The Society of Motor Manufacturers and Traders (SMMT) recently released its August 2024 new car registration figures, revealing a slight 1.3% decline compared to the same month last year.

With 84,575 units registered, August’s figures reflect a traditionally quiet month for car sales, as buyers typically wait for September’s new number plates. However, the broader context surrounding these numbers points to significant challenges for the UK automotive sector, especially in light of the upcoming Autumn Budget on 30 October.

A review of industry comments following the release of the SMMT figures highlights several concerns about profitability, market growth, infrastructure gaps, and the need for stronger government leadership.

Fleet sales dominance and EV market growth

Fleet sales continued to dominate the market, accounting for 60% of all new car registrations in August, despite a slight decline. This dominance highlights ongoing structural challenges for manufacturers, as fleet sales are generally less profitable than private sales.

David Borland, EY UK & Ireland Automotive Leader, noted that the “less profitable fleet channel continues to dominate,” raising concerns about the broader impact on sustainable profitability for the industry. The heavy reliance on fleet sales underscores the difficulties manufacturers face in driving profitability while balancing regulatory and market pressures.

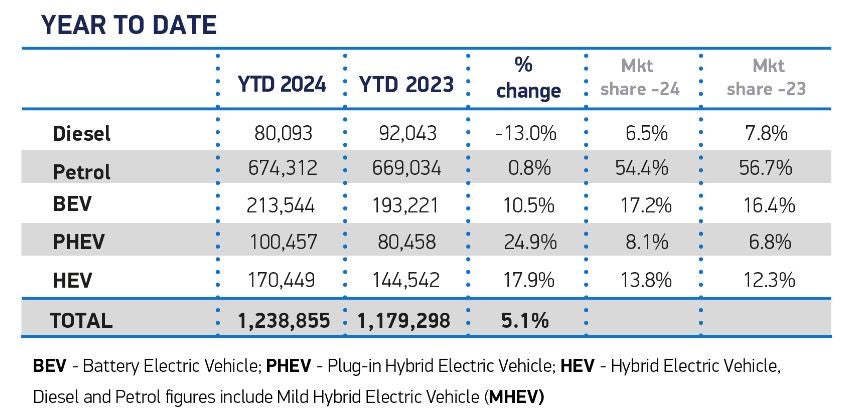

The positive news from the SMMT figures lies in the continued growth of battery electric vehicles (BEVs), which saw a 10.8% increase in registrations. This growth pushed BEVs to a 22.6% market share in August, the highest since December 2022. However, despite this progress, the sector remains under pressure to meet the Zero Emission Vehicle (ZEV) Mandate, which requires BEVs to reach a 22% market share for the year — a target that remains elusive, with year-to-date figures sitting at 17.2%.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataPhilipp Sayler von Amende, Chief Commercial Officer at Carwow, pointed out that while the BEV market shows promise, “leads are taking longer to convert,” with consumers requiring more information and reassurance before committing to an electric vehicle. This slow conversion rate highlights the ongoing challenges in achieving mass adoption of EVs, a concern echoed across the industry.

Government policy and infrastructure gaps

The industry’s ability to meet ZEV targets is further complicated by gaps in infrastructure and consumer confidence.

Jamie Hamilton, Automotive Partner and Head of Electric Vehicles at Deloitte, emphasised that “concerns around charging” remain a significant barrier to EV adoption, particularly for consumers without access to off-street parking. The need for a more robust charging network is becoming increasingly urgent as EV sales rise, but the pace of infrastructure development has not kept up with demand.

Kim Royds, Director of Mobility at Centrica, added that addressing the inequality between home and public EV charging is critical. Without a concerted effort to expand and improve the public charging network, the shift to electric vehicles could stall, undermining the government’s ambitious targets for the sector.

Industry calls for government action

As the automotive industry grapples with these challenges, all eyes are on the government’s upcoming Budget.

Mike Hawes, SMMT Chief Executive, acknowledged the growth in EV sales but warned that “urgent action must be taken to help buyers overcome affordability issues and concerns about chargepoint provision.” This sentiment is widely shared across the industry, with calls for the government to reintroduce incentives for EV buyers, improve public charging infrastructure, and reconsider policies that could disincentivise EV adoption, such as the Vehicle Excise Duty (VED) supplement for expensive cars set to be introduced in 2025.

Ali Fitt, EY UK Automotive Tax Director, pointed out that while the market has shown resilience, the “longevity of such growth” remains in question. He stressed that manufacturers need to strike a balance between regulatory compliance, consumer appeal, and competitive pricing — a complex task that requires a supportive policy environment.

Nick Williams, Managing Director at Lex Autolease, urged the government to “support the transition” to EVs by providing a stable policy backdrop and further incentives to ease the transition for consumers and businesses alike. The industry is particularly keen to see measures that address consumer misperceptions about battery life and running costs, as well as initiatives to boost the affordability of new EV models.

Lisa Watson, Director of Sales at Close Brothers Motor Finance, echoed these concerns, highlighting that while demand for battery electric vehicles is strong, high upfront costs and infrastructure shortfalls continue to act as barriers for motorists. Her observation that fleet statistics “skew the data” also points to the complexity of interpreting market trends, as fleet purchases often mask the challenges faced by individual buyers. Watson’s comments underline the need for targeted government interventions to support private buyers and ensure that EV uptake is not driven solely by fleet sales.

2030 deadline

Sue Robinson, Chief Executive of the National Franchised Dealers Association (NFDA), observed that, as the year progresses, the ZEV mandate will come under greater scrutiny, particularly with the government’s reaffirmation of the 2030 phase-out date for new internal combustion engine cars.

Ben Nelmes, CEO of New AutoMotive, shared a more optimistic view, noting the “continued growth in the number of people opting for an electric car” and highlighting the declining sales of petrol and diesel vehicles as a sign that consumers are increasingly “shunning older, polluting technologies.” Nelmes also suggested that the government can confidently reintroduce the 2030 ban on petrol and diesel sales, given the strong market performance of electric vehicles.

The road ahead

As the automotive sector awaits the Autumn Budget, the stakes could not be higher. The government’s response will be critical in determining whether the UK can meet its ambitious EV targets and maintain the growth momentum seen in recent months. With the ZEV mandate looming and infrastructure gaps still prevalent, the industry is looking for clear signals that the government is committed to supporting the transition to electric vehicles.

In the short term, September’s registration figures — buoyed by the introduction of the new 74 plate — will provide a clearer indication of market demand. However, the longer-term outlook will depend on the policy decisions made in the coming weeks. The industry’s resilience has been tested, but as the UK continues its journey towards a zero-emission future, it is clear that government support will be crucial in navigating the challenges ahead.

Industry demands clear EV incentives following Labour’s legislative omission

Related Company Profiles

Deloitte Touche Tohmatsu Ltd

Centrica Plc