Motor Finance highlights some of the key figures from the BCA, Manheim and the ONS.

Analysis

BCA Pulse – used market strong as values rise again.

Demand from buyers is driving rising used car values at BCA, as April saw more records tumble. Buyer demand was high and conversion rates stayed strong in April. Professional buyers remain very active, reflecting the strong retail demand that has been widely reported.

Fleet & Lease values rose to £11,137, the highest point on record, while Dealer Part-Exchange prices increased sharply to reach £5,000 for the first time.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataDespite this, the headline average value declined to £9,584, a fall of £84 (0.8%) caused by a changing model mix as dealer volumes increased. Year-on-year, average values are up by £494, a 5.4% rise.

Average dealer part-exchange values continued to rise, reaching £5,000 for the first time on record as values increased by £105 (2.1%) over the month. Yearon-year values were ahead by £324, representing a substantial 6.9% uplift with age static and mileage rising.

Values for nearly-new vehicles improved to £19,170, a rise of £301 (1.5%) compared to March and up by £1,142 (6.3%) year-on-year. Model mix has a significant effect in this very low volume sector, with brand specific winners and losers

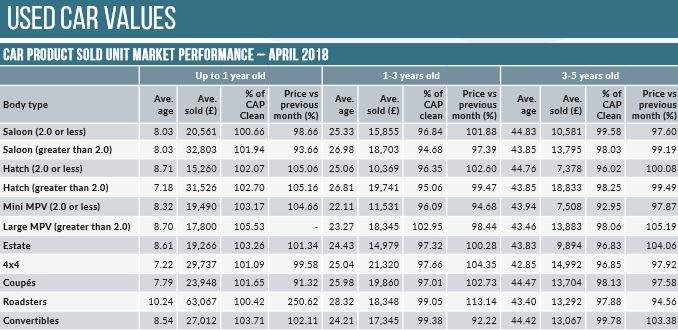

Car product sold unit market performance – April 2018

Employment Figures