European car manufacturers are expected to face significant profitability challenges as competitive pressures drive price cuts across all market segments, including luxury vehicles, according to Fitch Ratings.

Despite favourable raw material prices, these trends are likely to erode the profitability of European automakers.

Fitch’s latest report, EMEA Automotive Manufacturers – Relative Credit Analysis, highlights that improved parts availability has led to higher production and changes in sales mixes, making car markets more favourable for buyers.

However, this shift is expected to result in a median EBIT margin decline of around 200 basis points year-on-year in 2024 due to strong price competition.

The report notes that labour and logistics costs continue to pressure gross margins, even as raw material and energy costs have decreased from their peaks 18 months ago. Fitch expects these challenges to persist into 2025.

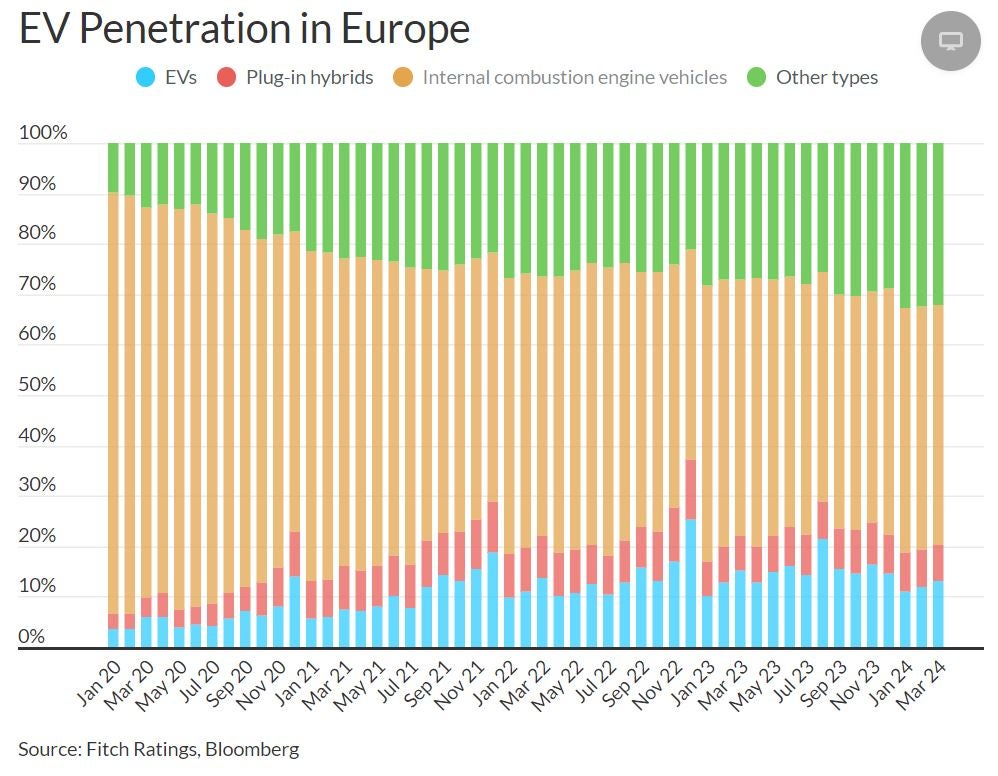

The slowdown in electric vehicle (EV) sales since the second half of 2023 has prompted European automakers to reassess their electrification strategies. Many are now calling for a revision of the EU’s CO2 emissions targets.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataHowever, Fitch believes these updated plans will not significantly improve EV margins, particularly for entry-level and volume models that face stiff competition from Chinese manufacturers. Despite this, automakers’ cash generation could benefit as they reduce capital-intensive battery investments, helping to maintain credit metrics.

The European Commission’s tariffs on Chinese EV imports are not expected to have a substantial impact on the competitive landscape in the near term due to the slowdown in EV demand. However, any potential retaliation by China, especially broader measures affecting other vehicle types or industrial sectors, could hit German automakers the hardest. Fitch predicts that while broader measures could affect margins and cash flow, German automakers have enough financial headroom to absorb these pressures without affecting their credit ratings.

Despite rising borrowing costs, consumer demand for vehicles remains robust in Europe. However, Fitch warns that demand could soften if consumers face increased financial strain and pandemic-related savings are depleted. This could lead to higher purchase incentives and a shift towards lower-priced vehicles, which Fitch has factored into its 2024 sales forecasts.

Investment-grade European automakers are expected to continue generating strong free cash flow (FCF), even with declining profitability. Fitch anticipates that working capital needs, which were elevated in 2022 and 2023 due to inflation, will normalise, and inventory levels will remain stable.

As automakers reassess their battery supply needs, reduced battery investments will boost cash generation, balancing out the impact on credit metrics. A slight increase in capital expenditure is expected in 2025 as some investments continue, but overall battery investments are forecasted to decline in the medium term.

Luxury carmakers such as Aston Martin and McLaren are facing more severe financial pressures, with ongoing cash burn due to fixed costs and new model launches. Fitch expects their FCF generation to improve over the next two years, though McLaren may see slower progress. However, high financing costs are likely to offset much of the improved cash flow due to execution risks.