UK car production has plummeted 30.1% in November, marking the ninth consecutive month of decline, according to the Society of Motor Manufacturers and Traders (SMMT).

A total of 64,216 cars were produced, 27,711 fewer than in the same month last year.

This decline is driven by strategic product decisions, global market weaknesses, and production adjustments post-Covid.

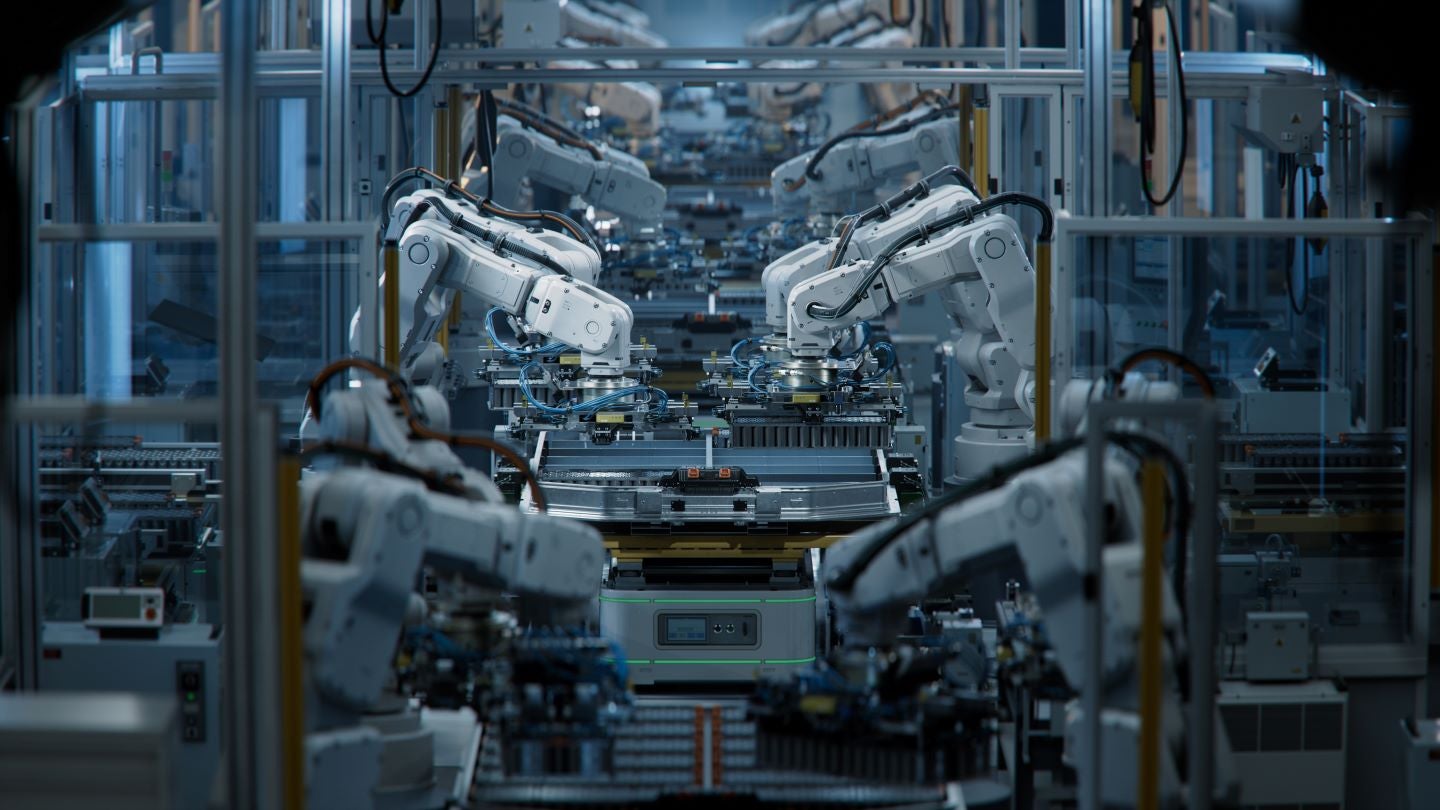

As UK manufacturers retool factories for electric vehicle (EV) production, all major manufacturers reported declines, making it the worst November performance since 1980.

Output for domestic and export markets fell sharply, down 56.7% and 21.3% respectively.

Over 80% of cars were exported, with more than half destined for the EU.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataIn November, 19,165 battery electric, plug-in hybrid, and hybrid cars were produced, accounting for nearly a third of the output.

However, this segment saw volume plunging 45.5%.

From January to November, UK car makers produced over 250,000 electrified vehicles, a 19.7% decrease from the same period in 2023, mainly due to model switchovers.

Year-to-date, UK car output decreased by 12.9% to 734,562 units, 108,787 fewer than the same period in 2023 and significantly below 2019 volumes.

The decline aligns with global automotive industry restructuring, including plant closures and the shift from internal combustion engines (ICE) to EV production.

This transition to a decarbonised future is a priority for major markets, with the UK taking a leading role.

Recent investments in EV and battery production highlight the UK’s readiness for this shift.

However, depressed consumer confidence and sluggish new car registrations in the UK and Europe, up just 0.4% in the first 11 months, has impacted output.

According to SMMT, government intervention is crucial to boost consumer confidence and alleviate financial pressure on the industry.

The UK government must introduce incentives for private consumers, enhance infrastructure rollout, and expedite an industrial and trade strategy for competitive conditions, it added.

Immediate publication of the consultation on ‘ZEV mandate’ regulation changes is seen essential to link a vibrant local market with healthy production.

SMMT CEO Mike Hawes said: “These figures offer little Christmas cheer for the sector. While a decline was to be expected given the extensive changes underway at many plants, manufacturing is under pressure at home and abroad, with billions of pounds committed to new technologies, new models and new production tooling.

“Government can help by supporting consumers in the transition, fast tracking its Industrial Strategy for advanced manufacturing and, most urgently, reviewing the market regulation which is putting enormous strain on the sector.”