Chinese car manufacturers are poised to take the lead in the international electric vehicle (EV) market, backed by robust domestic growth, strategic government support, and a competitive edge in production costs. With generous subsidies, proximity to vital raw materials, and a deliberate shift toward EV innovation, China is on track to nearly double its global market share by 2030, posing a significant challenge to traditional Western automakers.

Chinese car manufacturers are ahead in the EV race, not only is their domestic market the most developed, but Chinese brands are soon predicted to take over the West. Production costs, government support, availability of natural resources and supply chains all suggest that China will prevail as a world leader in the EV industry.

According to the Chinese Association of car manufacturers, the number of EVs sold annually in the country grew from 1.3 million to a whopping 6.8 million between 2019 and 2022. In comparison to ICE vehicles, approximately 25% of passenger cars sold in China last year were either fully electric or plug-in hybrid vehicles, according to Counterpoint Research.

In the international markets, Chinese brands now represent approximately half of all EVs sold. UBS analysts have predicted that China’s global market share will nearly double to 33% by 2030, while traditional Western automakers will witness their market share decline from 81% in 2023 to 58%. An influx of cheaper Chinese EVs will result in Western automakers losing approximately 20% of their global market share.

How did the industry get here? China’s comparative advantage

In an article by the world-renowned MIT Technology review, analysts put together a compelling theory about how generous government subsidies and proximity to crucial raw materials made China a world-leading industry in electric vehicles.

The story of how the sector got here starts in the early 2000s. While China produced ICE vehicles very intensively and at a scale that was irreplicable in any other country, no domestic brand had a notable international presence or had the potential to succeed in the West.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn terms of legacy, innovation and a history of reliability and quality, Chinese brands were unlikely to compete with centuries-old Western brands such as Volkswagen AG, Mercedes-Benz Group or Renault SA.

According to the MIT Technology Review, the Chinese government realised this and decided to depart from conventional technology to allocate resources to an innovative domain within the automobile sector: electric vehicles. The potential payoff was substantial; an early start to the EV race could result in China gaining a substantial share of the global automotive sector, while also addressing a major issue in the country; street pollution.

Government support

As early as 2001, the Chinese government took steps towards transforming its existent supply chains towards the production of EVs, introducing this technology as a priority science research project in China’s Five-Year Plan. Moreover, the election of auto engineer and EV fanatic Wan Gang as minister of science and technology in 2007 gave China a free way to go all in into the electrification of the industry.

The late 2010s marked the beginning of the nationwide distribution of generous financial incentives to electric vehicle companies that manufactured buses, taxis, or vehicles for individual consumers. According to data from the MIT Technology Review, the government allocated more than the equivalent of £23 billion in subsidies and tax incentives from 2009 to 2022.

In addition to giving incentives to domestic companies, China decided to hand out subsidies to foreign companies, thus fostering the creation of an EV-focused corporate ecosystem and strengthening supply chains. For instance, local Chinese governments have been known to actively encourage Tesla in the building of production facilities in the country.

EVs and supply chains

An EV’s affordability and reliability depend mostly on its battery, as approximately 40% of a vehicle’s cost stems from this system. Regarding the manufacturer’s go-to-market strategy, success in global markets is directly correlated with the quality and affordability of its battery system. As of today, China has the upper hand.

According to BloombergNEF, with over 80% of electric vehicle battery cells being manufactured in China, the country’s supply chain increasingly controls the mining and processing of essential minerals like lithium, cobalt, manganese, and rare earth metals.

Chinese companies have significantly advanced battery technology. Five out of eight companies in the top automobile cell suppliers are Chinese. Specifically, the country has strongly advocated for lithium iron phosphate (LFP) batteries, in contrast to the more prevalent lithium nickel manganese cobalt (NMC) batteries used in the Western world.

When asked about the performance of LFP systems compared to NMC, Jim Saker, Director of the Centre for Automotive Management and President of the UK-based Institute of the Motor Industry, a professional association, said it was too soon to tell.

“There just hasn't been enough on the road to realistically make a kind of judgment call on it. And also, it varies with different Chinese manufacturers and their level of sophistication. BYD was a battery company and their specialism has always been that. And so, therefore, they are probably more sophisticated than some of the other Chinese brands when it comes to the battery,” Saker said.

LFP technology was not initially adopted by the global battery industry as the preferred option due to its historically lower energy density and subpar performance in colder temperatures. However, as identified by MIT Technology Review, this decade has seen Chinese companies effectively reducing this energy density gap.

Regarding battery degradation, James Wallace, product lead at Elysia, said in an interview with GlobalData that NMCs have "traditionally been the most common type of battery associated now with higher-end vehicles. And then there is LFP, lithium-ion phosphate batteries, which are related primarily to the Chinese market, but typically related to lower-cost vehicles, because of the lower energy and energy density of those vehicles.

"So what I would say is, as a general rule, lithium-ion phosphate does undergo lower degradation and has a longer lifetime. That should be expected and as a general case," said Wallace.

But in reality, battery quality is dependent largely on other factors too, he adds.

"So, it's dependent on the different manufacturers, the different vehicles, the different usage applications, and we need to treat them on an individual basis rather than with general rules. But as a general rule, yes, LFP probably does have a longer lifetime”, he added.

Where does Europe stand competitively?

Only time and thus more data will allow us to draw decisive conclusions on the safety, degradation and overall performance of these two types of battery systems. One thing is for sure, LFP batteries can be produced more cheaply, which represents a huge competitive advantage.

According to BloombergNEF's Lithium-ion Battery Price Survey for 2022, pack prices were 33% greater in Europe compared to China and 24% higher in the United States, which raises one crucial question, how are European governments responding to protect their domestic industries?

On the one hand, the European Commission (EC) announced in September that it would launch an investigation into Chinese subsidies for EVs. Von der Leyen, the head of the EU’s executive branch, has made it clear she will do “whatever it takes” to support the European manufacturing industry and its competitiveness abroad, especially if the issue is related to the green energy transition.

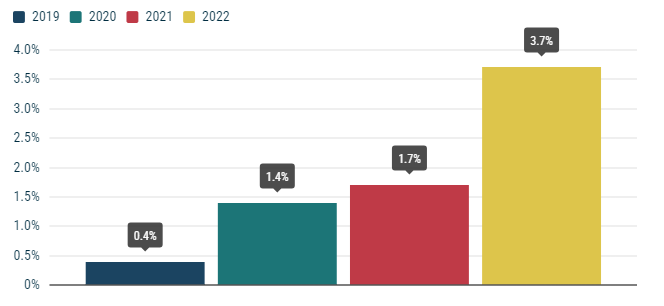

However, a possible increase in tariffs to 10% is unlikely to deter Chinese companies from selling in Europe, especially when you take into account that they already face levies close to 27.5% in places like the United States. Chinese brands account for almost 4% of EU battery-electric car sales in 2022, up from 0.4% just three years ago.

Share of Chinese brands in total EU electric car sales

On the other hand, the UK is doing very little to tackle the problem, which in addition to the threat of a post-Brexit EV trade tariff being imposed by the EU, paints a gloomy picture for the UK’s auto market competitiveness.

Jim Saker highlights how production targets and government regulations are pointless, given the country does not have solid supply chains in place: “When [former Prime Minister] Boris Johnson launched the UK 2030 ICE ban, which was completely kind of random, there was no reason for 2030, he didn't guarantee the supply chain, he handed over the UK motor industry to China. This is because China controls 95% of the world's supply of batteries, and the raw materials that make up their supply. They've got the Belt and Road Initiative that runs into Africa with something like 80% of the world's cobalt from the Democratic Republic of Congo. So, therefore, what you've got is a kind of a situation where you basically place the UK in a very difficult position.”

Even though the ICE ban has been effectively pushed back to 2035 for car buyers, government targets for car manufacturers remain unchanged. Starting in 2024, 22% of newly sold cars must be zero-emission vehicles.

ZEV mandate will continue unabated despite ICE ban delay

In June 2023, research by New AutoMotive found that 32 ZEV-eligible manufacturers would fall short of meeting the 2024 targets, based on their existing sales projections, and face a collective charge of up to £730m.

Brands that are leading the pack in EV manufacturing - Tesla, MG and Polestar (Volvo) - are likely to be the beneficiaries of the ZEV mandate. While, manufacturers such as Ford, Toyota, Audi and Land Rover are expected to be in the market for buying credits to achieve their quotas.

Commenting on this situation, Saker said: It's a £15,000 penalty per car if you don't get the 22% (by 2024), which is actually ridiculous. Now if you look at the table, the bottom three of Ford, Land Rover and Toyota. Toyota has been the most carbon-efficient company car company in Britain for the last 20 years. With hybrid, they're going to be penalised. And also, the three companies are the ones that have actually invested in manufacturing in the UK. Essentially, they are penalising the ones who have invested in your country and you're also penalising the most carbon-efficient car company in the world.”