unfolding day-by-day, and set to be the case for the remainder of 2018, many businesses will be looking to the used-car market to bring stability and more importantly profit to their bottom line.

Reviewing the Cazana data collated daily over the past month shows that the used-car market has slowed slightly, although this should come as no surprise given that August is a key holiday month for much of the UK population, and with such favourable weather conditions, traffic at the dealerships – and, more importantly, online – has been slower than many would have liked.

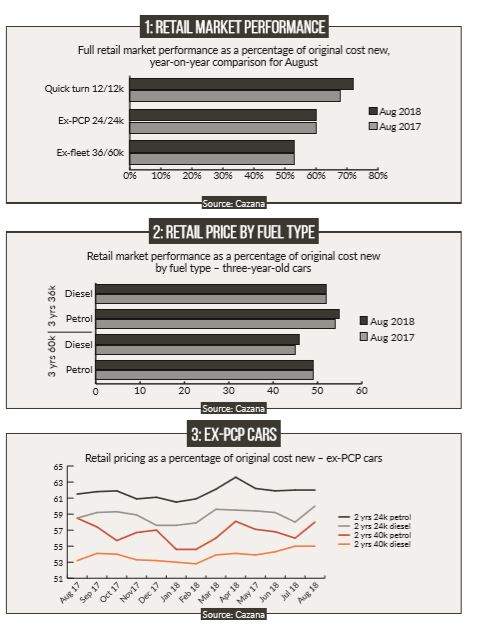

Chart 1 looks at the overall market performance of the three key market profiles.

The August data sees a further improvement in the performance of the quick-turn sector, that consists of cars that have generally come from the ex-rental agents, manufacturer company car and demo schemes and, of course, preregistered cars.

This greater strength represents a twopercentage-point lift over August 2017, and it will be very interesting to see how this sector changes next month. As it stands, this performance implies that despite the increase in volume for the sector, retail demand is able to keep pace at the moment.

This is contrary to what might be expected, given the increase in pre-registration activity. It is also of note that, in August, the exPCP profile has seen a stabilisation of retail pricing, which may come as a surprise to some.

However, while these top-level figures suggest an air of market stability, it is essential to drill deeper and look at more specific vehicles; this is key in a market area that is experiencing such an increase in volumes.

The ex-fleet profile is also in a similar position, with stability in retail pricing as a percentage of original cost new, in comparison to August 2017. This is less surprising given that defleet volumes for the month of August are always quite low, as the fleet market tends to hold fleet changes for the new plate.

However, with the disruption caused by WLTP, this sector may see an improvement in retail pricing should defleet volumes be lower then expected in the coming months as a result of lower new car sales.

While the new diesel car market continues to struggle, there is a conflicting discussion about the ongoing strength of value and popularity of these cars in the wholesale market.

Having experienced a slower used-car month, anecdotal discussion from trade buyers always leaps to the conclusion that there is a need to pay less to stock the forecourt as there is lower retail demand, and retail pricing must therefore be reduced to generate demand.

This has not been the case so far this year, despite subjective protestations. Chart 2 shows the retail pricing performance of three-year-old cars by fuel type. This gives a mixed picture of retail pricing for three-year-old cars.

At lower mileage the data shows there is consistency of pricing for diesel cars in comparison with August 2017, and an increase in values for petrol cars. This is perhaps odd, as there is a steady supply of lower-mileage petrol cars coming from end-of-contract PCP returns, and expectations would be that this volume may exceed demand, but the reality is different at the moment.

However, the position is reversed for higher-mileage ex-fleet stock, with diesel values one percentage point higher than at the same time last year. This may be a blip due to lower defleet volumes in the run-up to the plate change in September.

Conversely, petrol pricing remains stable where, arguably, there is less stock available and the market might expect higher retail pricing. The important point here is that the anecdotal discussion and protestation that retail demand is lower for diesel cars with retail pricing falling is certainly not the case for three-year-old cars. Naturally, a deeper investigation may identify specific ranges and models where this may not be the case.

PCP CONTRACTS

For many, the pinch point now is what is happening to the two-year-old vehicles that are coming off PCP contracts. Last month, Cazana highlighted that there had been a drop in the retail values of two-year-old ex-PCP diesel and petrol cars compared to the same period last year, albeit with differing mileages.

Industry discussion followed as to whether this was a short-term blip due to tactical new car activity affecting volumes of fuel type and key mileages into the used-car market.

To some, this was a confirmation of the long-standing warning that there would be significant downward pressure on values due to oversupply. Chart 3 shows the performance of live retail pricing in the used market.

The data demonstrates that there is a high level of consistency in the retail pricing performance of fuel types at this age and respective comparable mileages. It also shows that petrolpowered cars at 24,000 miles and diesel cars at 40,000 miles have seen, at best, stability in the last couple of months. It is interesting to note that diesel at 24,000 miles and petrol at 40,000 miles have both seen an upturn in retail pricing following the drop reported in July.

A more detailed analysis is likely to confirm that this was due to significant volumes of certain cars returning to the market, and should perhaps be a lesson in the damage that poorly planned remarketing can do.

To summarise, the August market has been as variable as expected in many ways. The interesting piece has been the odd shape of the new car market, and it is reassuring to see that, to date, the pre-registration activity has yet to impact the used-car market in a significant manner.

However, as the market heads into the last trimester, that is traditionally quiet before the complications of the new market are taken into consideration, understanding and reacting to changes in the used market will be of paramount importance.

Cazana’s real-time retail-based data is unique in providing up-to-the-day market insight and intelligence being driven from over 16,000 websites each day. Seeking more focused information relating to specific market sectors or time periods ensures maximum vision and the most comprehensive insight required to maximise profit, ROI and asset management.

This is exactly the data and insight required to deal with what is becoming a more challenging market with every day that passes, and will continue to do so as the industry heads into 2019 and beyond.