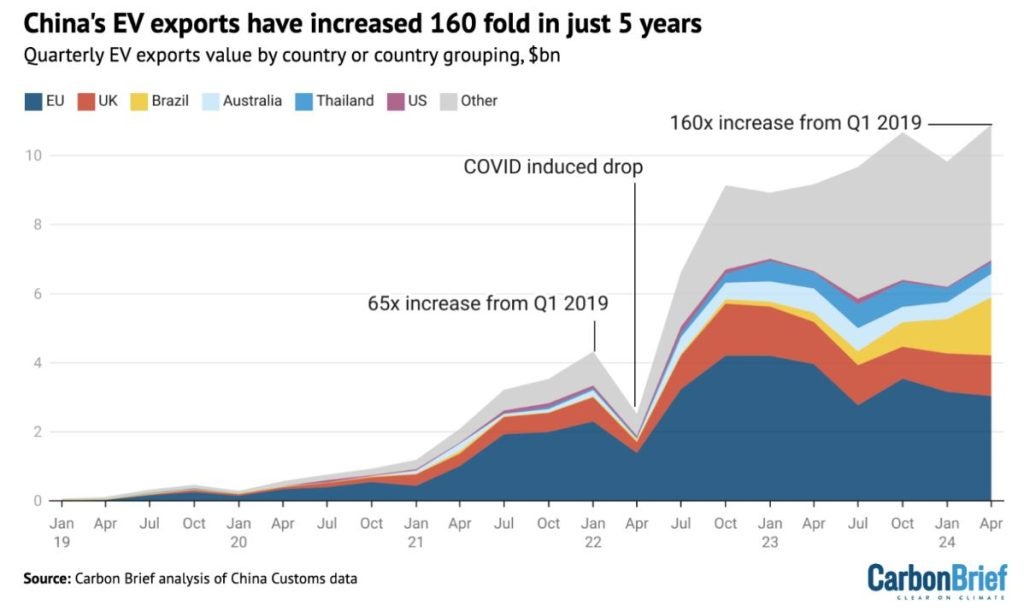

As Europe accelerates its transition to electric vehicles (EVs) in the face of the climate emergency, a looming challenge emerges from the East: the rapid rise of Chinese automotive technology. Chinese EVs, flooding the market at prices significantly lower than their European counterparts, pose a real threat to Europe’s automotive sector, a key economic pillar. But according to new findings from Transport & Environment (T&E), Europe may still have a chance to reclaim some of the market share lost to Chinese manufacturers — if the right policies are in place.

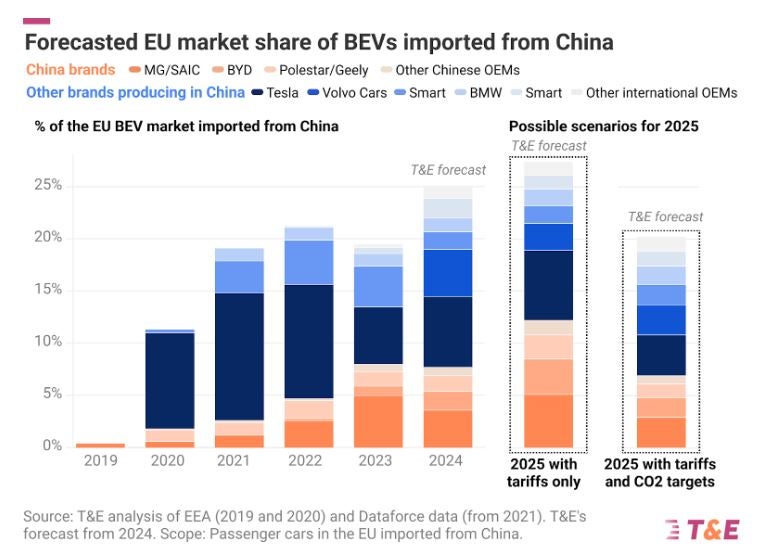

T&E’s forecast shows that without a concerted effort, Chinese imports — currently accounting for about a quarter of all EVs sold in Europe, including models from Tesla, BMW, and Volvo — could climb even higher. The report estimates that this market share could reach 27% next year if the European Union delays the 2025 CO2 targets and relies solely on tariffs. However, if the bloc enforces both emissions standards and tariffs, Chinese EVs could see their share shrink to 18% by 2026, providing European carmakers with an opportunity to re-establish themselves.

European automakers are set to launch a range of more affordable EVs in 2024 and 2025 to meet emissions targets. But this effort must be paired with tariffs to prevent Chinese manufacturers from dominating the market. Julia Poliscanova, T&E’s senior director for vehicles and e-mobility supply chains, highlighted the importance of keeping both policies aligned, stating, “Higher EV tariffs are right but only in tandem with the car CO2 targets.” Without stringent emissions standards, European manufacturers might continue prioritising profitable combustion engines, delaying the rollout of affordable electric models and hindering the sector’s overall competitiveness.

The influx of low-cost Chinese EVs not only threatens European manufacturing but could also significantly impact motor financing. The rise of inexpensive imports risks reducing demand for financing European models, leading to a potential cycle of reduced sales and fewer financing opportunities for local brands. This shift could weaken Europe’s automotive sector, long supported by its robust financing system, where local financial institutions play a crucial role in backing domestic manufacturers through loans, leasing, and incentives.

The job market faces a similar dilemma. The success of Chinese EVs could result in factory closures and layoffs in Europe, with ramifications stretching from car manufacturing to parts suppliers and service providers. Policymakers are aware of the need to safeguard domestic jobs, but the question remains: how best to protect the industry while also maintaining Europe’s commitment to open markets and competition?

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe dominance of Chinese technology in battery production further complicates this scenario. Batteries are the core of EVs, and China’s lead in this area positions it as a strategic player. Europe’s battery industry, already facing challenges from global market dynamics and low-cost Chinese products, risks losing its foothold entirely unless urgent action is taken. T&E has warned that 59% of the planned battery production in Europe could be scrapped without proper support, resulting in billions of lost investment and up to 100,000 jobs at risk.

Poliscanova has urged the EU to bolster its trade defences and protect its battery sector, advocating for an EU Battery Fund and policies that reward clean manufacturing. Without these measures, Europe could become overly dependent on Chinese technology, which could stifle its own innovation and leave it vulnerable to global supply chain disruptions.

Trade tensions between the EU and China over state subsidies and market imbalances are intensifying, with European authorities launching investigations that could lead to tariffs or other restrictions.

But some experts, like Karlheinz Zuerl, CEO of the German Technology & Engineering Corporation (GTEC), argue that European manufacturers must also take responsibility for their own struggles. Zuerl believes that European carmakers have focused too much on luxury features and have been slow to adopt the types of innovative technologies — such as battery swap systems and range extenders — that have given Chinese brands a competitive edge.

Rather than seeing China solely as a competitor, Zuerl suggests Europe could benefit by drawing lessons from the country’s success, especially in areas of rapid technological advancement. This approach could lead to a more collaborative, rather than confrontational, relationship, allowing Europe to remain competitive in a global market while fostering its own innovation.

As Europe navigates these challenges, the path forward will require a delicate balance between fostering international trade and protecting its domestic industries. The key to sustaining the automotive sector may not lie in protectionism but in strengthening its innovation capacity, supporting its battery industry, and encouraging competition. Policymakers must ensure that emissions standards, tariffs, and trade defence measures work in harmony to create an environment where European automakers can thrive, while also embracing the opportunities for technological collaboration with China.

The future of Europe’s automotive industry and motor financing will depend on the region’s ability to adapt to the changing landscape. By investing in affordable EV models, supporting local battery production, and addressing the competitive threat from Chinese imports, Europe can continue to lead in the global transition to sustainable transportation — while protecting jobs and consumer choice at home.

‘European carmakers face innovation crisis amid Chinese advancements’