According to the Auto Trader Retail Price Index, average used car retail prices contracted on a year-on-year (YoY) basis for the second consecutive month in October, dropping -1.7% like-for-like. The headline figure, however, continues to mask a nuanced and resilient used car market, with robust levels of consumer demand and price growth still present in market segments.

The current rate of contraction marks the largest drop in YoY prices in over 43 months, but context is critical. In October 2019, before the unprecedented market forces unsettled all “normal” pricing patterns and catapulted average prices upwards, retail values also contracted at the same rate of -1.7%. And by comparing average prices in October 2023 (£17,641) with previous years, it’s evident just how strong used car prices remain and how fast they have increased; average values are up £3,627 on the same period in 2020, and a massive £4,308 on pre-pandemic 2019.

Crucially, the used car market remains resilient. Auto Trader’s proxy sold data suggests transactions were up circa 2% YoY in October. Speed of sale is also robust, ahead of prior year levels at 29 days (versus 30 in October 2022). What’s more, Auto Trader data shows that whilst used car supply into the market is beginning to pick back up, with current levels up 2.3% on October 2022 (the highest rate of growth in 12 months), it remains below the levels of consumer demand growth, which is up a healthy 6.8% YoY. Further highlighting the robust demand in the market there were 74.3 million visits across Auto Trader’s marketplace last month, which is nearly 6.4 million more than in October 2022.

Younger vehicles and EVs holding headline figures back

The contraction in headline average prices follows months of gradual softening in the levels of growth, which can be attributed to several factors, not least the fact the market is now overlapping three years of very large increases; in October 2022 and 2021, prices had increased 8% YoY, and a whopping 25.6% respectively. However, looking at the data on a more granular level not only highlights the huge nuance in today’s retail market, but also reveals that the overall figure is being dampened by the large drop in prices amongst younger used cars.

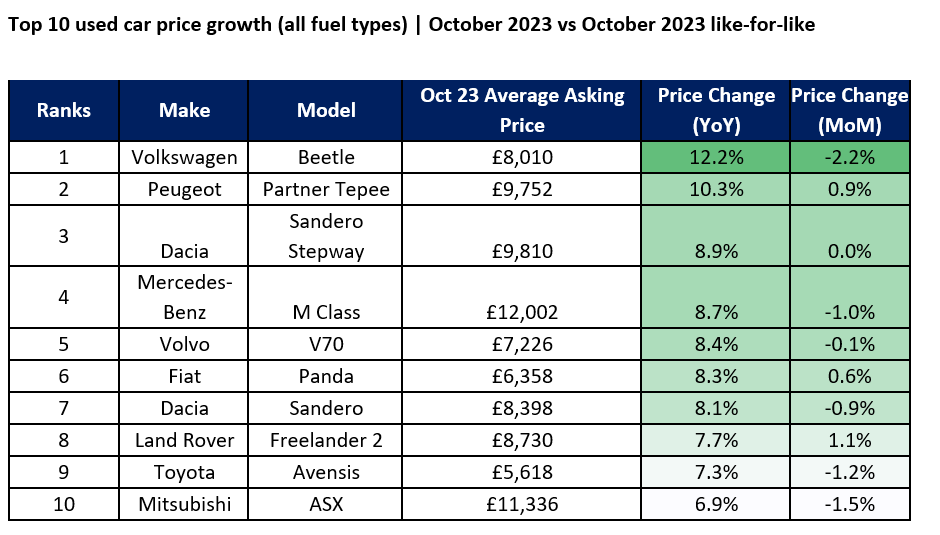

Underlining the strong profit potential still available in segments of the second-hand market, the average price of cars aged 10-15 years-old (£6,655) recorded a huge 9.6% YoY increase in October, whilst those over 15 years (£5,561) were up 6.4%. The middle of the market remains stable, with the average retail price of those cars aged 5-10-years-old up 2% YoY and flat MoM. At the newer end of the market, however, the average price of cars under 12 months old fell -3.5% YoY (£35,939), and those aged 1-3 dropped -7.6% (£26,132).

This softening in younger vehicle values is due both to increasing consumer offers now being widely available for the first time in nearly three years on equivalent brand-new cars, and to increasing supply following improved new car sales over the last 14 months. In October, the rate of supply growth for cars under 12 month was 36.4% YoY (but remaining considerably down on pre-pandemic levels). Although demand growth within this age cohort remains strong (up 30%), the slight imbalance is having a negative impact on values.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

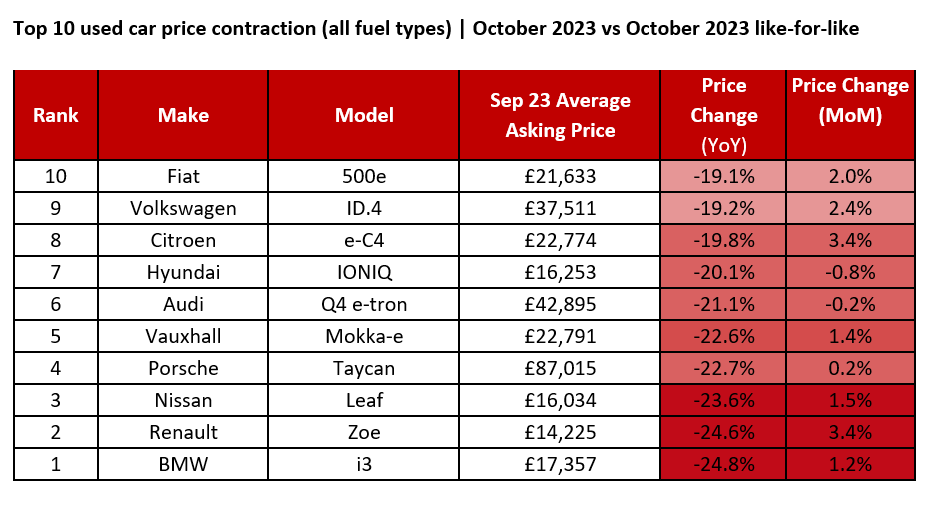

By GlobalDataIt’s been intensified by the increased supply of young electric vehicles (EV) entering the market, driven by the ongoing de-fleeting of the circa 750,000 sold over the last three years. In October alone, supply of EVs under a year old on Auto Trader was up 48.1% YoY, and with the average values of EVs within this cohort down -11.4% YoY, it’s dragging the overall price for younger cars down.

Used EV prices across all age groups (£31,787) were down -20.5% YoY in October, improving on the -22.1% drop in September and the -22.6% in August, showing the continued recent strengthening of the used EV market context. Prices also fell on a MoM basis, albeit by just -0.3% and by the second lowest rate in over 12 months.

This is due to very strong growth in consumer demand for second-hand electric cars, which is being driven by an enticing combination of better affordability (with many models reaching price parity with their ICE counterparts) and greater availability. On Auto Trader, used EV demand increased 75.9% YoY in October, the second highest level ever recorded, whilst its data shows they took an average of just 24 days to sell, well ahead of their petrol and diesel counterparts at 29 and 30 days respectively. Such is the current strength of used EV demand, it’s now outpacing the rate of supply growth, which in October softened to 19.8% YoY (the lowest rate since July 2022). It’s this readjustment of levels of supply and demand which is helping to stabilise prices.

Commenting, Auto Trader’s director of data and insights, Richard Walker, said: “Although October marked the second month of contraction in headline figures, as always context is important. Transactions are stable, consumer demand is robust, engagement is increasing, cars are selling quickly, and there are still segments of the market recording strong price growth. These are reasons to feel positive, and as always, we’d urge dealers to be led by these consumer trends and the broader retail environment to inform stocking and pricing decisions. With 14% of used cars advertised on Auto Trader priced below their market value in October, potential profit is still being left on the table. In such a nuanced market it’s essential to be guided by a vehicle view, not a forecourt view.”