Car Price Inflation: Anticipating Shifts in Automotive Market Trends

The post-pandemic period has been characterised for the automotive industry, perhaps above all other things, by the profound shortage of semiconductors.

The effect on the new vehicle industry has been dramatic, causing global industry volume to be at levels we would in more normal times associate with a severe economic recession – at least as bad as the Global Financial Crisis.

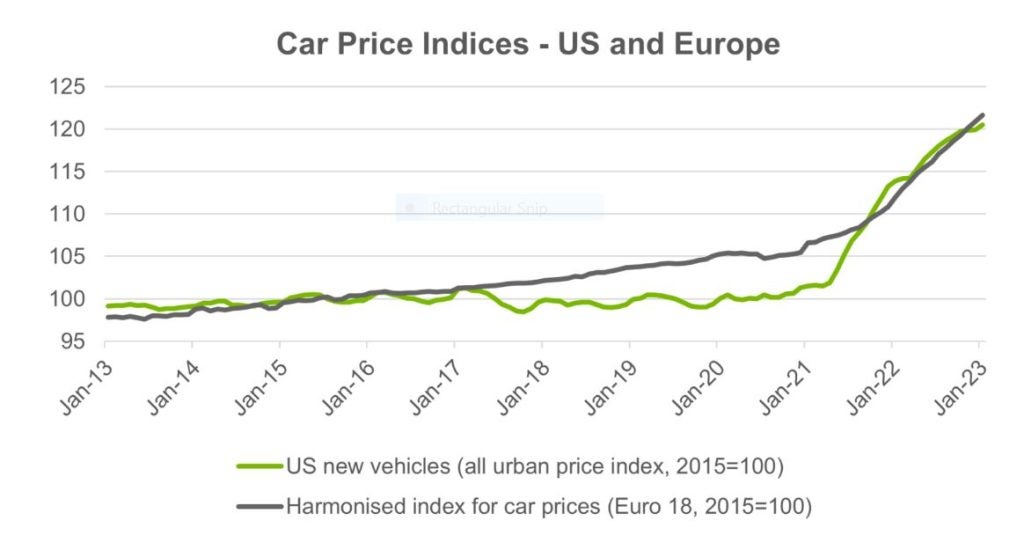

As a result of such a supply-constrained reduction in vehicle sales (and production), demand for vehicles has far outstripped supply. The consequence of this imbalance, as we all now know, has been a surge in new vehicle pricing, and OEM profitability.

This chart illustrates the unique scale, in the modern era, of these price changes. There has been nothing like it for decades.

“If something cannot go on forever, it will stop,” is the comment attributed to 1980s economist Herbert Stein. And these price increases clearly cannot continue, and nor, we would argue, are they likely to remain so elevated.

There are no clear signs of a slowdown in car price inflation yet, but we do know that the underlying supply issue is being steadily, though slowly, addressed. Meanwhile, the mild recessionary economic conditions prevalent in some countries are also bringing demand down. At some point, possibly later this year, though unlikely sooner than that, rising supply should meet falling demand.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe strong profitability of OEMs that has resulted from the supply-demand imbalance is likely to then start to normalise over time. Several OEMs have talked of never going back to the old ways: inventory will be permanently held at low levels; always building to order will be the new normal; highly specified vehicles are now all they will sell; recent results are proof that eager consumers will be prepared to wait while also paying higher prices permanently.

Car price inflation

We are not convinced by this logic and expect market competition to become a major factor once the supply-demand imbalance dissipates. It will take a brave OEM to stand by and preside over significant market share loss to an aggressive competitor willing to deliver more quickly and/or at better prices. It will only take one or two large OEMs to change any market – and the notion that the industry could discipline itself without collusion, which would attract serious regulatory attention, can largely be dismissed.

So, if OEMs have done well, though we expect a return to more normal conditions over the next couple of years, what about other industry players?

For much of the automotive supply industry, the supply shortages have created challenging conditions. Most suppliers do not have sufficient pricing power with their (OEM or higher-tier supplier) customers to be able to use scarcity to increase unit prices, as OEMs have managed with consumers. Lower production volumes caused by the shortages have simply crimped revenues. Throw in broad-based cost inflation and margins have been squeezed. The coming increase in vehicle output in our forecast – we expect global Light Vehicle production to increase by 4.4% this year – will be a relief to most suppliers. And falling inflation should also help in overall cost management. More favourable conditions should be coming soon for component suppliers.

As for other sectors in the industry, retailers’ fortunes have been more closely aligned to the OEMs and, broadly, they have a similar outlook. Meanwhile, aftermarket suppliers have done solidly as the supply of new vehicles has been curtailed, leading to an older fleet than would have been the case without the constraints. That boost seems unlikely to have any significant swing in the other direction so recent events appear to have been net positive.

Pete Kelly, Director of Research, LMC Automotive (a GlobalData company)

This article was first published on GlobalData’s dedicated research platform, the Automotive Intelligence Center