While rumblings of shortages within the world’s chipmaking industry began before the pandemic, the unprecedented impact of the coronavirus significantly exacerbated the problem.

As more countries locked down, forcing consumers to stay at home and factories to sit idle, automakers cancelled chip orders with suppliers to reduce their costs and avoid having lots of surplus parts just sitting in their inventories. This meant that chipmakers pivoted to supplying industries such as personal electronics where demand remained stable. In addition, auto players generally prefer slightly older chipmaking technologies that have proven reliability records but, with the pandemic forcing chipmakers’ hands, they mostly chose to focus on newer technologies that are common in consumer products such as smartphones and games consoles, but not typically deployed in vehicles until later in their lifecycle.

These factors have led to the current chip shortage plaguing the automotive industry along with many adjacent sectors. Without access to strong supplies of semiconductor products, automakers have had to prioritize what supply they have available to models that either represent a strong profit margin such as SUVs and pickups, or older models that use fewer semiconductor products. Companies including Tesla and Stellantis have made adjustments to their vehicles’ equipment ranges to account for the more limited semiconductor supply.

With vehicle sales nosediving in 2020 as a result of the COVID-19 pandemic, it was hoped that 2021 would see a strong recovery in the sector, minimizing the financial damage of the previous year. However, in practice, few automakers were able to build as many vehicles as they would have originally planned despite healthy demand from consumers, causing a significant drag on 2021’s sales and muting the recovery over the previous year.

The question on many lips now is “when will automotive chip supply recover?”. Early reports from 2021 were optimistic that the shortage may last just a few months before supplies began to recover but, by August, those hopes began to evaporate as it became clear that there was no immediate end in sight for the semiconductor shortage.

What do GlobalData respondents think?

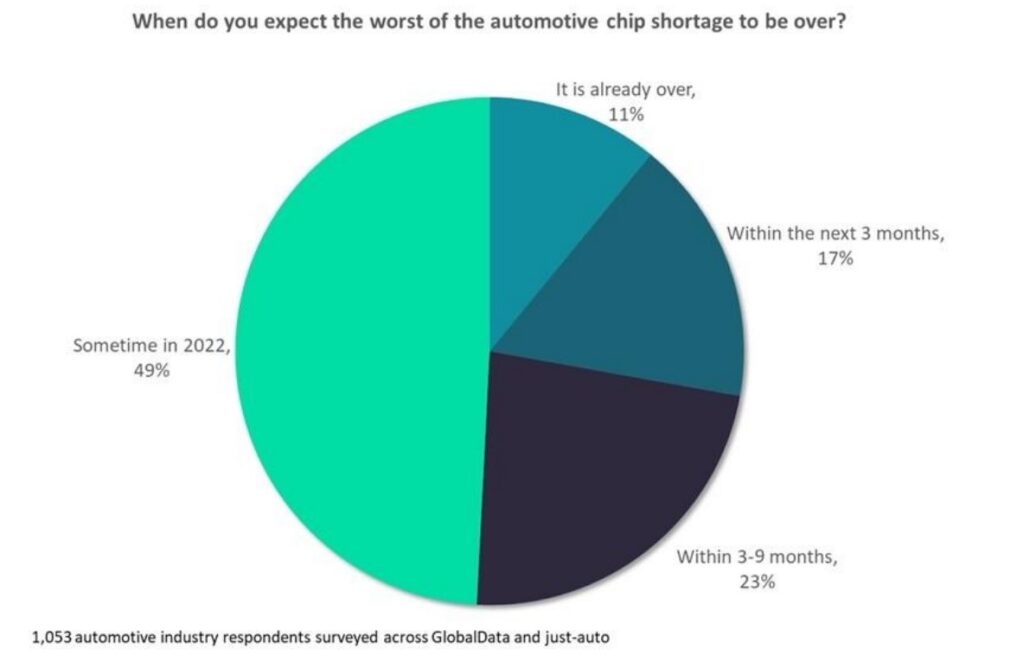

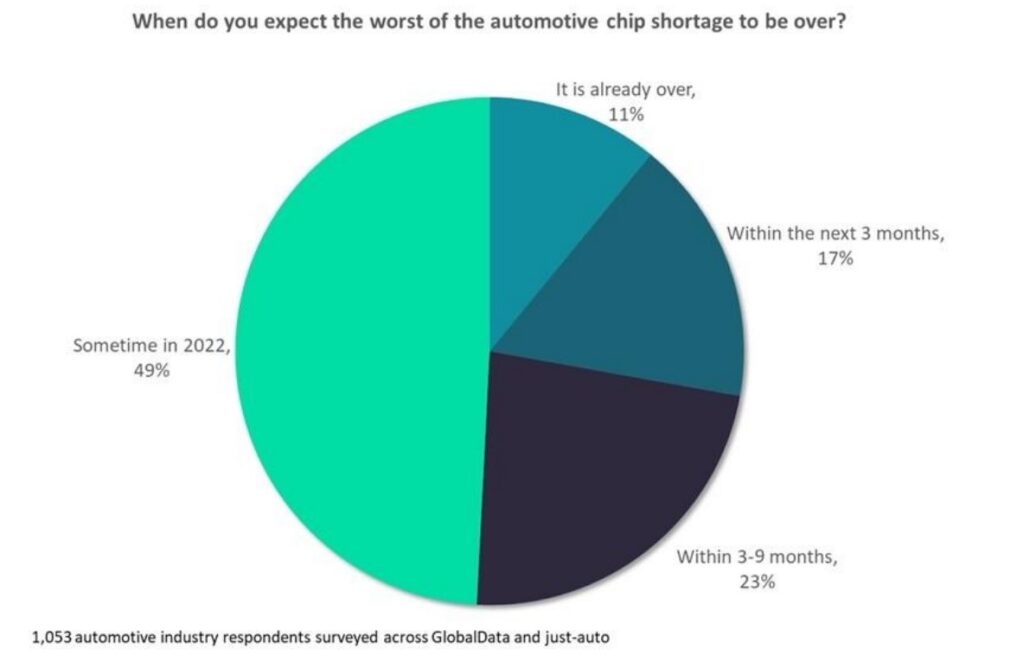

Thousands of automotive industry professionals use GlobalData and just-auto every day, so we surveyed them to see what timescales the industry expects for chip supply recovery. Looking across all 1,053 responses from Q2 though Q4 2021, we can see that around half of respondents (51%) believed when they were asked that the shortage would peak within the next nine months. This breaks down as 11% of respondents that felt the shortage had already peaked, 17% that thought the worst would pass within three months, and 23% that thought the timeframe was between three and nine months. On the other hand, the largest contingent – 49% – said they felt the issue would pass sometime in 2022, and that the nine-month timeframe offered by the other 51% was too optimistic.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataLooking at the responses by region, we can see broad agreement across survey respondents. In all regions, the longest 2022 timeframe was the most popular single response and, in the Americas, Asia-Pacific and Middle-East & African regions, those respondents outnumbered all other timeframes put together (52% across the three regions). The final average was made marginally more optimistic by responses from Europe, where 46% felt that the chip shortage would continue deep into 2022.

Interestingly, we can see how industry optimism began to vanish as the scale of the chip shortage began to emerge. The second quarter of 2021 was dominated by news of automakers slowing or pausing production of vehicles around the world as they suffered shortages of various components. As a result, we can compare responses from before August 2021 against those that came afterwards to see how opinion changed as more OEMs suffered manufacturing disruption.

At the time they were asked, most respondents (41%) from before August were predicting a three-to-nine-month period before semiconductor supplies began to improve. During this period, only 36% of those surveyed felt the chip shortage would continue into 2022. However, the responses from August onwards reveal a creeping pessimism in the industry with 52% believing the timeframe would stretch into 2022, with only 19% still believing the peak was nine months away or less.