UK car manufacturing output experienced a significant decline of 15.3% in October 2024, compared to the same period a year ago, according to data released by the Society of Motor Manufacturers and Traders (SMMT).

Last month, only 77,484 units were produced, a drop of 14,037 units compared to the same month last year.

This marks the eighth consecutive month of downturn in the country’s car manufacturing output.

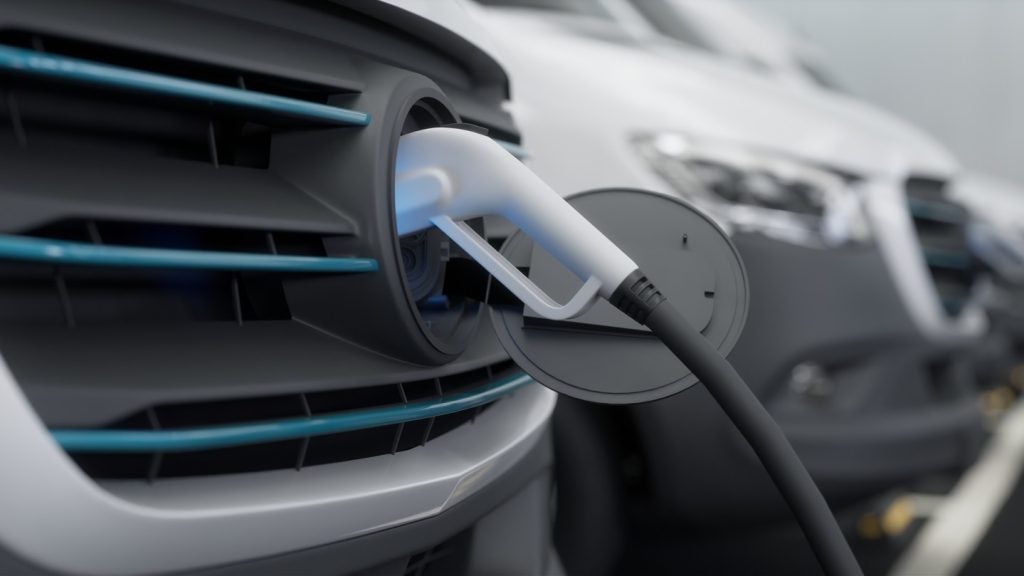

Despite the overall downturn, 24,719 electrified vehicles, including battery-electric, plug-in hybrid, and hybrid electric cars, were produced, accounting for nearly one-third (31.9%) of the total output.

However, this segment also saw a decline of 32.6%.

The UK car makers have produced 239,773 electrified vehicles since January 2024, with 71.8% destined for export.

Both export and domestic volumes saw a reduction last month, falling by 17.6% and 4.7%, respectively.

Year-to-date figures show a 10.8% decrease in UK car production to 670,346 units, primarily due to a decline in exports.

Domestic production has risen by 5.3% to 159,125 units and exports have fallen by 14.8% to 511,221 units. This equates to 89,095 fewer cars shipped overseas in the first ten months of the year.

SMMT CEO Mike Hawes said: “These are deeply concerning times for the automotive industry, with massive investments in plants and new zero-emission products under intense pressure.

“Slowdowns in the global market – especially for EVs – are impacting production output, with the situation in the UK particularly acute given we have arguably the toughest targets and most accelerated timeline but without the consumer incentives necessary to drive demand.

“The cost of stimulating that demand and complying with those targets is huge and, as we are seeing, unsustainable. Urgent action is therefore needed and we will work with government on its rapid review of the regulation and the development of an ambitious and comprehensive Industrial Strategy to assure our competitiveness.”

The industry body said that production could top one million units by 2028 if the UK zero-emission plans succeed and demand rises.

However, if plans falter, production could stay under one million until 2030 or fall below 750,000, risking jobs and economic growth.