In a stride toward modernising the motor fleet insurance landscape, UK-based insurance technology company Flock has embarked on a partnership with commercial insurance provider NIG.

This collaboration signifies a strategic move to effectively target larger fleets, emphasising a digital and data-driven approach to motor fleet insurance in the UK.

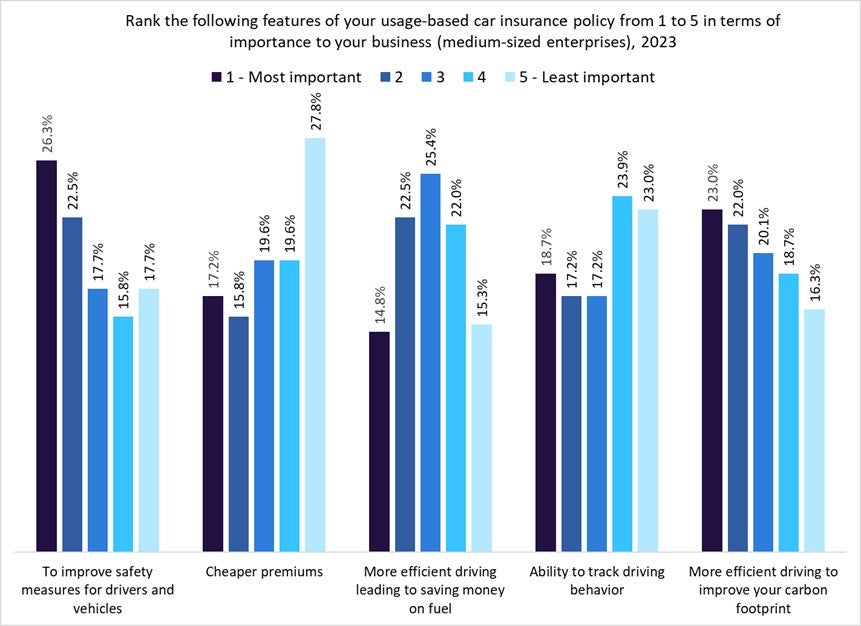

While this partnership charts new territories, recent survey data from GlobalData offers valuable insights into the evolving priorities within the landscape of usage-based insurance (UBI) policies, particularly among larger fleets. The survey reveals that enhanced safety measures have taken centre stage, emerging as the most critical aspect of UBI policies.

According to GlobalData's 2023 UK SME Insurance Survey, medium-sized enterprises (50–249 employees) lead the charge in prioritising enhanced safety measures, with 26.3% considering it the key feature of a UBI policy. In comparison, this preference is echoed by 24.1% of small-sized enterprises, 9.5% of micro-enterprises, and 10.5% of sole traders.

Noteworthy is the discernible trend among medium-sized companies, placing a higher value on improved safety features than on lower premiums. While 17.2% of medium-sized enterprises rank cheaper premiums as their most important feature, a stark contrast is seen among sole traders (57.9%), micro-businesses (30.2%), and small companies (18.8%), who prioritise cheaper premiums over enhanced safety measures.

Interestingly, economic pressures, often the driving force behind cost-related considerations, appear to be undergoing a shift. GlobalData's survey results indicate a pronounced emphasis on safety for medium-sized businesses. This shift could be attributed to a growing recognition among larger SMEs of the broader risks and uncertainties associated with their operations.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe cost-of-living crisis, marked by inflationary pressures and economic challenges, has prompted SMEs to re-evaluate their risk management strategies. In this context, prioritising improved safety measures reflects a proactive stance toward mitigating potential risks and disruptions, even at the expense of lower premiums.

Further validating this trend, GlobalData's survey finds that medium-sized enterprises value risk management services more than their smaller counterparts when switching providers. An impressive 13.1% of medium-sized companies state that they switched primarily due to the new provider's added risk management services, compared to 11.1% of small enterprises, 5.1% of micro-enterprises, and 3.8% of sole traders.

Enter the Flock-NIG partnership, poised to resonate with this changing landscape. Flock's specialisation in advanced technologies and data analytics for motor fleet insurance aligns seamlessly with the current priorities. Leveraging real-time data and AI-driven algorithms, Flock provides personalised risk assessments based on driving habits, mileage, and road conditions.

The partnership with NIG is set to target larger fleets in the commercial motor insurance market, offering a comprehensive digital, data-driven approach. This includes a fully digital insurance management portal, rebates for safer driving, and safety and claims workshops. Flock will harness NIG's real-time safety insights and interventions for fleet managers, aiming to bring a fresh, data-driven perspective to the motor fleet market, with a specific focus on safety and risk management.

The data-driven collaboration between Flock and NIG aligns with the changing dynamics of safety priorities among larger businesses. As larger enterprises increasingly prioritise enhanced safety features, insurers stand to benefit by providing customised solutions that not only prioritise safety but also utilise data-driven insights and foster collaborative risk management. This strategic alignment places insurers in a favourable position within the evolving landscape of commercial motor insurance for larger businesses.

Flock secures key motor fleet insurance partnership with NIG