The diesel debate continues to rumble on with the national and trade press seeking to understand the impact on the new and used car market from pollution and health problems caused by older diesel engine emissions.

New diesel car registrations continue to fall, down 25.6% in January 2018 against the same period last year, with petrol taking some of the business previously destined for diesel powered cars. In addition, the AFV (Alternative Fuel Vehicle) sector, now at 5.5% of the total market, has been growing consistently although at this point there remains a question mark over whether buyers of hybrid and battery vehicles truly understand whether they have bought the right car for the right purpose.

Looking at the feedback from the new car market and the data about diesels published both online and in the printed press, it is clear that accurate information is still in short supply. Talk to the dealer networks and many will tell you that retail customers still need a significant amount of guidance and clarity on how clean a modern diesel is. Move to the used market and consumer social conscience in many cases evaporates when it comes to money. For many, diesel running costs are very advantageous and therefore more important to them than the affect older diesel emissions have on health and the environment.

In 2017 the Government missed an opportunity to make a real difference when they failed to tackle older diesel car ownership. VED changes could have helped push the worst offending vehicles off the road although cynics will also highlight that the potential loss in revenue for the Government was a key driving factor in policy decisions. Equally the lack of a Government backed scrappage scheme has not encouraged a consumer shift to newer less polluting diesels and at the moment AFV taxation is also set to penalise ownership of newer cleaner technologies.

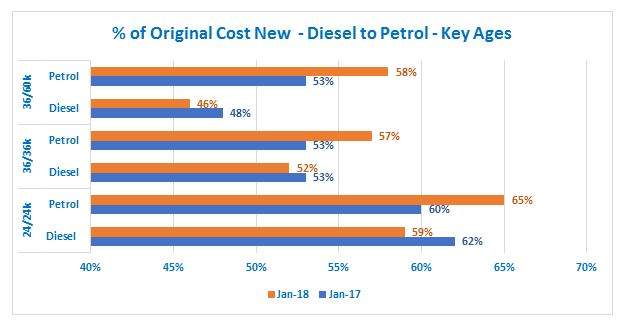

However, the important thing to review is what the market data says. Using the Cazana.com database the chart below shows how values as a percentage of original cost new have changed between January 2017 and January 2018.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataData from Cazana.com

The chart very clearly demonstrates that across key retail market sectors the values of petrol vehicles have increased year on year. At the same time diesel values have dropped, although by a lower figure than the level at which petrol have increased. This is interesting in several ways and the first thing to consider is whether the volume of product has played a significant part in these trends. As we know the market has seen considerable increases in new car registrations in recent years and the laws of supply and demand usually show that as the volume of product increases, so does demand and therefore values will dip.

In this instance, this would explain the reasonably normal drop in diesel values over the course of the year, although the increase in petrol values is likely to have been driven more by a shift in consumer demand for what is currently seen as the cleaner of the two fossil-fuel powered cars.

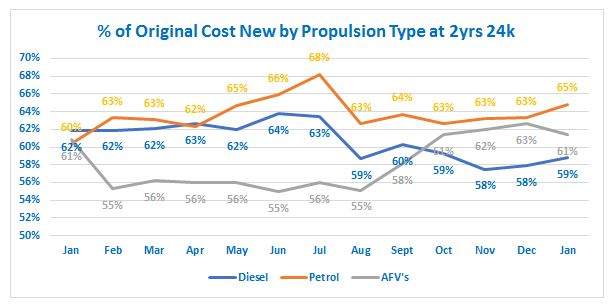

New AFV registrations have been climbing consistently in recent years and given that the new car sales growth is in part due to BIK advantages the chart below shows a comparison of Retail pricing in the used car market.

Data from Cazana.com

Data for AFV’s in the used market is still at a low level and as such the results can be volatile. In addition to consumer retail demand, varying supply volumes have also made understanding this fuel type more complex. However, it is very clear from the chart that after a marked drop in values at the start of the year, the value of AFV’s took a significant upturn from September 2017. This was in part as a result of increased demand for what is perceived to be a cleaner way of travelling and also because the national press made much of the diesel pollution issue in the last trimester of the year. That said, it is prudent to note that the % of original cost new for AFV’s was at 61% in January 2017 and is at the same level for January 2018.

The really interesting insights can be gained from interrogating the data in more detail. Reviewing specific manufacturers or even at looking at model level can help any business in the UK automotive industry be more aware of the position of specific cars. In today’s ever shifting market benchmark data is invaluable.

In summary, where national sentiment has been portrayed as being strongly anti diesel with implications of an imminent collapse in used car values, the data overrides the anecdotal discussion. Comments from trade buyers nationwide eager to buy diesel cars at a lower value are shown to be subjective in the face of the dynamic retail data from Cazana.com. Whilst markets can shift quickly it is apparent that diesel values have dropped largely in line with market forecasts and as such it would seem there is no immediate cause for concern.

By Rupert Pontin, director of valuations at Cazana