Observations Tim Naylor, BCA

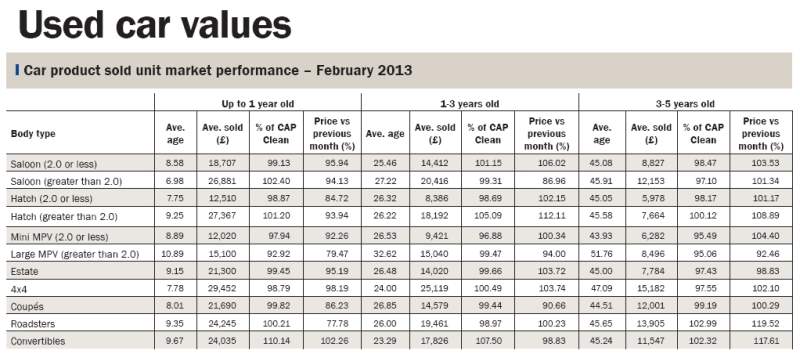

The headline average used car value declined by 1.1% in February to £7,056, although year-on-year values were up by 13%. Average values remained above £7,000 for the third consecutive month as the market continued to be short of retailquality stock.

There remains an underlying fragility in the marketplace reflecting economic conditions. Prices are high largely as a result of the constricted supply, and – seasonal variations aside – BCA expects to see a similar picture across much of 2013.

However, there will be an adjustment to values at some stage. How this will manifest is impossible to judge, but the Easter break often represents a watershed in demand and we might see some pressure on values in April. With the March plate change and

more confidence in the retail new car market, BCA expects to see significantly higher volumes and much greater choice for buyers

at auction over the next few weeks.

Wholesale market dynamics are going to change in the weeks ahead. Vendors will need to be aware of this when valuing their vehicles and recognise the market will experience a seasonal change in demand combined with a major upswing in supply.

Fleet and lease cars averaged £8,851 in February and CAP performance improved by a point to 98.8%, while retained value against original manufacturer’s retail price improved by over a point to 42.6%.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData