How Finance is Accelerating the EV Transition

Finance is at the heart of how we decarbonise road transport and make EV transition a reality in the UK, says Lauren Pamma, transport director at the Green Finance Institute, an independent, commercially-focused organisation backed by the UK government and led by bankers.

Transport is the single largest contributor (24%) to UK domestic greenhouse gas emissions with cars alone contributing 55% of this total. Reducing transport emissions is a crucial part of tackling climate change and meeting the UK’s net zero target – with the additional benefits of reducing air and noise pollution and creating skilled jobs across the supply chain.

Despite the momentum behind the EV transition in recent years – with over 680,000 EVs on the road in 2023, compared to just over 205,000 in 2020 – financing the switch for consumers, businesses, and communities remains a challenge. The complexity and interconnectedness of the transport system requires a collaborative approach across multiple sectors and value chains to ensure that the transition is accessible and affordable to all. This requires both public and private finance, as well as a supportive policy environment.

The Green Finance Institute established the Coalition for the Decarbonisation of Road Transport in May 2021 to unlock the financial barriers to the decarbonisation of road transport, and enabling infrastructure, with an initial focus on three elements:

- Purchasing and leasing: co-designing new and enhancing existing financial solutions to encourage increased EV adoption

- Charging Infrastructure: Linking public and private finance to unlock barriers to the creation of a strategic charging network

- Battery Technology: Unlocking the required capital across the battery manufacturing supply chain

We have made some progress on a number of potential solutions in each of these three areas. In November 2021, we released a report entitled “Road to Zero: Unlocking public and private capital to decarbonise road transport” and in the year ahead, we are focused on driving through some high-impact solutions recommended by the Coalition.

EV transition: Reducing EV costs by developing a used market

One of the challenges for consumers in purchasing an EV is the upfront cost. While the total cost of ownership tends to be lower on the whole for EVs, the upfront cost remains a barrier for many people.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataTo make EVs more accessible to wider swathes of the population, it is vital that we scale the second-hand EV market. Supply of used EVs is growing quickly and we need to ensure the demand is there to absorb this. These vehicles are typically more affordable to run than second-hand ICEs, and are more affordable than new EVs. Rapidly scaling the second-hand market will open up ownership to a vast number of people looking to buy at a lower price point.

Today, as many as 92% of new cars are bought on finance in the UK, and around one-third of used cars. Growth of the used EV market brings an opportunity to offer a wider range of financial products to purchase used EVs such as leasing for used vehicles, salary sacrifice for used vehicles and beyond.

EV transition: Rolling out charging infrastructure through utilisation-linked loans

One of the often-cited barriers to EV adoption in the UK is the perceived lack of charging infrastructure. If drivers aren’t confident in the availability of charge points across the country, the transition will remain slow.

Chargepoint installers are aware of this; but installation locations are decided based on the predicted amounts of use the new charging points will get. Installers only have the confidence to roll out chargers to new areas with the indication that there will be high utilisation and therefore, higher commercial returns. To encourage more installation we need to increase the provision of usage data or provide financial de-risking mechanisms to reduce the financial risk of new charge points initially being underused as drivers slowly transition to EVs.

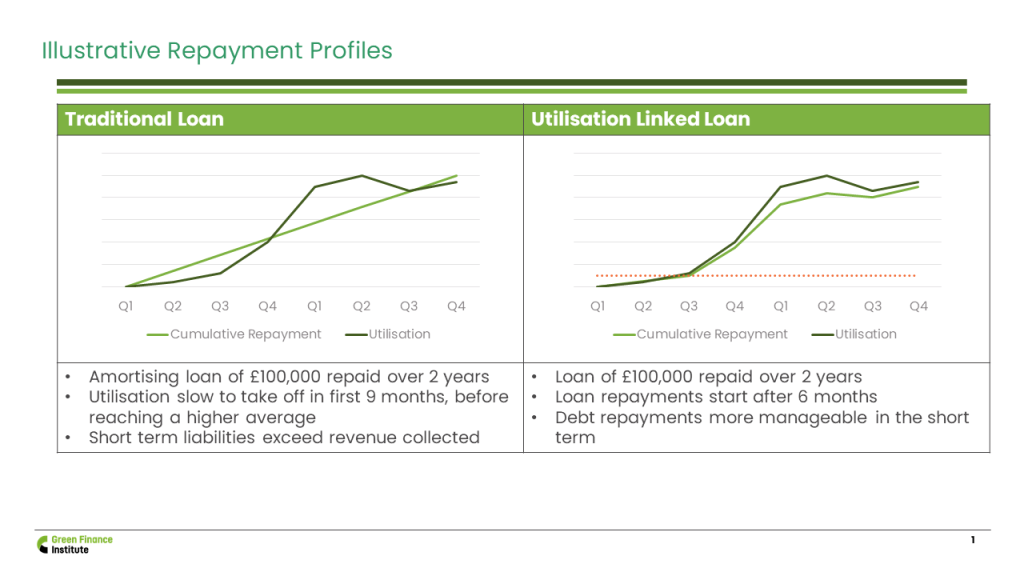

One of the solutions we are exploring to do this is utilisation-linked loans – loans for chargepoint operators or installers (such as businesses or local authorities) that are repaid based on utilisation rates. This would offset the risk of loan repayment liabilities not matching revenues inflow – a particular risk for chargepoints in some rural communities, or those where usage will be seasonal for example.

ULLs encourage the supply of charging infrastructure ahead of demand, by de-risking the initial period where chargepoints may have lower levels of utilisation, increasing the overall network coverage ahead of demand ramping up.

Supporting scale-up battery companies through an investment facility

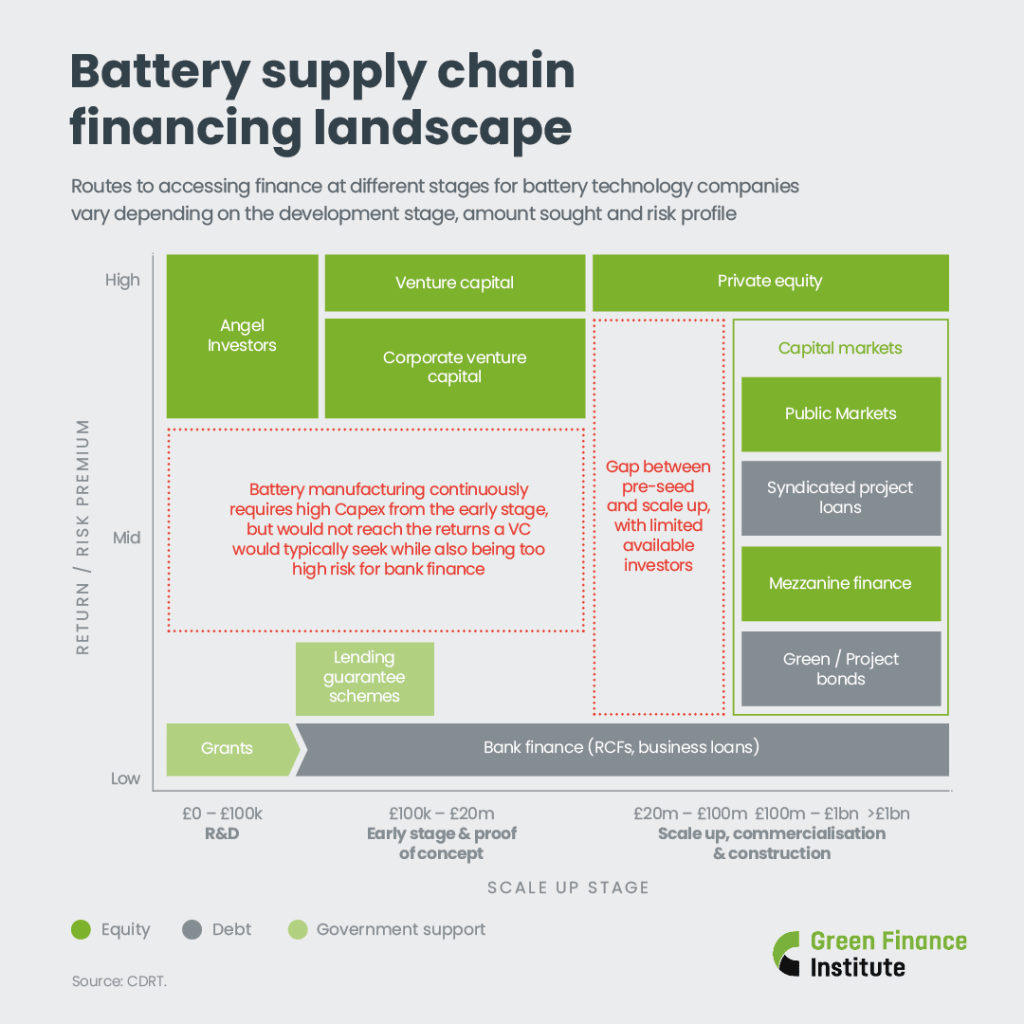

Turning to the supply of EVs, a Battery Investment Facility (BIF) is one of our proposed demonstrator solutions to help organisations across the battery manufacturing value chain access capital at a critical point in their growth – when scaling operations. Public finance can be used to de-risk specific investments in key businesses in the supply chain for private sector financiers, which would otherwise sit outside of traditional risk appetite; serving to unlock funding for organisations to cross the infamous “valley of death” and bridge the gap to mainstream funding.

We welcome further collaboration as we work to deliver these solutions. Our coalition is open to anyone across the road transport ecosystem looking to accelerate the transition to net zero mobility. Only by acting together, at pace, will we see the transformational change we need.

The systemic risk posed by the climate crisis to financial services requires decisive action and a rapid pivot towards the opportunities presented by the zero-carbon economy. Box-ticking, sloganeering, greenwashing and relying on the heroic efforts of individuals won’t achieve the scale of the transformation required. Cross-sector collaboration and the focused application of the creativity, innovation and skills of the financial services industry to finance the global transition will.

Dr Rhian-Mari Thomas OBE, Chief Executive, Green Finance Institute

How software is powering the shift to BEVs