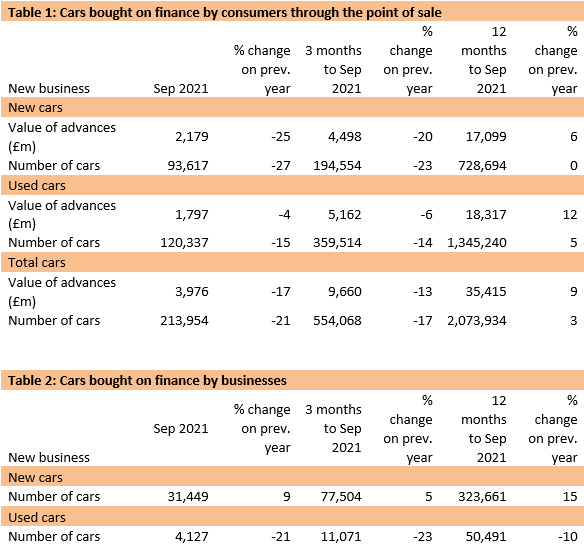

The UK consumer car finance market reported a year-on-year fall in new business volumes of 21% in September, according to the latest figures from the Finance & Leasing Association (FLA).

In the nine months to September 2021, new business volumes were 9% higher than in the same period in 2020.

The consumer new car finance market reported a fall in new business of 25% by value and 27% by volume in September when compared with the same month in 2020. In the nine months to September 2021, new business volumes in this market were 6% higher than in the same period in 2020.

The percentage of private new car sales financed by FLA members in the 12 months to September 2021 was 93.8%, up from 93.3% in August.

The consumer used car finance market reported a year-on-year fall in new business of 4% by value and 15% by volume in September. In the nine months to September 2021, new business volumes in this market remained 11% higher than in the same period in 2020.

Geraldine Kilkelly, director of research and chief economist at the FLA, said: “Supply chain issues have been particularly acute in the car market which is reflected in the 17% fall in new business volumes reported by the consumer car finance market in Q3 2021. Motor finance providers expect constraints on new car supply to ease sooner than those in the used car market.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“The supply issues in the new car market have primarily been driven by the lack of semi-conductors, while the knock-on effects from new car shortages combined with high demand have hit used car supply.

“Despite the risks to the economic and market recovery from supply chain disruption, higher inflation and further waves of Covid-19, our latest research suggests that the industry has maintained its optimism about the opportunities for growth. FLA’s Q4 2021 industry outlook survey shows that 88% of motor finance providers expected new business growth over the next 12 months.”

Last month, the FLA recommended that the government implement a Green Finance Wholesale Guarantee to help ensure a supply of affordable funding for green assets in the consumer and business finance markets.