A recent analysis by Transport & Environment (T&E), a clean transport NGO, has uncovered a notable discrepancy in the availability of affordable compact electric cars compared to their combustion engine counterparts in Europe.

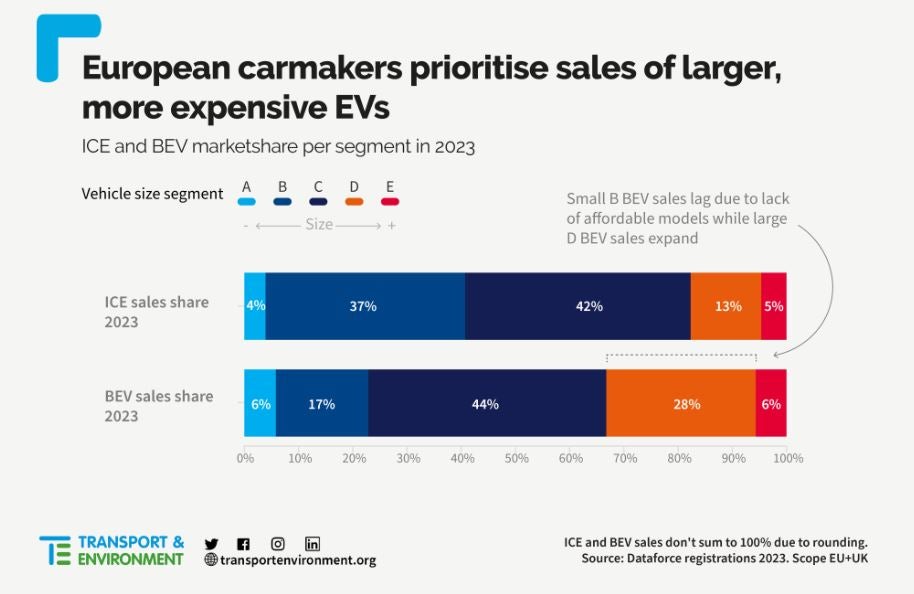

The study found that only 17% of EVs sold in the region belong to the cheaper B segment, while 37% of new combustion engines fall into this category.

T&E argues that car manufacturers are hindering the adoption of electric vehicles (EVs) by prioritising the sales of larger and more expensive electric models. The research indicates that only 40 fully electric models in the compact segments (A and B) were launched between 2018 and 2023, in contrast to 66 large and luxury models (D and E).

Greening corporate fleets: a consultation

In Europe, 28% of electric vehicle sales fall into the large car D segment, whereas only 13% of new combustion cars fit into this category, as per T&E’s analysis of 2023 sales figures from Dataforce.

The average price of a battery electric car in Europe has risen by 39% (€18,000) since 2015, while in China, it has decreased by 53%, according to Jato Dynamics’ 2023 report titled EV Price Gap: A divide in the global automotive industry.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData

The disproportionate focus of European manufacturers on large cars and SUVs, which carry a price premium, contributes to this price gap.

Anna Krajinska, vehicle emissions manager at T&E, expressed concern that European carmakers are impeding the mass market adoption of EVs by not introducing affordable models at a faster pace and in greater volume. She highlighted the industry’s disproportionate focus on large SUVs and premium models, leading to a scarcity of mass-market EVs and elevated prices.

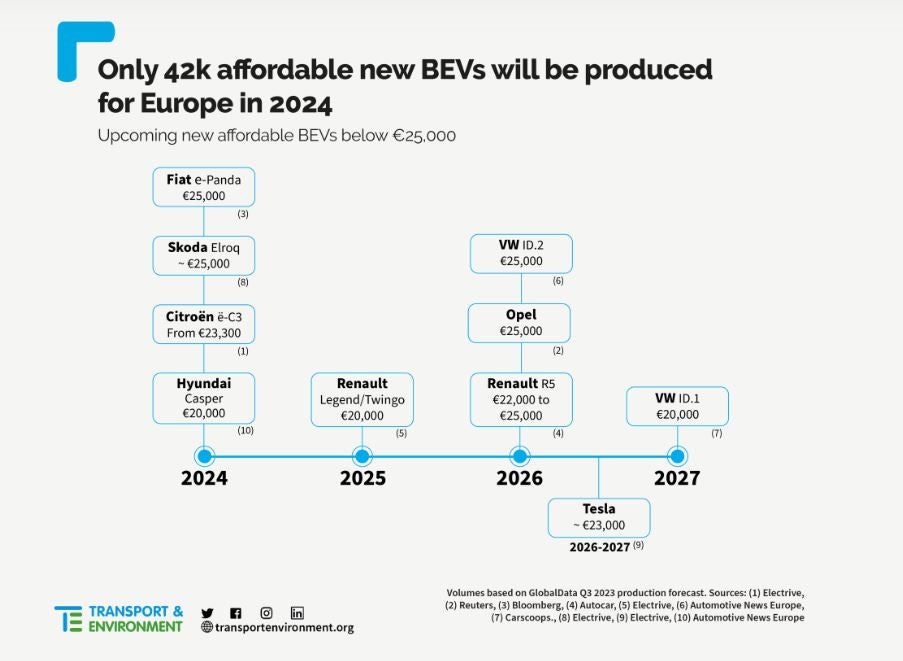

T&E’s analysis of production data from GlobalData suggests that of the sub-€25,000 models planned by carmakers, only around 42,000 vehicles are expected to be produced for the European market in the current year. Despite the scarcity of affordable models, the EU market share of battery electric cars increased by 2.5 percentage points to 14.6% in 2023.

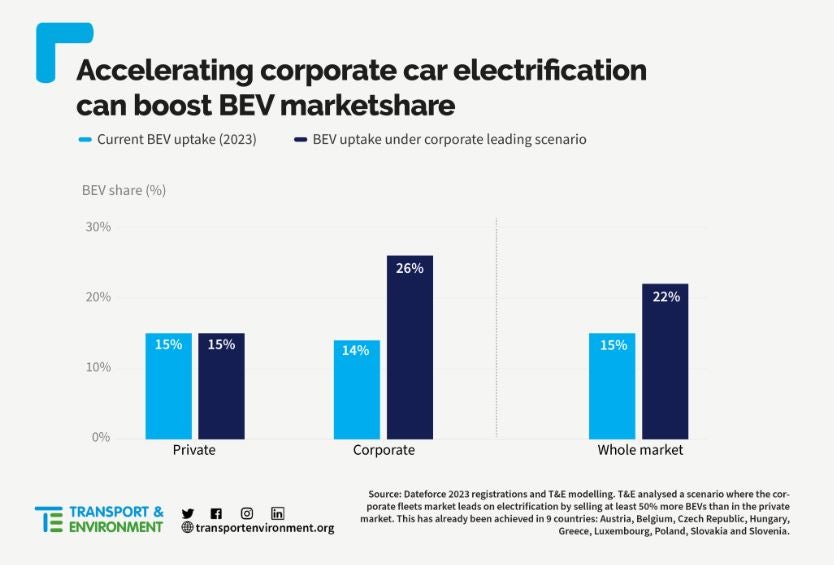

The analysis also indicates that if the corporate car segment, which constitutes the majority of new car sales, were leading on electrification, the EU battery electric vehicle (BEV) market share could already be at 22%. However, the corporate sector, with an electric uptake of 14%, is currently trailing behind the private market (15%).

T&E emphasises the crucial role of taxation in incentivising electric car adoption and calls for binding electrification targets for corporate fleets to accelerate electrification in Europe. The NGO is urging the EU to set targets for fleets to be 100% electric by 2030 at the latest. The EU Commission has initiated a public consultation on greening company cars.

Anna Krajinska highlighted the potential for accelerated electrification in corporate cars, emphasising their heavy subsidisation through tax cuts and companies’ financial capacity to invest in EVs. She urged the EU to enact a law covering a significant portion of the company car market by regulating leasing giants and companies with substantial car fleets.

Is new technology making cars less secure?