The June performance marks the 11th consecutive month of growth as the industry gradually overcomes the pandemic-induced supply chain shortages that constrained production for much of the previous two years.

With waiting times easing and pent-up demand being met, the sector is a rare bright spot in a gloomy economic landscape even though overall market volumes remain below pre-pandemic levels.

Growth in the month was driven predominantly by large fleet registrations, up 37.9% to 92,699 units, reflecting the normalisation of supply. Private demand grew more modestly, up 14.8% to 79,798 units.

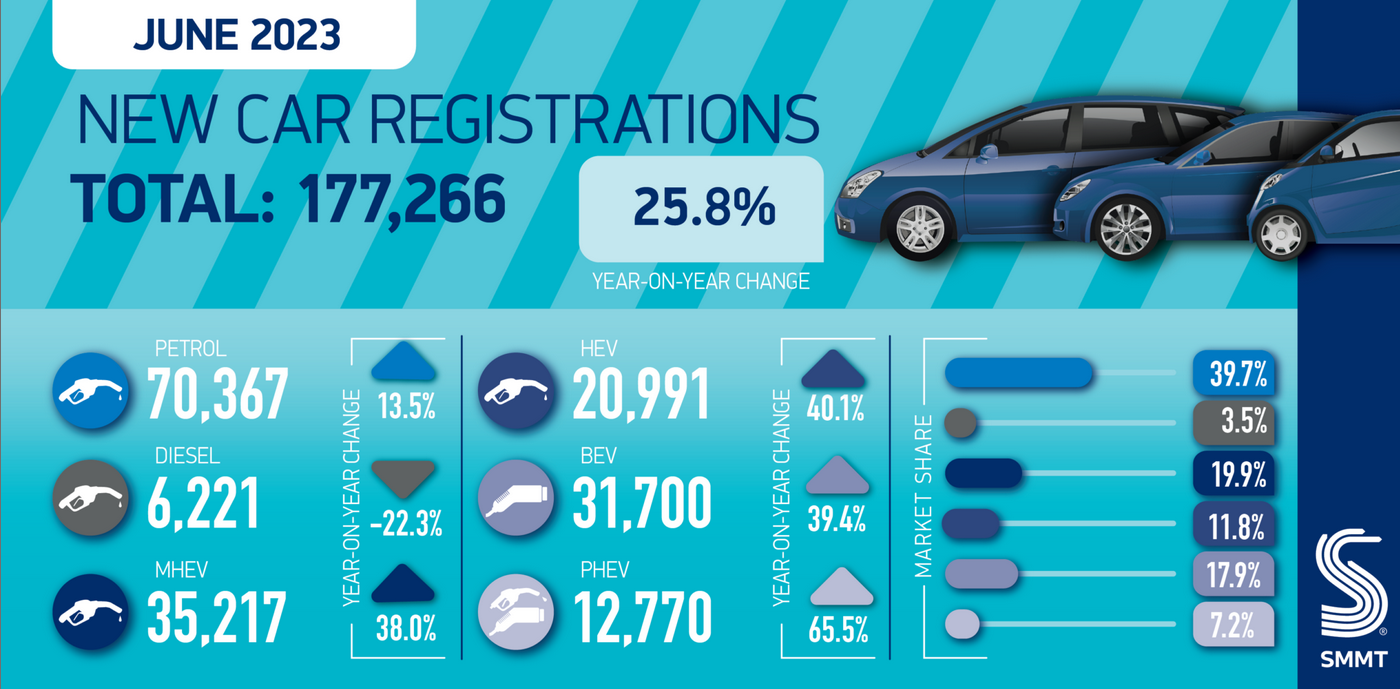

Deliveries of petrol cars increased by 22.7%, to remain the most popular powertrain, while those of hybrids (HEVs) and plug-in hybrids (PHEVs) also rose, by 40.1% and 65.5% respectively.

Diesel registrations were down -13.5%. Battery electric vehicle (BEV) registrations, meanwhile, grew again, with the segment up 39.4% as 31,700 buyers chose to get behind the wheel of a zero-emission car – 17.9% of the total market.

It is business and fleets, however, rather than private buyers, that continue to drive this growth, thanks to the attractive fiscal incentives on offer.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAlthough manufacturers are offering a range of BEV deals for private buyers, including flexible subscription models and attractive finance rates, more could be done by other stakeholders to make purchasing even more compelling.

Almost a million (949,720) new cars joined UK roads in the first six months of 2023, with total registrations up 18.4% and BEV uptake at record levels with 152,968 deliveries so far this year – some 13 times greater than the same period in 2019.

BEV market share for 2023 is now 16.1% but, with a zero-emission vehicle mandate requiring 22% BEV registrations per manufacturer due to come into force in less than six months’ time, more needs to be done to accelerate the transition.

Given that recharging an EV at home can offer a 60-70% cost per mile saving compared with refuelling a petrol or diesel vehicle, the industry is calling for a cut in VAT on public charging to help quicken uptake.

Drivers able to charge at home pay just 5% VAT to power up their EV, compared with 20% for those without access to a driveway or designated private parking space reliant on the public network. VAT equity would make switching to an electric vehicle feasible for more people regardless of home ownership or property status.

Mike Hawes, SMMT Chief Executive, said: “The new car market is growing back and growing green, as the attractions of electric cars become apparent to more drivers. But meeting our climate goals means we have to move even faster.

“Most electric vehicle owners enjoy the convenience and cost saving of charging at home but those that do not have a driveway or designated parking space must pay four times as much in tax for the same amount of energy.

“This is unfair and risks delaying greater uptake, so cutting VAT on public EV charging will help make owning an EV fairer and attractive to even more people.

Siemens UK metering deals set to fast-track 10,000 EV charging points