Automation and data-driven insights are transforming traditional motor finance processes. Josh Skelding of Fignum delves into how these innovations deliver instant approvals, mitigate risks, and empower buyers with tailored solutions that make car ownership more accessible.

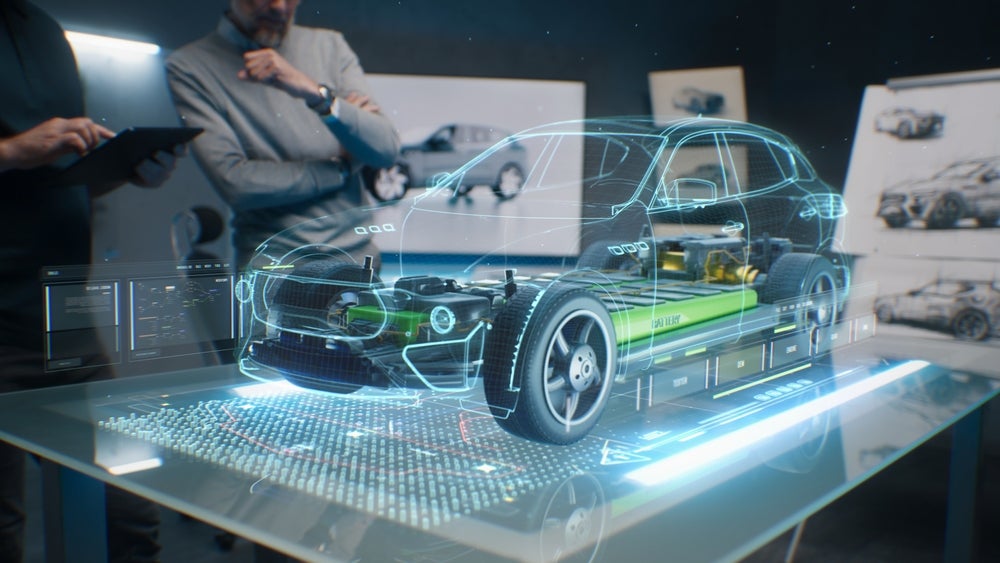

Motor finance, like any thriving sector, is feeling the positive effects of new technology – in this case, it’s reshaping the car-buying process. The industry, once limited to simple loan approvals, is embracing innovations that offer consumers a seamless experience and provide lenders with greater operational efficiency. From AI-driven loan approvals to personalised finance options, there’s no denying that technology is making its mark.

AI-powered loan approvals

Specifically, the use of artificial intelligence (AI) in motor finance is turning the traditional loan approval model on its head.

Historically, these processes were often slow and prone to human error, causing unnecessary delays and frustrating customers. Today, AI accelerates this process by automating credit assessments, bolstering lenders to make faster and more accurate decisions. The result is a streamlined, customer-friendly experience, where buyers can receive their loan approvals almost instantly. 95% of financial institutions already use AI or plan to adopt it soon for processing loans, evaluating borrowers and targeting credit offers. And the demand for AI-driven solutions is only going to grow.

Unlike traditional methods, which often depend on fixed criteria and legacy systems, AI algorithms bring a more nuanced approach to motor finance. They consider a wider range of factors, such as credit history, income trends and even social factors, enabling AI to identify patterns and predict outcomes more precisely.

But the technology is at its best when paired with human judgement. Although it can minimise human biases that skew traditional loan approval processes, human underwriters remain integral to the loan approval process – especially when interpreting complex cases, or making contextual decisions. Instead of displacing human oversight, AI’s adaptability and efficiency works in partnership with human review. The industry, as it stands, stands to benefit from the integration of AI alongside the benefits of human guidance.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAdditionally, advanced AI models are particularly effective at identifying suspicious behaviours across large datasets in real-time, which traditional loan approvals aren’t always equipped to do because of static rules. AI’s ability to adapt to new fraud trends means that it can identify sophisticated schemes, protecting both lenders and customers, minimising costly setbacks and boosting trust.

Tech-enabled personalisation

As the car-buying experience becomes an online journey, technology is enabling more personalised financing options that cater to the varied needs of individual buyers. While vehicle prices have shown signs of easing, it’s still a stretch for many consumers who would instead benefit from more flexible financing solutions.

Artificial intelligence has powerful potential, but it’s also plugging this gap by helping lenders assess a buyer’s financial situation in real-time and create bespoke payment plans.

However, this bespoke approach extends beyond efficiency – it fundamentally impacts affordability, and for the better. Tailored financing reduces unnecessary financial strain, enabling consumers to purchase vehicles within their means while maintaining a sense of financial security. Whether it’s adjusting loan terms based on the buyer’s credit history, or offering incentives for certain types of vehicles, it’s a strategic advantage for lenders and gives consumers peace of mind.

Managing risk and compliance

Regulatory compliance is another big challenge for motor finance providers, often requiring a delicate balancing act. But the good news is that AI can help on this front, too. Beyond its ability to personalise financing options, and its efficiency gains, the tech can analyse vast datasets to identify early warning signs of defaults or missed payments. This not only minimises risk but also helps meet regulatory obligations like Consumer Duty to ensure they’re better protecting vulnerable customers.

The recent court ruling mandating the disclosure of commission payments by brokers has reinforced the importance of staying compliant in a constantly evolving regulatory landscape, and motor finance providers must take note, too.

The road ahead

The industry is at an interesting turning point, driven by technology that is not only reshaping the car buying journey but also how motor finance providers engage with customers and manage risk. With AI streamlining processes, personalising financing options, and enhancing compliance, the opportunities for innovation are endless.

But embracing these advancements isn’t just about staying competitive – by adopting smarter tools and forward-thinking strategies, motor finance players can scale their operations, and build trust, all while driving sustainable business growth. Those who invest in this journey now will be best equipped to steer the future and reap the rewards.

Josh Skelding is the commercial director at of Fignum