The Coming Car Glut and Financing EVs

No new subsidies were announced during the Spring Budget 2023 to help fund EV takeup, which means affordability will continue to remain a significant obstacle for the average motorist and SME hoping to join the green revolution in the UK.

Having said that, there are early signs of steady demand for EVs in the UK. Last year, 16.2% of cars sold were battery-powered, and the same is true for March 2023. But the upfront cost of a vehicle, however, remains a barrier.

Managing high upfront costs is typically a clarion call for purveyors of leasing and financing to step in to save the day, but even so, bridging the gap for financing a new EV will still require much cheaper models to come on stream that do not trigger driver anxieties about range, resale value or charging.

If competition among car manufacturers is what is needed then that may be on the way.

Car glut?

According to a report in the Daily Telegraph this week, analysts at UBS are warning that a glut of cars on the market is likely to trigger a price war among car manufacturers this year.

Global car production will exceed sales by 6% this year, leaving about 5 million vehicles that will require price cuts to shift.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataIn January, Tesla cut the price of its cars by up to £8,000 in the UK. Meanwhile, the cost of second-hand EVs is also falling, with the average price of pre-owned EVs down by 13% in the last year to £33,060, according to AutoTrader.

UBS analysts say new car prices will remain high in the first half of the year but with sluggish global economic growth weighing heavily on people’s spending, new car affordability will falter, driving prices down even further mid-year.

Analysts at USB led by Patrick Hummel said: “Given the bullish production schedules, we see high risk of overproduction and growing pricing pressure as a result. The price war has already started unfolding in the EV space, and we expect it to spread into the combustion engine segment.”

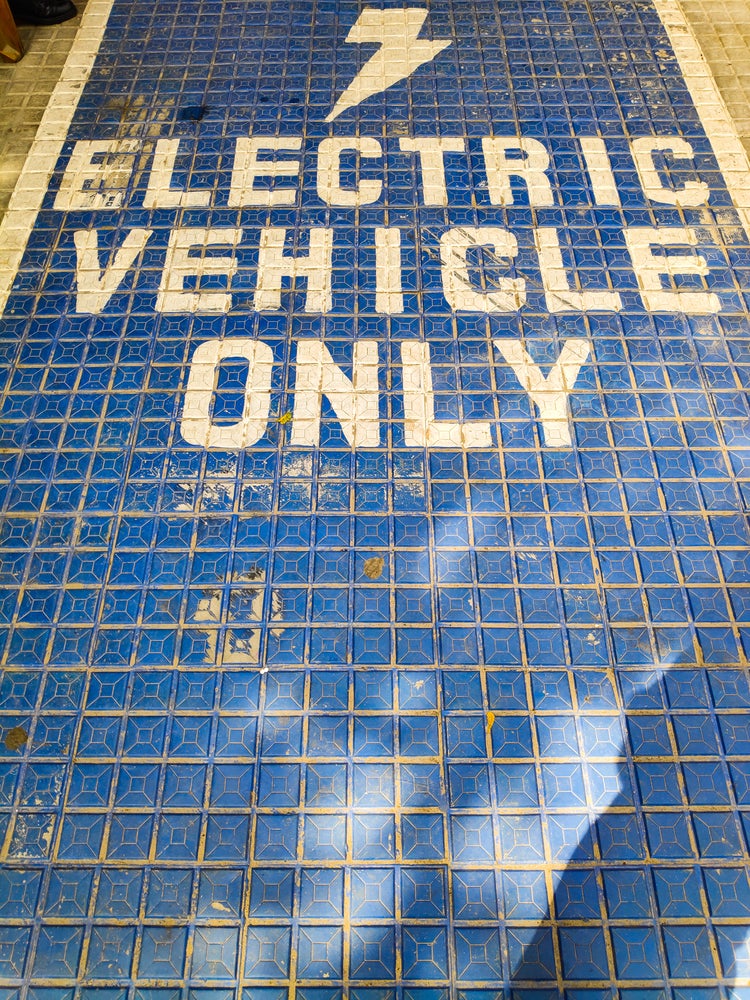

If prices are to come down for EVs and leasing companies are to play a key role, that still leaves one big unanswered question: who’s planning and building the charging infrastructure to replace the petrol pumps?

Addressing charging anxiety

With about 46,000 zero-emission cars sold last month, from a total of 287,000 new car sales, this total figure is still about half the number sold in March 2017 before Covid was a thing, according to the Society of Motor Manufacturers and Traders (SMMT).

Mike Hawes, CEO of SMMT, said: “The best month ever for zero-emission vehicles is reflective of increased consumer choice and improved availability, but if EV market ambitions – and regulation – are to be met, infrastructure investment must catch up.”

UK rules out e-fuels for cars and vans

Driving the EV transition through finance

Related Company Profiles

Tesla Inc