Motor Finance highlights some of the key figures from the FLA and SMMT.

Analysis

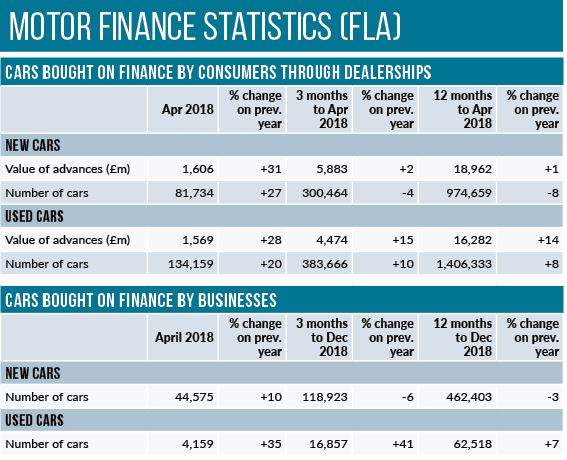

New figures released by the FLA show that new business in the POS consumer new car finance market grew 31% by value and 27% by volume in April, compared with the same month in 2017.

The percentage of private new car sales financed by FLA members through the POS was 89.7% in the twelve months to April 2018.

The POS consumer used car finance market also reported new business growth in April of 28% by value and 20% by volume.

FLA’s head of research and chief economist Geraldine Kilkelly said: “Trends in the new car finance market in 2018 so far have been affected by the pattern of demand for private new cars over the same period last year, when car purchases were brought forward.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Analysis

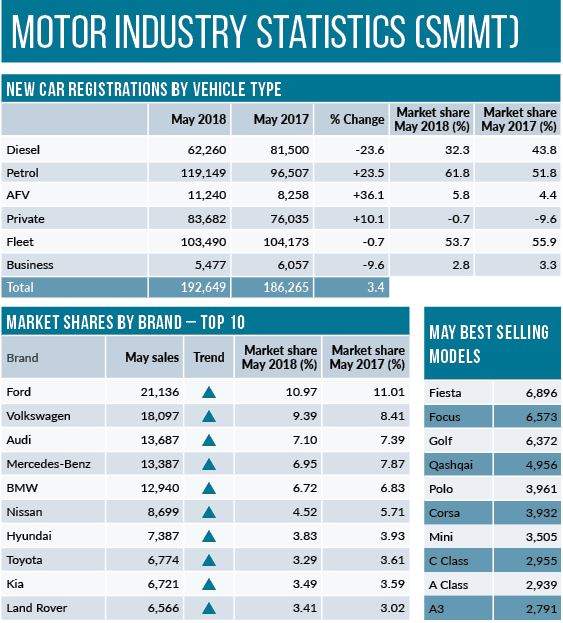

The UK new car market grew by a modest 3.4% in May with 192,649 new units registered, according to figures released today by the Society of Motor Manufacturers and Traders (SMMT).

Private demand in the month grew by 10.1%, with more than 83,000 consumers driving home in a new car, and offsetting ongoing declines in the business and fleet sectors, down -9.6% and -0.7% respectively.

Mike Hawes, SMMT chief executive, said: “May’s growth, albeit on the back of large declines last year, is encouraging and suggests the market is now starting to return to a more natural running rate. To ensure long-term stability, we need to avoid any further disruption to the market, and this will require sustainable policies that give consumers and businesses the confidence to invest in the new cars that best suit their needs.

In the year to date, the overall market remains down, with new registrations having fallen -6.8%, as economic and political uncertainty continues to impact demand.