Earlier this week the EU agreed to exempt e-fuels from its 2035 ban on new sales of combustion-engine cars prompting industry observers to speculate if the UK would follow suit.

In a statement today, the UK’s Department for Transport’s Zero Emissions Vehicle (ZEV) mandate said the government would be sticking to its original plan – to ban the sale of new ICE cars and vans from 2030 – and ruled out “expensive” e-fuels as an alternative.

Brussels and Berlin

In the lead-up to this decision, Germany had lobbied the EU for a special exemption on vehicles that could exclusively take CO2-neutral fuels – so-called e-fuels.

E-fuels use a traditional engine and therefore release emissions into the atmosphere. Its proponents argue the production process can be climate-neutral and offset any pollution, but its detractors argue e-fuels are expensive and represent a niche market.

The German-led concession opens the door in the EU for new sales of vehicles run exclusively on e-fuels to be sold after the 2035 deadline.

ZEV in the UK

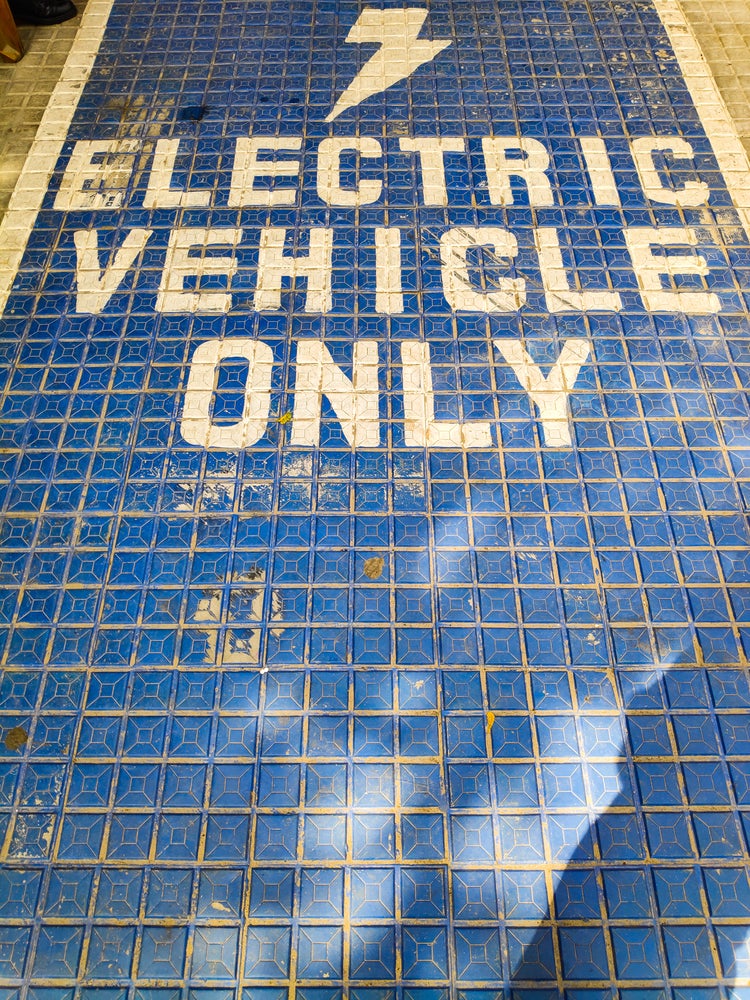

In the UK, the DfT dismissed any suggestion it was considering e-fuels as an alternative to traditional ICE fuels. Under the ZEV mandate, which comes into force next year, manufacturers will be expected to sell a specific proportion of EVs ahead of 2030.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn 2024, auto manufacturers will need to sell at least 22% of new cars and 10% of vans are zero-emission vehicles, by 2030 this will increase to 80% and 70%, respectively.

In February 2023, EVs accounted for 16.5% of all new car registrations.

A series of penalties will apply to manufacturers who can’t meet these targets of between £15,000 and £18,000 per vehicle.

Nick Williams, transport MD at Lloyds Banking Group, described the government’s renewed commitment as “a bold step forward” that “sends a clear message to both industry and drivers that the future of motoring is electric.”

The industry has been waiting with bated breath for how the government plans to deliver on its net zero commitments and so the DfT consultation on the ZEV mandate brings the sector a step closer to understanding how the plans will work in practice. (The DfT has also committed almost £400m to improve the EV charging network.)

“The clarity given today will give fleets and motorists the confidence to continue their decarbonisation journey and accelerate the transition to zero emission transport,” said Gerry Keaney, chief executive of the BVRLA.

The ZEV mandate is expected to increase the availability of EVs and spur competition in the market with an anticipated knock-on effect on the used car market.

Mike Todd, CEO of Volkswagen Financial Services UK, said: “More choice opens up more entry points for consumers, a cause for optimism that EV adoption will continue to accelerate. However, uptake depends on more than vehicle availability alone. As a collective, the automotive industry needs to help customers make the transition to their first EV, and equip them with the knowledge they need to make that journey confidently. That encompasses all that goes with EV ownership: home charging, provision of public charging, trip planning, and vehicle value retention.”

Meanwhile, Fiona Howarth, CEO of Octopus Electric Vehicles, added: “The devil will be in the detail, and this is our chance to further drive down costs and encourage new models to enter the market, giving drivers access to cheaper, greener, tech on wheels transport.”

The big question is: will any of this make EVs more affordable and accessible to the masses, and will it help drive investment in the UK?

UK commercial vehicle output down almost 22% in February: SMMT